As I write this the ASX All Ordinaries (ASX: XAO) are down an even 30%, in just one month. Like many readers, my portfolio has suffered a gigantic wallop, and that’s despite drastically increasing my cash holdings in late February.

When I would dwell on past mistakes, a friend of mine used to say to me: “Well, don’t lose the lesson.”

Not everyone was heavily invested right into the sharpest crash millennials can remember. And the point of this article is to learn from one of those wiser minds.

The truth is that quite a few investors picked the potential for a coronavirus crisis in advance and positioned themselves accordingly. And let’s face it, in hindsight, it was a pretty slow moving freight train. As Rob Shears, founder of Valor Wealth put it:

“I’ve never seen such a high probability of the market going down so quickly. I’d generally never short it because you could be wrong for years. Shorting is a young man’s game and it doesn’t make any rational sense mathematically. Shorting is a much harder game than most people understand and most people who are short get short squeezed and wipe themselves out… I may never short again in my entire life.”

If you’re one of those investors who go long and stay strong and never want to be any other way, stop reading now.

And this article certainly isn’t for the people telling themselves that “no-one could see it coming” or who think they have already figured out the optimum investing strategy. If you don’t want to learn how to handle a crisis from someone who did it better than most, you’ll find no joy below.

But this article is for the lifelong learners. This article is for those of us who don’t want to lose the lesson.

It was in that spirit that I asked Rob for a chat. Luckily for me, he agreed, and we spoke on Thursday last week as I traveled north and into social distancing.

By way of background, Rob is an international airline pilot and runs Valor Wealth. Unlike many, he moved early to protect his clients’ capital from the human tragedy that is the coronavirus pandemic. Seemingly as a public service, he disclosed a week ago today that their positions included:

- Betashares Strong Bear US (ASX: BBUS)

- Betashares Strong Bear Australian (ASX: BBOZ)

- Gold

- Ishares inflation government bonds

- Vanguard government bonds

- Gilead

- Evolution mining

- Kirkland Lake mining

- Cash

Of course, this post is for hindsight learning, not financial advice, and you should click here to read our detailed disclaimer.

It should be obvious to anyone that his fund has weathered this storm better than most, without having to get into the nitty gritty of performance.

And this article is not about performance, anyway. It’s about positioning, and more specifically, how Rob knew to get positioned for this crisis and where he saw it going when I spoke to him last week.

I started the chat by asking when Rob moved his clients out of equities. It seemed he was a little ahead of me, but acted with more conviction and timeliness. As chance would have it, he was already a net seller in January, but more due to valuation than the virus. However, and crucially, he was selling equities because of the coronavirus by mid to late February. This put his clients ahead of the curve, and allowed him to liquidate calmly and at good prices.

When I asked him what triggered him to start selling in February, he said simply: “I was looking at the [coronavirus] growth rate around the world… It was fairly obvious to me that it wasn’t being contained.”

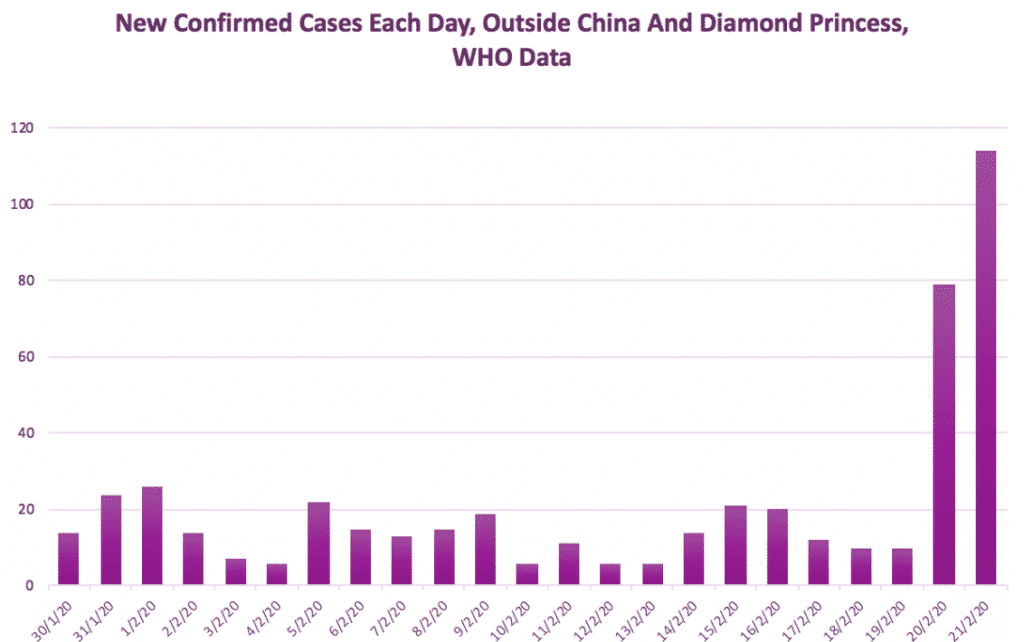

With the benefit of hindsight, we can see the same thing below:

Excluding the

floating petri dish in Japan, the spread outside China essentially started

growing fast towards the end of February, while the first cases of community

infection outside of China were reported in mid-February.

