While there’s no doubt that many companies will suffer from the tragedy caused by the novel coronavirus, there’s very little that can be done about that. Travel companies must suffer so that fewer humans do. What is best for all of us is that the outbreak is as controlled as possible and that patients are treated as well as possible.

The most obvious way to behave in light of the viral panic is to dust of your list of quality ASX stocks that you’d like to buy, if only they were a little cheaper. To quote VGI Partners, “historically virus-related market volatility has provided attractive entry points for long-term investors in high quality companies.”

A 1999 study published called The Economic Impact of Pandemic Influenza in the United States: Priorities for Intervention suggested that a global flu pandemic would cost the US about $250 billion in today’s dollars. The US has a GDP of around $19 trillion which grows around 2%, or $380 billion, most years. So based on this modelling a pandemic might ‘cost’ a lot.

Even if we assume that’s a massive underestimation, we’re still only talking about a disaster that will knock economies around temporarily. As always, that will severely punish shareholders low quality businesses with weak balance sheets. For a long term investor in high quality businesses with strong balance sheets, it should not be overly concerning.

Of course, if an economic blow strikes hard enough, everything is affected, so even investors in high quality growth stocks may want to bolster their cash reserves.

Having said that, it’s not entirely clear that Wuhan coronavirus is worse than a bad influenza virus. At this time, the novel coronavirus almost certainly kills fewer than 5% of those who catch it, and given that many milder cases of the disease have probably not been captured in the data, the rate may be even lower than that. That’s of scant comfort in a pandemic, of course.

What is entirely clear is that you have some really crazy cognition going on. I have seen professional investors profess concern that — I kid you not — the Chinese government have developed the coronavirus themselves and, inadvertently or otherwise, released it into their own population.

This hypothesis is so blatantly absurd, and lacking even so much as a scintilla of evidence, that I find myself wondering whether the veil has slipped and their racism is showing. Would they be similarly concerned if they read a lie on a propaganda website suggesting the Australian government might have done such a thing?

What we know about the coronavirus so far is that it will drastically reduce travel, reduce optional consumption in China, reduce demand in China generally, and increase demand for certain healthcare products.

Therefore, my response is threefold:

- Sell some lower conviction positions to raise a little extra cash to buy the (currently) more optimistically priced highest quality stocks that I already own, should they drop drastically. This is only required because I am usually close to fully invested at any given time.

- Buy shares in Ansell (ASX:ANN), as a momentum trade. The company is already buying back shares and is the most obvious beneficiary of soaring demand for items like face-masks and rubber gloves. This narrative should only gain strength as the media-driven hysteria around coronavirus gains traction. But I’ll probably sell before the company reports results on the 18th of February.

- A very small short position in Wisetech Global (ASX:WTC). Wisetech is a roll-up of software companies in the global shipping industry which has already been accused of using clever accounting to make its results look better than they would otherwise be. If high multiple shares drop, Wisetech should, and if global trade takes a hit, Wisetech should since it offers transaction based ‘on-demand’ licenses.

Within my portfolio my most exposed company is Webjet (ASX:WEB), which I would consider selling if the virus looks very likely to become a pandemic.

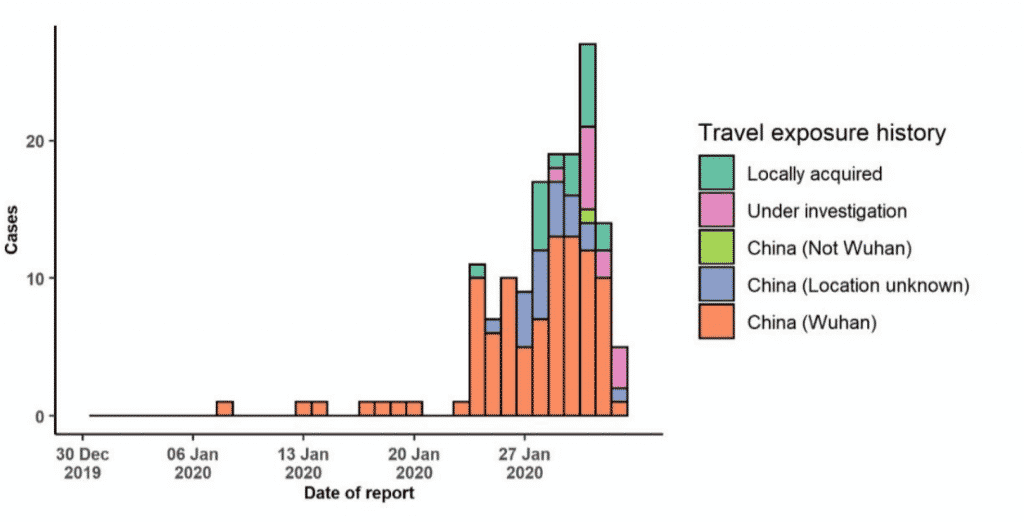

As you can see below, at the time of writing there is very little evidence of person-to-person spread outside of China. For me, that’s the key variable, and we won’t know if that’s happening for at least another week.

Addendum March 6: This was obviously far too complacent, but accurately reflected my thinking at the time. Luckily I sold out of Webjet not long after this post. The Wisetech short is working nicely, and as forecast I sold out of my position in Ansell (ASX:ANN).

I then bought shares in Sonic Healthcare (ASX:SHL) at around $30, because I think it will benefit from increased testing volumes.

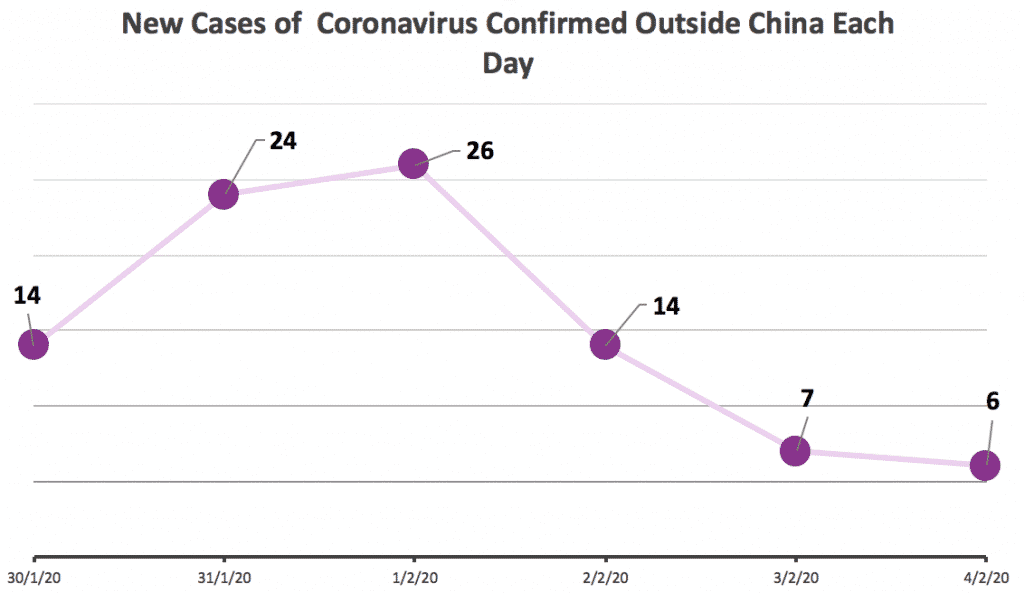

February 5, Update: I think it’s important to note that the rate of spread outside of China is actually slowing.