As we covered yesterday, financial advisers S3 Consortium recently bought shares in Oneview Healthcare at a share price of 6 cents per share, and agreed to their research and thesis about the stock. As a result, at least 5 organisations sent mass emails to investors, promoting OneView Healthcare. Today, we report that S3 Consortium, trading as StocksDigital, is publishing misleading information to its readers.

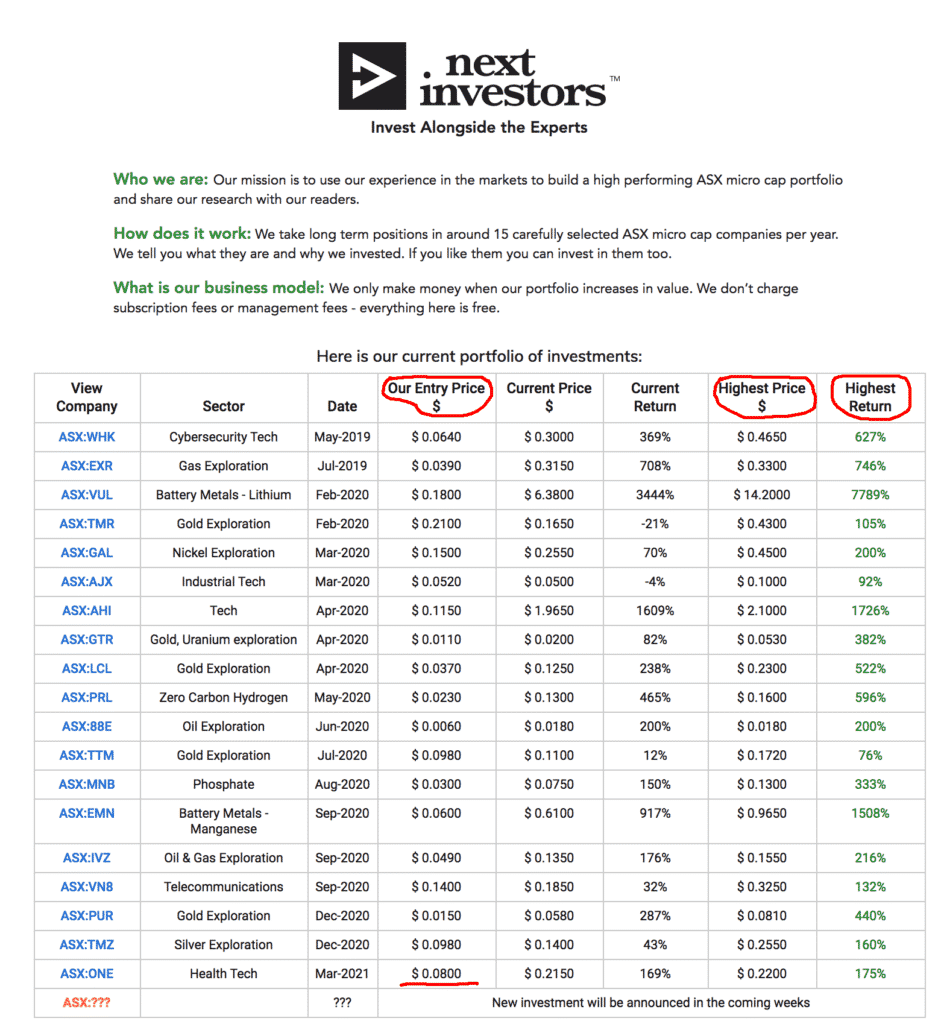

Below, you can see next investors’ scorecard page. Their motto is “Invest Alongside the Experts”. Notably, instead of advertising just their current returns, their scorecard below advertises the “highest price”, and the “highest return”. I would argue that this highest return is not very useful, unless next investors told their investors to sell (and their investors received the “highest return” price).

It’s pretty noteworthy to see advisors to report on the highest price their investment could ever have received, even if they never told people to sell at that price? Apparently so. Note that the highest return is highlighted in green but the current return is not.

Other financial advice websites we observe seem to report returns from the day after they release buy recommendations, so as to better reflect the returns their clients could have received, if they had followed the advice.

I have screenshotted the page below in case Next Investors change it, but you can see the real version for yourself.

Worse than that, the “Our Entry Price” column, used in the calculation of “highest return” and “current return” is misleading, at least in the case of OneView.