The key that I missed is that by the time government is picking up on infections in a country, absent strict control measures, the disease was probably already well established.

By the end of February, Rob was buying BBUS and BBOZ. This shows the value of being one step ahead. He said:

“It was when it started spreading in South Korea was when I realised it was going to move quickly. It had already started in a couple of other places like Italy.”

Rob mentioned to me he popped by John Hempton’s office and they too were pessimistic about the fast rate of spread.

Flashing back to my little world, by this stage I was too frantically liquidating stocks, and had only just started shorting individual stocks. It wasn’t until after Rob released his letter to investors on Wednesday 11 February that I took the simple (but profitable) act of buying some inverse ETF Units. In my case, that was the BEAR ETF.

There’s no shame in copying, as long as you copy the right people.

As late as March Rob was still taking longs off the table. When we spoke last week, he said their position was only about 20% long. That’s more conservatively positioned than I was, and indeed am now. Rob said that a lot of people are going to be selling “once the world starts to see this spreading over in the US and in Australia in the next 10 days.”

Six days into that prediction, it seems pretty accurate.

Rob was also helpful when it comes to creating a framework for understanding when we might be close to the bottom (I’ll be sharing my framework in a separate article). But one simple point he made really resonated:

“Buffett’s not making offers yet” he said, “There are no 2008-style bailout offers yet, but there will be.”

In terms of watching the crash unfold, Rob has an eye on the credit markets. He says the collapsing oil price has put a credit crisis on the cards and that “a lot of bonds that are gunna not be worth anything.”

In my view, when you’re taking any position in the market, it’s always worth knowing why you think the counter-party is wrong. So I asked Rob why he thought the market was so slow to act on the pandemic. He said:

“A lot of the authorities were saying it’s just a flu but the experts were saying it’s much much worse than the flu and the average person is not very good at exponential maths.”

Makes sense.

Looking forward, Rob sees the USA running into a whole world of pain. He said there is a non-zero chance that the US alone could see 1 million infected. His statement that “The US growth rates are actually worse than Italy” became the subject of my next article.

Rob sees this taking a while to play out. When I spoke to him, he said he’d be moving progressively to a neutral or cash position as the market continued to drop another 5% – 10%, and I’m assuming he’s been busy since then. After all, he said that he’s never worked harder in his life, than the last few weeks.

He said that as the market slumps, “I’ll remove my shorts and then just be in cash. What I own in my portfolio is only capital independent companies.” Even the prescient have to weather the storm. And, according to Rob, a storm is coming:

“March 2009 levels are still a long way down and people just don’t understand that,” he said, “And I think this is worse than the GFC.”

Before you dismiss this prediction let me tell you this. For my own selfish reasons, I asked Rob about most of my shorts.

In between explaining to me how vicious short squeezes could blow me up and telling me the story of auto-maker stocks destroying short sellers at the end of the GFC he dropped this gem, almost whimsically:

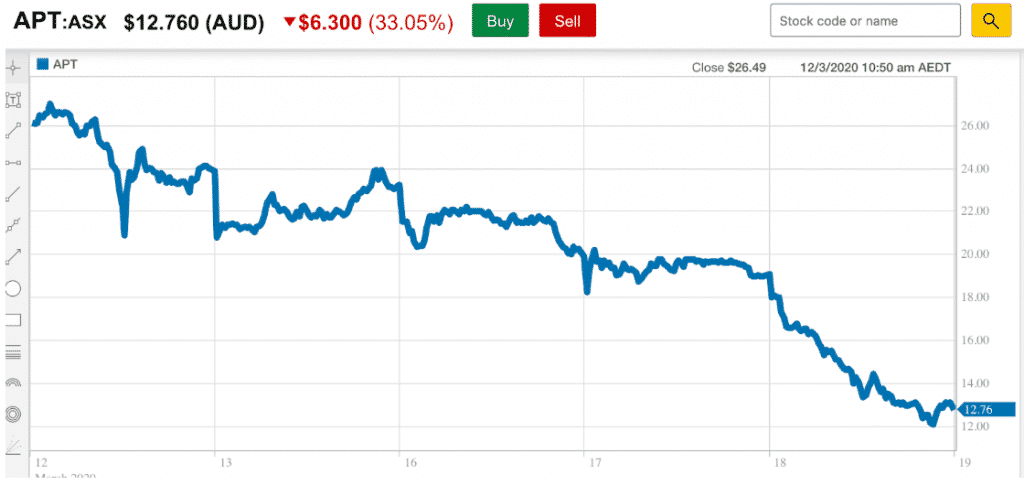

“Afterpay has a loss-making business in the good times. Afterpay is probably a really good short.”

Well, Afterpay is down 51% since he uttered those words. I wouldn’t want to be Rob Shears’ counter-party. (Disclosure: I am short Afterpay at the time of writing).

Rob is well worth following on Twitter.

If you’d like to receive a occasional Free email with more content like this, then sign up today!