Unfortunately for me, I have to report that I underperformed the market in calendar year 2021. As you can see below, I made just 13.6% relative to a 19.75% gain in my benchmark. In large part, that was due to the sharp drop in the highly priced growth stocks that drove my returns in 2020.

Notably, just 6 months ago my trailing twelve month return was thumping the market, so the latter 6 months have been a particularly bad stretch, for me. You can see what I mean in the chart below.

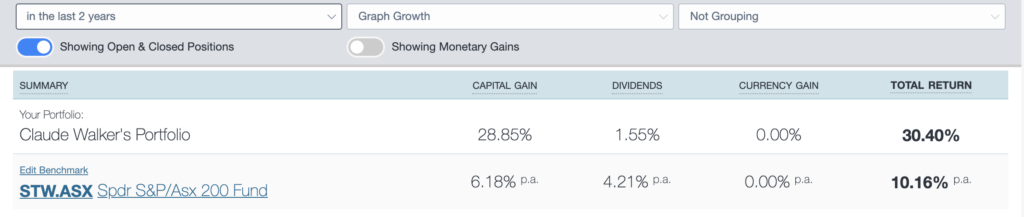

Indeed, notwithstanding the underperformance of around 6% over the last year, my two year performance is still well above the market…

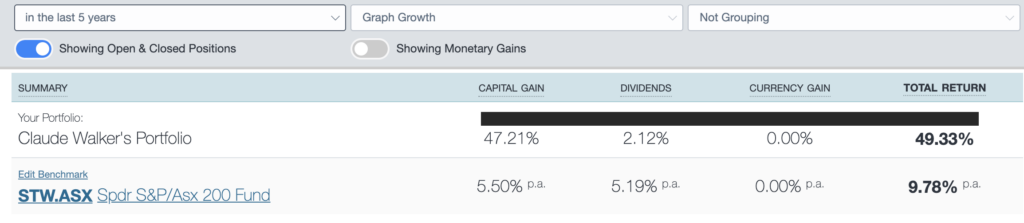

As is my 5 year performance…

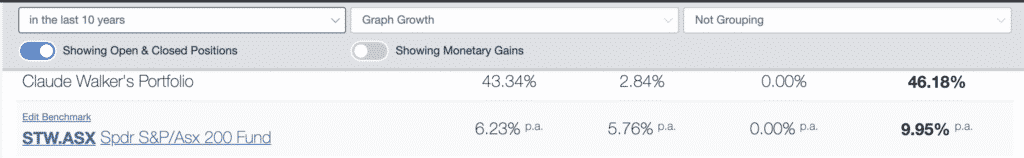

And 10 year performance.

These returns are annualised money weighted returns per the sharesight methodology.

What were my biggest losers in 2021?

My worst 5 detractors in 2021 were Damstra, Kip McGrath, Rightcrowd, IntelliHR and Corum Group. Of these, Damstra did by far the most damage, as it missed guidance multiple times, and I ended up selling at less than half its share price peak. Rightcrowd and IntelliHR both disappointed the market with poorly managed capital raisings, and trade below the capital raising prices as the market works through the overhang. Kip McGrath has been impacted by the pandemic and the market is waiting for Corum Group to prove its turnaround.

I continue to hold the latter 4 losers in my portfolio.

What were my biggest wins in 2021?

My biggest winners were Pro Medicus and Objective Corporation, which have managed to continue to trade at close to highs, despite the general drawback in expensively priced quality growth stocks. I fear these two may be a drag on my portfolio in 2022, but I continue to hold them as per my long term investing philosophy.

What Was My Biggest Missed Opportunities in 2021?

Unfortunately, during the year I sold my shares in Cettire at around $1, and they currently trade at around $3.60. Holding on to that stock could have easily put me roughly on par with the market.

However, the bigger missed opportunity was to sell Damstra shares after the takeover of Vault Intelligence, at over $2 per share. I did not have a positive view of Vault and in hindsight that transaction was the top in the share price. Mea culpa.

A Positive To Finish Off The Review

On the plus side, my first major purchases in 2022 are likely to be participating in the capital raisings of Alcidion and Ebos Group, at below the current share prices, which should be some instant gains to kick off the year… fingers crossed!

Please remember that these are personal reflections about a stock by the author. I own shares in EBO, ALC, PME, OCL, KME, RCW, IHR and COO.This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!