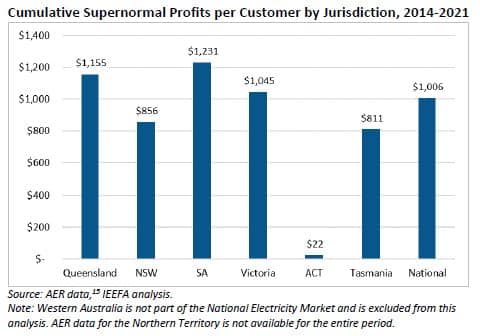

Electricity network providers in the National Energy Market pocketed $1.25 billion in “supernormal profits” each year from 2014 to 2021, over and above a generous “reasonable profit” allowed by the regulator. That’s according to a new report by energy consultant Simon Orme for the Institute for Energy Economics and Financial Analysis.

The report focused on the National Energy Market, which includes the eastern states plus the ACT and South Australia. It is regulated by the Australian Energy Regulator (AER), a federal agency set up to replace state-based regulators in 2005.

Because the energy networks are a natural monopoly, the AER sets an approved revenue for the providers. This is based on anticipated costs plus “reasonable profit.”

Yet during the eight years from 2014-2021, it cost network services providers $11.59 billion per year to run the networks, while their anticipated costs approved by the AER were $12.84 billion per year.

This $1.25 billion in profit is in addition to a “reasonable profit” allowed by the regulator of $1.87 billion per year. This is already a generous 14.6% return on the anticipated (not actual) expenditure.

The bonus $1.25 billion annually is a big increase on the network providers’ profit.

This is not just a subtle levy of millions of consumers for network costs that didn’t exist. The monopoly position of electricity networks means that inflated network costs affect the entire economy. Between 40-50% of electricity costs in the eastern states are attributed to network costs, making Australia less competitive.

Nobody who cares about Australia’s national interest could possibly oppose the idea that Australian businesses should have access to the lowest electricity prices that we can (profitably) provide. Excess profits for monopolists harm everyone, except the monopolists themselves.

This scenario continued over the course of the AER’s five-year reviews in 2015 and 2020. Possible conclusions are that the network providers continued to surprise with their innovation, or that the regulators are failing Australian businesses and citizens alike, perhaps due to insufficient political support.

On the Institute’s view, “The observed persistent sector-wide supernormal profits do not appear consistent with the revenue and pricing principles” in the regulations. This includes the Australia Energy Regulator’s (AER) goal of “ensuring that consumers pay no more than necessary for network services.”

The Institute also observed that the $10.2 billion in overcharging is close to the $12.7 billion required in network upgrades to transition the grid to support the transition to zero-carbon energy.

Follow Christian on Twitter for more news updates.

Sign Up To Our Free Newsletter