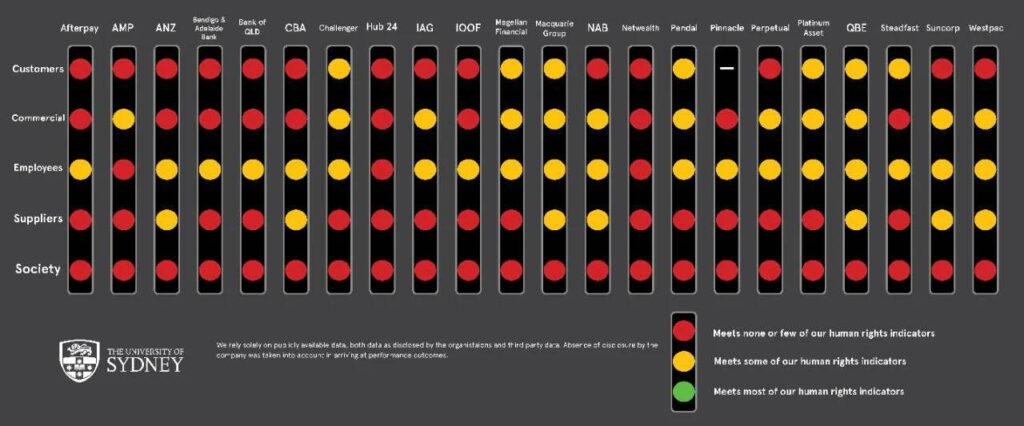

A new study has investigated human rights governance in the Australian financial services industry. The study – undertaken by Dr Kym Sheehan and Prof David Kinley of Sydney Law School – measured “the performance of 22 financial companies against six human rights categories: privacy and information; anti-discrimination; economic security; health and safety; voice and participation; and right to remedy.”

It included the major and minor banks, insurance companies IAG, QBE and AMP, as well as fund managers like Magellan and Challenger. “We look at how they treat their retail customers and employees, their supply chain, commercial lending and investments. We also investigate how they impact society by the way they advocate for changes in the law,” said Dr Sheehan.

The researchers’ main conclusion was that human rights-associated risk is not considered by the finance sector, whether that be the direct legal risk of facing compensation or fines, or the risk to their reputations and social license. Internal corporate governance mechanisms do not make the boards of these companies responsible or accountable for human rights breaches.

“I think they see that if they can manage the optics, no-one will ask the questions, dive into the data and see what is actually happening,” said Dr Sheehan.

Most of the 22 financial companies have not signed up to the UN’s Principles of Responsible Investment, nor the Equator Principles, which provide a benchmark for evaluating environmental and social risk. In other words, it’s not only that they’re not considering ethics as a positive for investments; they’re not even doing due diligence on not being completely unethical.

Relatedly, Australian financial companies typically have no board oversight or responsibility to prevent modern slavery in investments and supply chains. UK financial institutions are required to regularly report on their obligations to not finance modern slavery, nor support it in their supply chains.

Policies regarding anti-discrimination and employee rights were the strongest domain, given the necessity of complying with Australian employment law. The exception is the ongoing gender pay gap in finance.

Egregious examples of banking malpractice were uncovered in the Hayne Royal Commission into the financial sector. Revelations of recent years have included Westpac (unknowingly) laundering money from sex trafficking, and companies receiving fees-for-no-service, with respect to which many companies are still dragging their heels on compensation.

This latest study shows that the governance procedures to prevent these kinds of things from happening again are, by and large, yet to be put in place among the major players in Australian finance.

Follow Christian on Twitter for more news updates.