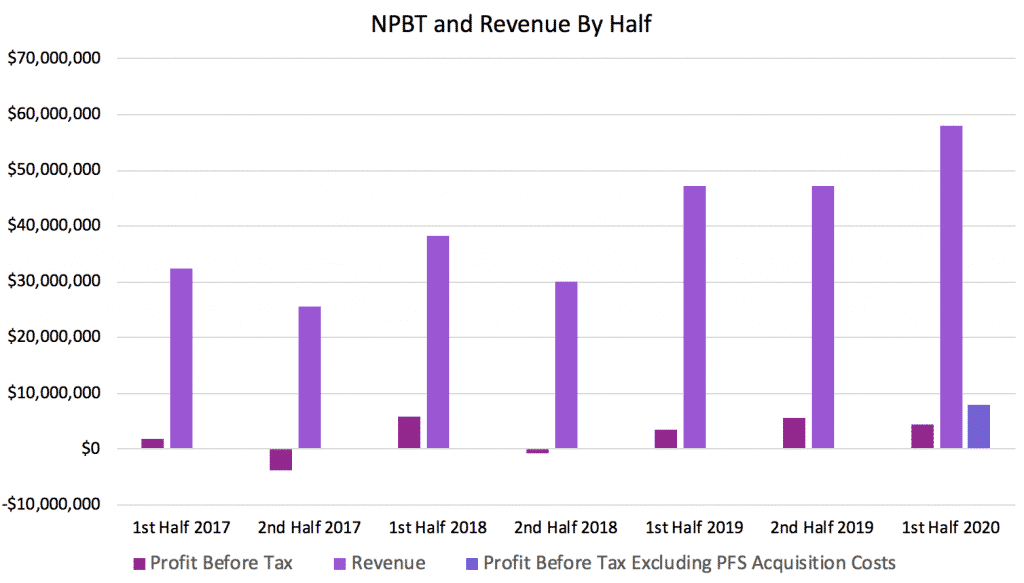

This morning, payment processing company EML Payments Limited (ASX: EML) announced its half year results. I tend to focus on profit before tax (PBT) as a measure of growth for EML, since it is not paying regular tax rates at this stage. As you can see below, PBT was up about 24% versus the prior corresponding period, or 119% if you back out the costs associated with the recent acquisition of PFS, discussed here.

Related: https://arichlife.com.au/critical-report-smashes-eml-payments-asx-eml-share-price/

