This article focuses on investors’ response to the novel coronavirus and the impact of that on society. It in no way intends to minimise the very real human cost of this disease.

Usually, when you see other market participants talking absolute rubbish its a good thing. In a stock market, if you are looking to sell shares, having others bullish about opportunity and complacent about threat is actually a good thing, because it means you’ll be able to sell your shares for a higher price. And that’s something I’m thankful for.

However, when you’re talking about a global pandemic, complacency, spread from individuals with vested interests to their followers, actually has the potential to increase harm. That’s because a complacent population will do less to minimise the spread of the virus, which can therefore spread more quickly, and put greater pressure on the health system. The concept should be obvious for people who care about their friends and neighbours.

Scenes from China and Italy show what is required when health systems are overwhelmed. In that scenario, society must effectively shut down, which has large economic impacts. Worse still, an overwhelmed health system also leads to more suffering and a higher mortality rate. Ironically, if we do react to dire warnings, they are less likely to prove accurate.

The Australian financial commenteriat should not be proud of their collective contribution to the discussion. While some have argued for protective measures, overall there is a strong current of commentators sharing material that suggests we are over-reacting to the threat.

In this article, I look at just two examples of the many investors who are promulgating the theory that the coronavirus is just a flu.

Ron Shamgar, TAMIM Asset Management

Ron Shamgar seems to have offended quite a few people with his prognostications about the virus. When I asked for examples of complacent investors, no single example was proffered more frequently than Ron.

Early on, Ron Shamgar decided that the virus was best referred to as the “Chinese Pneumonia”. Chris Behrenbruch’s response spoke for more than a few:

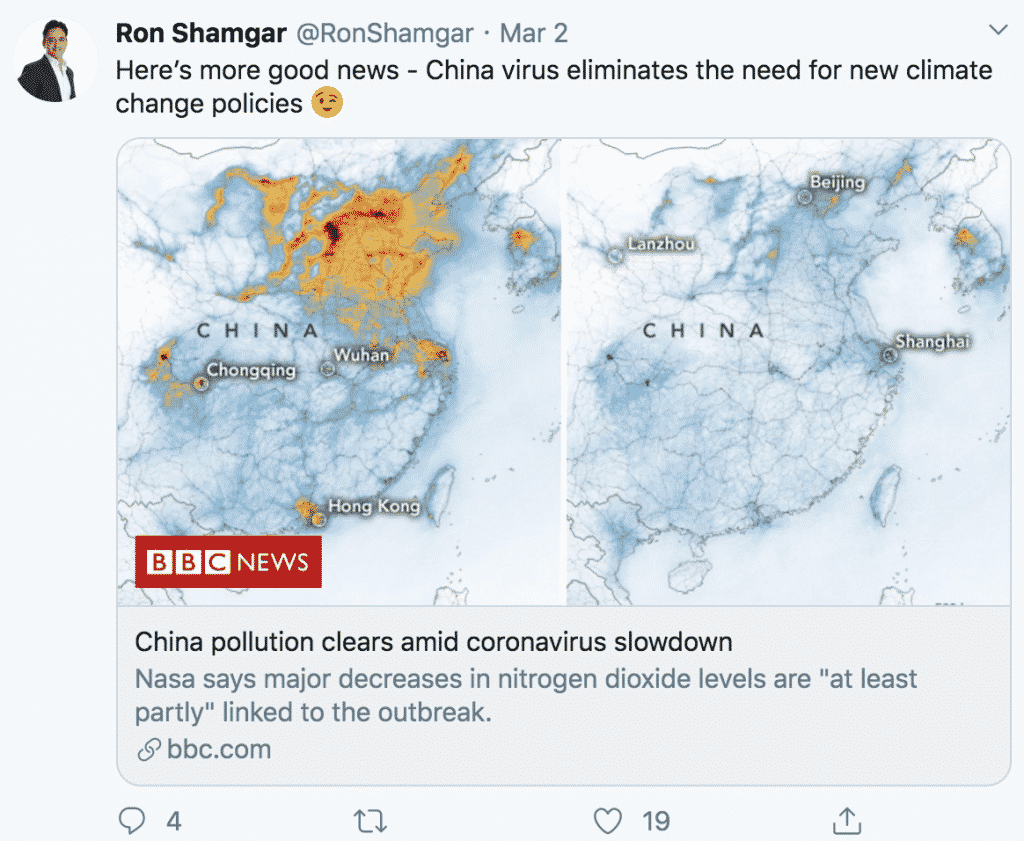

Even if you don’t consider this offensive, it’s a clear example of minimising the impact of the virus by implying it is only a problem in one country, China. Ron took plenty of opportunities to repeat it.

And of course, like many proponents of the #justaflu theory, he is promoting material that suggests the virus is less severe than the common cold. He goes further to say that the current “hysteria” is “for absolutely no reason”.

Ron disclosed in January that Tamim Asset management holds Bigtincan Holdings (ASX: BTH) and values it at $1.30. Given his view that the virus is largely China’s problem, it would be interesting to see if he has spent February deploying his investors’ money into the stock. If so, they may not feel great about his take on the viral threat!

Addendum April 21: Ron’s report for March 2020 shows the fund returned -34%, after returning -11% in February. Not only that, but the fund ended March with 49% cash. Unless it were quickly deployed in the first days of April, that means the fund managed may not have benefitted fully from the bounce. Maybe Ron would have achieved better results if he had not been so busy tweeting about how he would be calling Covid19 “Chinese pneumonia”.

