In April 2020, I was writing articles about stocks for a pandemic. Sure, I missed many of the best ideas. I wouldn’t say I played anything perfectly. But at the same time, the approach did lead to some genuine success. I’m the first to admit that longer term themes make for more successful longer term thematic investments. So it is with a degree of hesitation that I am gradually transforming my portfolio from being ‘for the pandemic’ to being ‘for the re-opening’.

Now, we are far from sure when the reopening will take place. But it’s fairly certain that at some point in the next couple of years the world will start feeling more like it was before. After all the sickness, death and heartbreak humanity has suffered at some point enough of us will be vaccinated that spread is slower and hospitals can give every individual the best shot possible at surviving covid-19. Even the least effective vaccines are likely to reduce the severity of a disease that impacts some people profoundly.

So we should be prepared for unusually rapid behaviour change over the next couple of years.

In June 2020, I was writing about the Money Printer Trade. And with all my major holdings now trading at close to all time highs, I think it’s fair to say I’ve managed to do ok out of that, even though I was slow to recognise the zeitgeist.

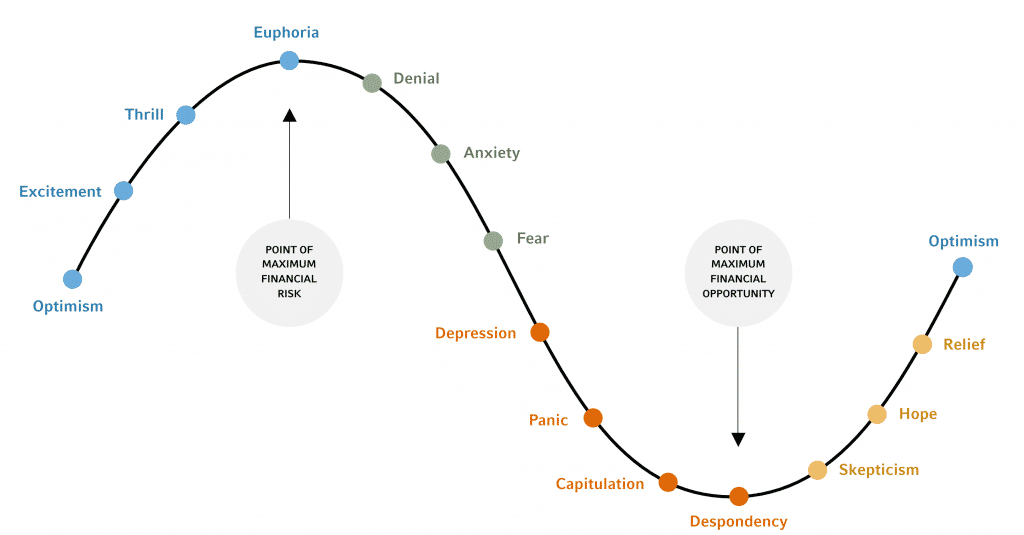

But what now? At an extremely basic level, we can think about sociological sentiment as moving through cycles. Different groups of people will move through cycles at different times, based on their experience. It’s only really when large numbers of participants (or large participants) are in sync that sentiment can move the entire market. But humans are a herding animal. We do naturally tend towards synchronicity.

Where do you think average investor is on the Russell Investments cycle of investor emotions, below?

I won’t bombard you with the furore about r/WallStreetBets and its market moving potential; but suffice it to say the hive makes Goldman Sachs look like weak sauce, because while Goldman influences thousands of stocks to varying degrees, the retail investor is focussed on meme stocks and cloud growth stocks.

Many stocks, or should I say stonks, are trading at all time highs. Some of these are great businesses; but others are flying on pure speculation. I’m not bemoaning any of this; but I do think it feels somewhat euphoric.

Children with a talent for content creation, if not company analysis, are creating thousands of hours of youtube content with superficial analysis of ASX small caps. They are monetising their audiences by introducing them to low/no transaction fee brokers (lured by the promise of a free stock), as well as ancillary products such as Sharesight.

Now, while many investors want to go deeper than “15 hot penny stocks in 15 minutes”, many thousands do not. This all represents fresh speculative money coming into the market.

And you probably see this in your own lives. On a pure sociological level, have you ever had so many people in your lives talking about stocks?

Most of my readers are usually the one in their friendship circles who is most interested in investing. But suddenly, we are watching our previously uninterested friends book whole-of-portfolio gains of 100%+ for 2020 (assisted quite often by concentration in just one or two stocks!) And that has unleashed further waves of investors. The more people see people make money on high risk speculation, the more capital is drawn in.

Meanwhile, the macroeconomic outlook looks very different depending on how rich you are already. Happily, though many businesses will come back to life in a vaccinated world and governments have never sounded so dovish about monetary policy. The prevailing ethos seems to be; let’s keep the financial markets pumping!

On the other hand, valuations look stretched. I’m not saying that great companies won’t grow into their current share prices, but I am saying there is a lot of trash that most definitely will not. It’s simply not possible that 100% of near zero revenue companies will succeed. And yet, I can scarcely find any of them priced for failure. Meme stocks are running so hot that Interactive Broker’s chairman and founder said he is “worried about the integrity of the marketplace and the clearing system.”

We don’t know what will happen in the future, but we do know that the implied listed company profit growth has been increasing rapidly, or the risk free rate has been shrinking rapidly, or a combination of both. When markets run hot we should see a spate of trash IPOs; and these are most likely in the works as we speak. Or else they have already happened.

To me, it looks like things run uncomfortably hot for a little while, before unwinding or stagnating. Sentiment can do anything to markets, but is less likely to break to the downside when there is fiscal stimulus in the hands of the people. And to me, that is the biggest near term risk. But whether the optimism is near its end, has some way to run or will be sustained longer than any of us believe, the ‘return to normal’ is fraught with uncertainty with regard to equity valuations.

The high valuations and immense buzz about investing is making me nervous.

It has been a big couple of years for many of us, in terms of returns. Personally, I am thinking now is the time to be more cautious.

Therefore, over the next six months I will try to avoid putting any incremental capital into the market. That means that I will be doing less buying because first I will need to sell some stocks to fund the purchases.

Over the long term, it generally pays to be as invested as possible, but purely based on sentiment I am feeling increasingly uncomfortable that markets are in bubble territory. Having said that, the current bubble momentum in markets could continue for quite some time, and I’m not moving to cash in a hurry. Rather, I’m looking to gradually harvest dividends, at least, and harvest some profits too.

But stocks have entered the mainstream consciousness in a way that is reminiscent of bitcoin in 2017. That feels like something we should pay attention to. We could be closer to the end of the coronavirus bull market than we think. How much capital is still waiting to be deployed?

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes; and I still have many loose ends to explore. Please read our detailed disclaimer.