In a Friday TV interview, Wayne Swam slammed the Reserve Bank of Australia for its decisions over interest rates. “Hammering mums and dads with higher rates, causing a collapse in spending and driving the economy backwards doesn’t necessarily deal with the principal pushes when it comes to higher inflation,” said Swan.

Though Albanese and Treasurer Jim Chalmers have been more diplomatic, the comments can only be taken as a deliberate rhetorical intervention. Wayne Swan is the current National President of the Australian Labor Party, not to mention former mentor to Chalmers.

How bad has the economy got since rates began to rise? The ABS’s second quarter economic figures were released this week and the picture is not pretty.

The Australian economy grew just 0.2% in the second quarter. That’s after 0.1% growth in the first quarter, a figure which, being above 0, meant Australia narrowly avoided being formally in a recession.

Per capita economic growth, however, was -0.4% in the second quarter. It’s the fifth consecutive quarter of negative per capita economic growth, surpassing the recessions in the 1980s, 1990s and 2000s. On a per capita basis, the economy has shrunk 2% in the past two years.

The figures for household income are even worse. Since rate rises began in 2022, per household disposable income has fallen 8%. This is at the same time as the OECD country average is a 2.8% increase. Household savings continue to be negative. All this shows the flaw in the immigration-led economic model. Historically living standards improve as a result of productivity gains, not just more people.

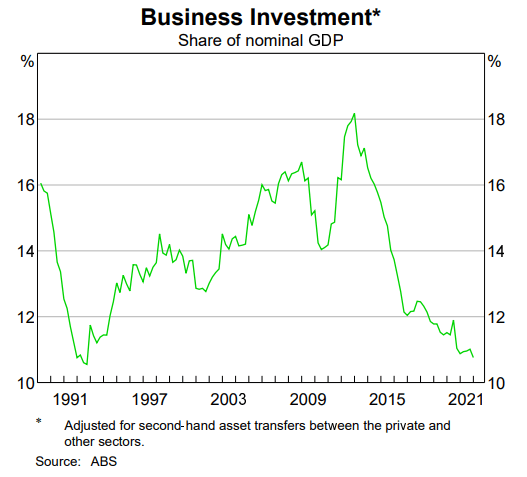

So does Swan have a point? Since the end of Swan’s treasury years, business investment has fallen from around 18% of Australian GDP to around 11%. This means that the Reserve Bank has to hit mortgagees relatively harder than it used to in order to arrive at the same impact in dampening economic demand.

But of course, the Reserve Bank is only acting according to its mandate. If the federal government has alternative ideas, it’s their prerogative to put them forward. It certainly hasn’t been restrained in hiring since its term began.

The economic news adds up to Albanese scoring his highest ever disapproval rating of 54%. So the federal government will be doing everything in its power to scrape a rate reduction before the 2025 election.

Sign Up To Our Free Newsletter