Is It Time To Take Profits On Gentrack (ASX: GTK) Shares

Gentrack (ASX: GTK) shares are up 766% from 2022 lows. With growth steady but slowing, should investors consider taking profits after the turnaround?

Gentrack (ASX: GTK) shares are up 766% from 2022 lows. With growth steady but slowing, should investors consider taking profits after the turnaround?

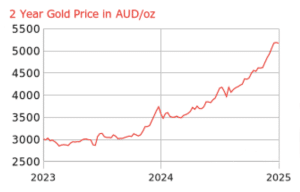

It doesn’t pay a dividend, it doesn’t grow earnings, and you can’t build a discounted cash flow model around it. So why do I invest in gold?

Sure, you can hide gold bars under your bed. But what if you want to keep your gold in your ASX portfolio?

This is a great company but it is certainly priced as such.

The Supply Network share price has been pretty flat despite market volatility, in the time since it released its H1 FY 2025 results.

ABS queries calculation of students’ income earned in Australia as export revenue.

The Q3 results were a little on the weak side, but still very solid.

Australian Finance Group (ASX: AFG) sees steady growth in broker services, improving loan margins, and a 4.7% yield despite flat profit.

“The King plays golf. The courtiers draw swords. The empire holds its breath.”

The results were fairly solid, but beneath the surface I’ve spotted a few mild warning signs that make me cautious.

The thinking behind ALP’s promise of minimum $1,000 income tax deduction.

Pilot project to replace car park with public housing takes five years to reach public tender.

Only a few analysts are following this strongly profitable small-cap stock.

What happened on stock markets overnight, and why we anticipate more panic to come.

Come ask a question if you want!

The tariffs brought in by the Trump administration are causing havoc on the stock market. What to do?