Addendum June 25, 2021: As Sydney and Melbourne continue to suffer lockdown, Ron Shamgar is now proudly refusing the vaccine until he gets to travel.

Update January 2022

Ron Shamgar in 2022 doesn’t seem to understand how masks slow the spread of coronavirus.

Peter Switzer, Switzer Report

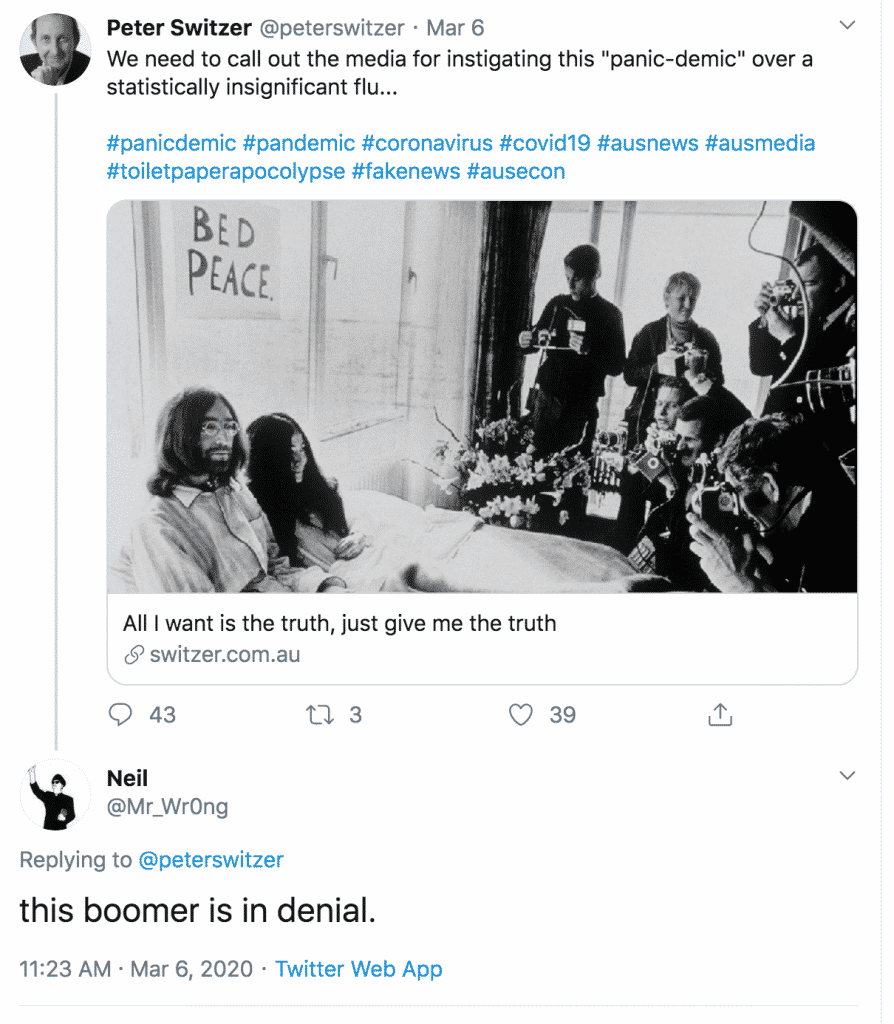

Arguably, though, a worse take on the emerging coronavirus pandemic, or “panic-demic” as he prefers, comes from Peter Switzer. He describes it as a “statistically insignificant flu”.

It is actual misinformation to describe the coronavirus as a flu, since it is biologically not that, and we know it. But to go one step further and minimise it as “statistically insignificant” leaves me at a loss for words.

Conclusion

I have no problem with stock commentators making bad calls. For example one prominent Advisor recommended Webjet (ASX: WEB), Corporate Travel Management (ASX: CTD) and Treasury Wine Estates (ASX: TWE) as “Best Buys Now” on February 6. Subsequently the same Advisor made both Webjet (ASX: WEB) and Treasury Wine Estates (ASX: TWE) “Best Buys Now” again on March 5.

While investors who follow this advice may live to regret their decision, losing money on the stock market is a far lesser concern than minimising the actual threat posed by the coronavirus to society.

If citizens take the view that the coronavirus is a “statistically insignificant flu”, then they are more likely risk exposure to the virus and, worse, take risks that may expose others. What do you think the impact will be if Peter Switzer’s views spread too widely?

It is one thing to take the view that stocks are cheap and that the current sell off is a buying opportunity (though I myself am very cautiously positioned). But it is another thing altogether to encourage the view that the coronavirus is less severe than the regular flu or even the common cold. Responsible citizens should discourage such behaviour. If you think that stock market commentators have a duty to stick to the facts, then I hope you will share this message.

The original version of this article made reference to this tweet, which is since dated.

If you only learn one thing about #COVID19 today make it this: everyone’s job is to help FLATTEN THE CURVE. With thanks to @XTOTL & @TheSpinoffTV for the awesome GIF. Please share far & wide. pic.twitter.com/O7xlBGAiZY

— Dr Siouxsie Wiles (@SiouxsieW) March 8, 2020