Labor’s cut-off of superannuation tax concessions at $3 million-dollar accounts has now been digested without further fuss. Polls immediately following the announcement showed 64% of voters supported the changes.

It made sense for the change to win a clear majority of public sentiment when only 80,000 people have funds large enough to lose their tax concessions. Yet that poll found a striking 29% of voters opposed the change. An Essential poll released earlier this month indicates why.

Essential found a ridiculous 23% of Australians think they are likely to retire with $3 million in superannuation. That’s despite the fact that less than 1% of Australians have $3 million in super at present.

To be clear, a 21 year-old today who made $80,000 per year every year until the age of 67 would retire with around $600,000 in super. That’s a 21 year-old earning well above the current average wage of $68,000.

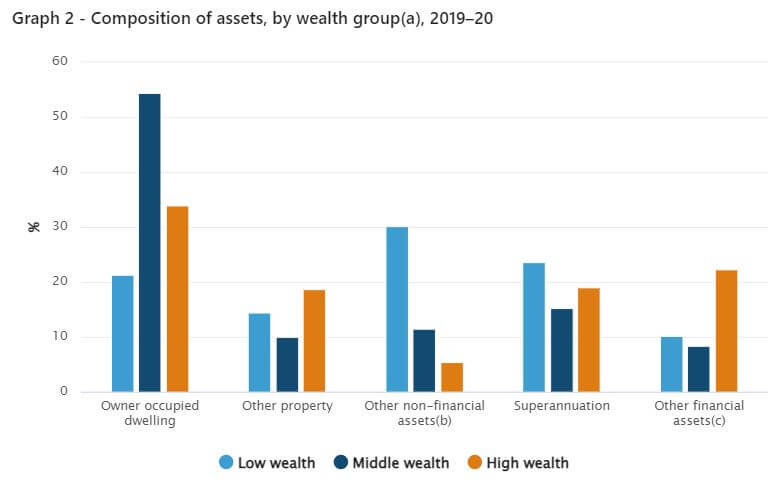

In fact, the average net wealth of the entire top 20% of Australians is $3.2 million. Superannuation makes up 19% of the net wealth of folks in this group, or roughly $600,000 each (which goes to show how unusual our hardworking 21 year-old really is).

For the top 20%, some 53% of this group’s wealth is in property and a further 22% in financial assets. A person holding a $3 million super account that amounts to 19% of their total wealth would have a net position of $15.8m.

This goes to show that the Albanese super change is barely a tax on high net wealth individuals. It is better described as the closing of a tax loophole that had been used by a portion of the very wealthy.

Yet almost a quarter of voters feared that it would detrimentally impact them.

The aspiration fantasies of voters remain the biggest asset for pro-rich politics.

Follow Christian on Twitter for more news updates.

Feature image courtesy of @megnixon via Unsplash.

Sign Up To Our Free Newsletter