One of the features of modern stock markets is that billions and billions of dollars are invested into passive index funds, such as the Betashares Australia 200 ETF (ASX: A200). The attraction of these broad index funds is that they charge incredibly low fees. In the case of the Betashares Australia 200 ETF, the management fee is just 0.04% per annum.

These index tracking exchange traded funds do not need to employ any analysts because they simply buy the companies that are included in the relevant index. In the case of the Betashares Australia 200 ETF, and many others, the relevant index is the S&P ASX 200 Index. As a result, when a company is included in the S&P ASX 200 Index, passive index funds will automatically have to buy shares within a certain time period (according to their mandates).

How Is A Stock Included In The ASX 200?

One common misconception is that the ASX 200 Index consists of the 200 largest ASX stocks. In fact, it consists of the largest and most liquid 200 stocks. You can read more about the S&P ASX 200 methodology here, but the short version is that S&P considers both the liquidity of a stock, and the free float adjusted market capitalisation.

That means S&P will exclude some shares from their calculation of market capitalisation. The most impactful type of exclusion is when a founder owns a large chunk of the company (sometimes over 50%). In that scenario, S&P will exclude those shares when calculating the market capitalisation for the purposes of inclusion in the ASX 200. To quote the company:

“The [ASX 200] index measures the performance of 200 of the largest, by float-adjusted market capitalization, highly-liquid ASX-listed securities defined as ‘domestic’ or ‘Australian’ for index purposes.”

Finally, because the ASX 200 Index is used as a benchmark by many funds, once a company enters the ASX 200, some “index hugging” funds will buy shares in it, even if they underweight it relative to the index.

The bottom line is that once a stock enters the ASX 200, many more market participants are incentivised to buy shares.

What ASX Companies Might Be Included In the ASX 200 In The Future?

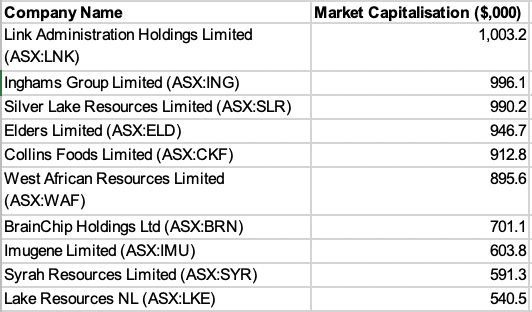

In order to come up with a list of companies that could be included in the future, I looked at the largest companies that are currently in the ASX 300, but not in the ASX 200. Obviously, certain things would need to happen for these companies to be included. Potential paths to inclusion would be a founder selling shares, increased trading liquidity, or a rising share price. Before we go on to the stocks I think could enter the ASX 200, for interests sake here are the 10 smallest stocks currently in the ASX 200 (keep in mind this is by market capitalisation, not float adjusted market capitalisation).

And without further ado…

ASX Stocks That Could Enter The ASX 200 Soon

Adbri (ASX: ABC)

Adbri is an Australian manufacturer of cement, lime and dry blended products. It dropped out of the ASX 200 in the March 2023 rebalance, in part because its share price was down considerably. More recently, its share price has increased again (up over 40% since March), so it may well be included once again. Adbri’s market capitalisation is around $1.5b.

Ventia (ASX: VNT)

Ventia is an Australasian infrastructure service provider. It was established in 2015 when CIMIC Group merged its Leighton Contractors Services, Thiess Services and Visionstream divisions. In February this year, almost 600 million shares came out of escrow and its share price is up around 15% since March. Ventia has a market capitalisation of around $2.4b.

Codan (ASX: CDA)

Codan is a stock I have owned before (but not now). It sells both secure telecommunications equipment and metal detectors. It fell out of the ASX 200 back in June 2022, as a result of a falling share price. But its increasing share price since then has potentially put it in play for inclusion, once again. Codan has a market capitalisation of about $1.4b.

Weebit Nano (ASX: WBT)

Much like fellow computer chip hype stock Brainchip (ASX: BRN), Weebit Nano is big on story and low on paying customers. However, unlike Brainchip, its share price is still quite near its highs. So as long as there is a greater fool willing to buy shares at a higher price, Weebit could well be included in the ASX 200, at which point index fund will likely buy shares and lend them to short sellers. Sounds like a trap to me, but couldn’t leave it off this list. Weebit Nano has a market capitalisation of around $1.35 billion.

Please note: I included Weebit Nano is an example of a stock that I think is more likely to actually suffer from inclusion in the ASX 200 Index. Remember, inclusion in the ASX 200 makes it cheaper to short sell a company, so it can be a double edged sword!

Dicker Data (ASX: DDR)

Dicker Data, an IT distribution stock that I like due to its long track record of success, although I sold my shares in some time ago. Unfortunately, it has fallen on hard times as its debt funded business model suffers with increasing interest rates.

However, the founders still own more than half the company, and founder sales could increase that adjusted market capitalisation enough for inclusion in the index. With a great long term track record, I wouldn’t be surprised if Dicker Data makes it into the ASX 200 eventually; but it is swimming against the tide right now, so I considered leaving it off this list.

Having said that, the current setting might encourage the company to raise more capital, which would also increase liquidity, so I’ve included it for now. For the patient, this might be one of the most attractive stocks on this list. Dicker Data has a market capitalisation of around $1.46 billion.

Leo Lithium (ASX: LLL)

Leo Lithium is a recently de-merged lithium explorer with a high grade deposit over in Africa. Its share price has been strong as it proves up its quality resource, so I could definitely see it making it into the index sooner rather than later if sentiment persists. Leo Lithium has a market capitalisation of around $1.29 billion.

Strike Energy (ASX: STX)

Gas prospector Strike Energy has been listed for over a decade on the ASX, and has grown its market capitalisation massively in that time. Its share price hasn’t been quite so impressive. Either way, it’s had a strong run over the last 6 months and could make it to the ASX 200 if momentum persists. Strike has a market capitalisation of about $1.18 billion.

EBOS Group (ASX: EBO)

EBOS Group is a large healthcare distribution company that I have often covered on these pages. It has currently suffered a setback in losing a major customer in Chemists warehouse, but at the same time, any sell-down by its private equity shareholders could improve liquidity. Part of the problem for EBOS is it trades on the New Zealand stock exchange, as well as the ASX. Because of this, I don’t know if S&P would consider it domestic for index purposes, despite the fact it gets most of its revenue from Australia. EBOS has a market capitalisation of around $6.4b.

McMillan Shakespeare (ASX: MMS)

The salary packaging and novated leasing company was removed from the ASX 200 in September 2020 after suffering badly from the impact of covid lockdowns. However, the share price has since recovered and it is now trading close to 12 months highs. McMillan Shakespeare has a market capitalisation of around $1.1 billion.

Hansen Technologies (ASX: HSN)

Software and IT roll-up Hansen Technologies has suffered over the last year, from the general downturn in tech stocks. But it remains a profitable dividend payer, and its share price is up considerably in the last year. The founding family still own over 17% of the company, so any further sell down could also result in index inclusion. Hansen Technologies has a market capitalisation of about $1b.

Well, I hope you enjoyed these 10 stocks that I think could join the ASX 200 in the next couple of years.

However, none of these companies look as good as my favourite company on the cusp of the ASX 200.

I have written a lengthy article on why I like this company, with its stellar history of growth, profits and long term demand tailwinds. However, this article is only available to Supporters of A Rich Life.

If you’d like to be the first to receive my favourite long term investment ideas, then join the waitlist to become a supporter, today!

Disclosure: the author of this article does not own shares in any of the above mentioned companies, and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.