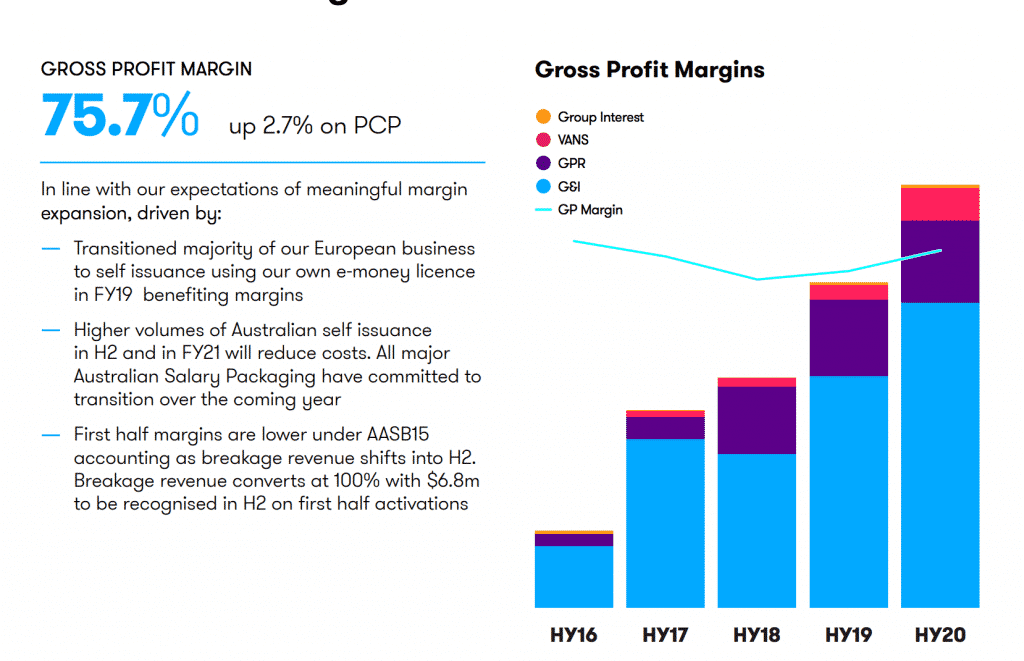

Each of the business segments managed to grow their gross profit contribution, with virtual account numbers (VANS) growing particularly strongly, albeit off a low base.

Notably, we should see a dramatic increase to the GPR segment once the PFS acquisition is completed, which will shift the overall business to be higher growth, but lower margin.

EML tends to highlight its NPATA measure of profitability, which represents the profit generated by the business excluding all acquisition related costs including; amortisation, contingent considerations, share based payments and cash expenses that relate to acquisitions. Its NPATA was $16 million for the half, up by about 70%. The company has updated its guidance, slightly increasing its NPATA guidance to at least $27.5 m for the full year.

As I write the share price is down about 15% to $4.70, giving the company a market capitalisation of around $1.53 billion. It has cash of just over $250 million, leaving an enterprise value of around $1.28 billion. That seems rather rich for its level of profitability.

On top of that, this half saw very weak cash conversion, with free cash flow of only $2.1 million for the half. While the company is forecasting improved cash conversion in the second half, it’s impossible to ignore the fact that the to reject the conclusion that the company must sustain strong growth if it is to justify its current valuation.

Should I Sell Some EML Payments Shares?

Results time is always a good prompt to re-visit an investment thesis. A huge part of why I write these investment diaries, which are not advice, is because I want to hold myself to account as an investor.

As Supporters may recall, I first bought in August last year for around $3 per share, because I thought the business model is attractive, and the valuation not too demanding. You can see what I wrote to Supporters, below:

Subsequently, the company produced some strong results for the second half of FY 2019, and upgraded guidance. At that time, I still considered the stock attractive at around $3.40, in part because I anticipated further uplift in both the business, and market sentiment towards the business. You can see part of that diary entry, sent to Supporters, below:

Since then, the company has entered into the ASX 200 and also announced a huge acquisition of PFS financial, which we covered here. These events have had the effect of putting a spotlight on the stock, which has translated to positive market sentiment, in turn pushing the price to heady heights. Today’s 15% suggests that many investors in the stock wee hoping fore more.

In reality, the next big challenge fore the company will be to integrate PFS successfully. If they succeed they could seriously kick-start growth, since digital banking is a growing industry and PFS should improve EML’s ability to serve that kind of company. While the pre-paid gift voucher cards are a solid earner for EML, digital card payments has more potential for growth.

I really like that EML is growing organically, and I think the PFS acquisition is a good move to continue that growth. Having said that, I’m a bit wary because a lot of the sentiment based uplift I previously predicted has already come to pass. These days, the stock is well known and trades on an optimistic price, meaning there is far less potential for sentiment based gains.

As a small-cap investor, it’s important to let winners run because a good portion for my returns come from outsized winners. For this reason, I’m hesitant to sell EML shares.

On the other hand, there is a fairly optimistic valuation and a very important acquisition integration coming up, and I don’t see a lot of share term upside to justify the risk that the acquisition causes problems.

As a result, I’m considering selling some my shares tomorrow, mainly due to the high valuation relative to the level of profitability. For better or for worse, I’m inclined to sleep on it rather than rush a decision. I do think it still has plenty of long term potential, but it might be time to take some profits, at the very least.

This post is not financial advice, and you should click here to read out detailed disclaimer.

Click here to join the waitlist to become a Supporter.