Sometimes, things just work out for the best. But not always; and it’s my job as an investor to try to keep an eye out for drawdowns and make decisions about whether I want to ride them out or risk opportunity cost to try to avoid them.

First, we have the upcoming presidential election. I have a friend, who bet another friend, that Trump would have three terms as president (at something like 50:1). Did Matt buy an attractively priced put on the end of democracy in America? I don’t know, (and I don’t remember the odds) but I definitely would have preferred his side of the bet.

Second, we have the potential for a second wave of coronavirus hospitalisations. Given high positivity rates, it’s likely the true number of cases were massively undercounted in the first northern hemisphere wave. We now know that respiratory spread is a major culprit and the vast majority, if not virtually all respiratory super-spreading events take place indoors. We also know that in colder climates, people make the most of summer, spending much of the time outdoors, but retreat indoors for winter.

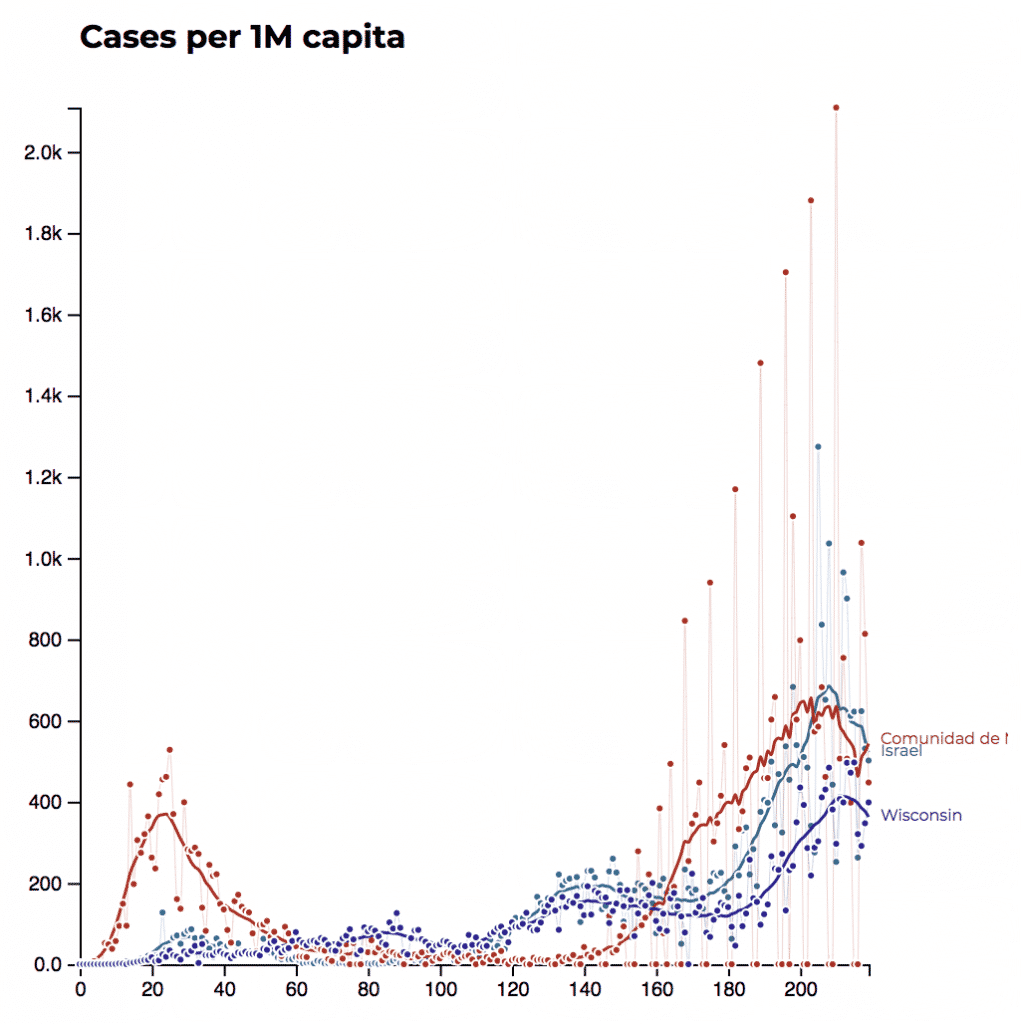

For example, Wisconsin starts getting cooler in September, and we’ve seen a serious increase in cases emerge. We know it is serious because the state is set to open a field hospital at State Fair Park to manage a surge in Covid-19 cases and hospitalisations across the state.

