On 24 January, the US Department of Justice (DOJ) along with states including New York and California filed a lawsuit against Google in US Federal Court. Google is accused of illegal monopoly practices in digital advertising. If successful, the Justice Department suit would break up the company’s digital advertising business, as well as obliging Google to pay as yet unspecified damages.

As reported by Jason Kint, CEO of Digital Content Next, the principal issue is Google’s AdX, an exchange where advertisers and websites are automatically matched based on their bid prices. Formerly DoubleClick Ad Exchange, it was purchased by Google in 2008.

According to the DOJ, Google takes 20% of all ad auction transactions via AdX. It is alleged that Google manipulated the winning bid price to maximise the number of completed transactions and total revenue, without the knowledge of the buyers or sellers of advertising.

“The analogy would be if Goldman [Sachs] or Citibank owned the New York Stock Exchange,” Jonathan Kanter, head of the DOJ’s antitrust division said Tuesday at a press conference.

The DoubleClick acquisition also gave Google control of the largest ads server. The DOJ alleges Google illegally leveraged this monopoly position. “If publishers wanted access to exclusive Google Ads’ advertising demands,” they say, “they had to use Google’s published ad server and ad exchange, rather than equivalent tools offered by Google’s rivals.”

DOJ also claims that Google secretly reduced payments to advertising publishers (the websites) who partnered with Google’s competitors.

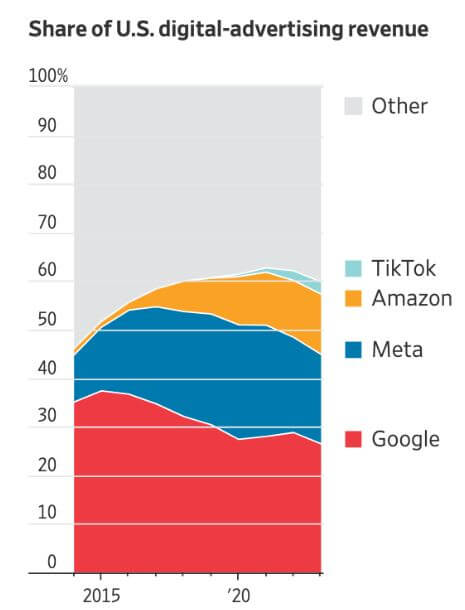

The suit has been at least five years in the works. Ironically, the dominance of Google (and Meta) in online advertising has been gradually declining since 2017 and dipped below 50% for the first time in 2022. Politico estimates digital advertising will be worth USD $280 billion in 2023.

As Axios recently reported, major sites in e-commerce (e.g. Amazon, eBay, Etsy), streaming (e.g. TikTok, Hulu, Spotify) and social media (e.g. Twitter) who do not pay Google to run their advertising have been eating away at the company’s market share. In other words, the centralisation of the internet around a few major platforms reduces the amount of traffic whose advertising is managed by Google.

Follow Christian on Twitter for more news updates.

Sign Up To Our Free Newsletter