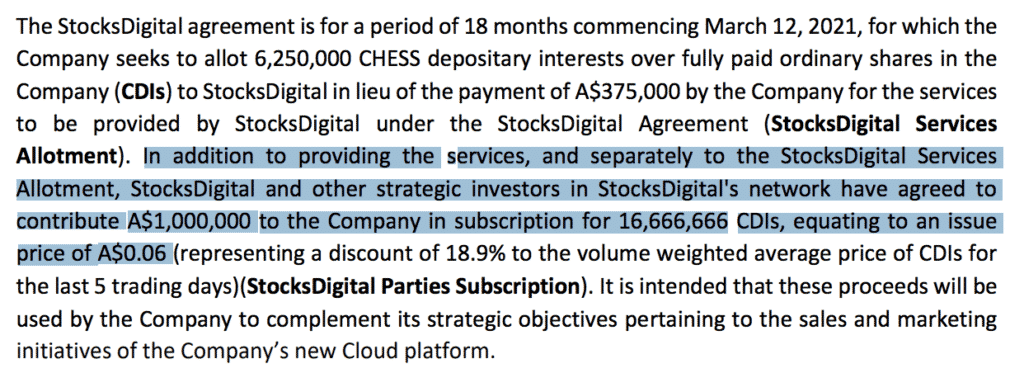

According to the OneView company announcement, S3 and its network invested in OneView at 6 cents per share, not 8 cents per share. Rather, 8 cents per share was the last closing price when they released their report promoting OneView on the morning of 12 March, 2021. According to the company announcements, it is not the price that Next Investors bought shares at.

This is plainly evident, below:

I am surprised to see AFSL holders present “our entry price” as 8 cents per share, when in fact they bought at 6c.

Furthermore, Next Investors’ clients (by which I mean the people receiving their free financial advice, not the people paying them) could not possibly have bought shares in OneView at 8 cents after reading their report. That’s because after Next Investors sent their email to their “clients”, the stock opened at over 14 cents. Therefore, it would not have been possible for any clients to buy shares at the 8 cents they claim as “Our Entry Price”, let alone the price of 6 cents per share, that they actually received.

As you can see below many retail investors bought shares in ASX:ONE on the day S3 Consortium started their promotional campaign, but not a single one bought below 14 cents on that day, and many bought at much higher prices.

Here’s the top 5 #ASX trades by Sharesight users on March 15 2021 pic.twitter.com/txaFuBRe2C

— Sharesight (@sharesight) March 15, 2021

It is very interesting to learn that AFSL holders like S3 consortium are willing to present entry prices that are a) incorrect and b) unable to be attained by any of the people who follow their advice.

Given that S3 Consortium is able to publish these numbers, we can only assume we will see more AFSL holders presenting entry prices to their readers, in this way. Eventually, this practice will lure many new retail investors into low quality companies not realising that the advisors they are following are buying in at lower prices than they can.

Notably, Next Investors report on OneView did not disclose that they bought at 6 cents per share. In my experience, if you name the price you were willing to buy at, readers will anchor to that price and be less willing to pay any price. It truly is a pity but some readers may not realise that the people who wrote the investment report prompting them to buy at 20 cents per share, actually paid only 6 cents per share.

Are Next Investors Misleading Readers About Business Model?

Finally, Next Investors says on the page linked above that “We only make money when our portfolio increases in value”. However, in OneView’s announcement of its deal with Next Investors, the company discloses it will pay 6,250,000 shares to S3 “in lieu of $375,000” as consideration for S3 using StocksDigital (aka The Next Investors) to “share its research, commentary and investment thesis on the company.” Therefore, the company will make money even if the portfolio goes down in value, because it is given shares as payment for services.

It truly is an interesting state of play when authorised financial advisers are allowed to make these kinds of advertisements to readers. We believe S3 Consortium has considerable power to induce naive retail investors to buy stocks they own shares in.

We believe AFSL holders should be compelled to accurately report the prices at which they buy into the companies they are promoting, and thoroughly disclose if they are paid for sharing their research at every relevant juncture, particularly whenever they are presenting returns.

This article documents some of the factors influencing a company’s share price, but the article is not intended financial advice, it is general in nature, and our disclaimer is here. The author has no position short or long in this company.