Is this a situation where Wisconsin people are susceptible to a second wave because they haven’t had a bad first one or is it simply unlucky that it took off a little sooner there, than elsewhere? I have included Israel in the image below (source) so as to show Wisconsin is not the only place like this. And I have included Madrid to show that it seems a second wave is possible even after a big first wave, though it is still reasonable to expect some immunity benefits.

Third, we have a huge influx of new, smaller, inexperienced investors. I don’t think I really need to link to a source for that, because it is literally all around us. It is on facebook, reddit, twitter and linked in. The algorithms are forming echo chambers, and this is a generation that cut its teeth on cryptocurrencies. Yolo, indeed.

For the first ingredient, the election, I think it’s a wash. Both parties will do their best to keep stock markets strong medium term; Biden through stimulating economic activity from a more bottom up approach (potentially after a short period spent restricting virus spread), while Trump will continue shifting wealth from the poor to the rich. While I would say there is an approximately 60% – 80% chance that both outcomes are medium term bullish equities, both outcomes definitely have a non zero chance of backfiring.

For example, Trump could blatantly steal the election through the disenfranchisement of some voters, leading to a crisis of confidence in the USA as a functioning democratic system (or could surreptitiously steal it, or win legitimately.) Biden could win, and immediately impose harsh measure which would be effective were they followed; but prove impossible to implement as a result of the intellectual evolution that has occurred in what Americans assure us is the greatest country on earth. The resulting show of disunity, ineffective policy and (potentially) taxes on high wealth could spook markets.

The second ingredient is what worries me most, as it has a strong skew to negative outcomes until a vaccine or more effective treatment (for symptoms; not just saving lives) becomes widespread. To my mind logic dictates more cases in northern hemisphere winter, though I think this is much more of a threat in places without the political will to track and trace effectively. In this scenario, Australia continues to experience a relatively benign pandemic but is nonetheless impacted by the global recession that is W shaped in the best case scenario. Of course, we could see effective treatments and vaccines emerge any time from the end of this year, in the best case scenario.

The third ingredient has a skewed positive outcome, if governments continue with generous monetary policy. Millennials have been priced out of housing which in general offers mediocre returns (though these are traditionally juiced with extreme leverage). I don’t think a bull market in cheap apartments can be easily sustained now that we’ve glimpsed the fundamental value of living in a house most little boxes in the sky. Well built, sunny apartments with nice views should do fine; though not as well as in the past, and only assuming we maintain low community spread.

If millennials get a taste for equity investing the net result will be sustained higher participation in my opinion. Since this cohort are still earning incomes, this should mean much more active investing over time. The way this cohort evolves over time will be very interesting; and potentially rewarding for everyone. So while I do think this rising tide of exuberance could recede (and probably will to some extent), I think overall it’s a positive for markets and will remain so. Of course, this ingredient also has a dark side which is that clearly a lot of this has been one off, and driven by superannuation withdrawals, job-keeper and job-seeker. Therefore, I think we are reasonably close to the peak of the wave for new participation, which may occur around Christmas and New Years (as people get together and trade stonk tips).

As a result of all these factors, my outlook skews noticeably negative at the moment overall, and I may look to trim some profits once the current dash of buying momentum subsides. The main positive is the active speculation by millennials. I can maximise my chances of catching that particular tailwind by sitting in smaller stocks with good thematics, so I have initiated three new micro-cap positions and topped up on a couple of others, over the last week. Unfortunately the overlap of good businesses and meme stocks is limited, but that is another story.

If you’d like to receive a occasional Free email with more content like this, then sign up today!