Previously we covered how to calculate market capitalisation accurately from the primary documents using share count and share price. I have just updated that article on how to calculate market capitalisation, to include reference to the new Appendix 2A.

That calculation is essential as a starting point to calculate enterprise value, which is the amount that the market is valuing the actual business at, adjusted for the impact of the balance sheet. Enterprise value is important because it accounts for cash and debt, unlike market capitalisation.

The market capitalisation of a company should reflect both its cash and its debt, and the enterprise value calculation assumes that each dollar of cash is valued at $1 and each dollar of debt is valued at $1. The simple formula is:

Market Capitalisation + Debt – Cash = Enterprise Value

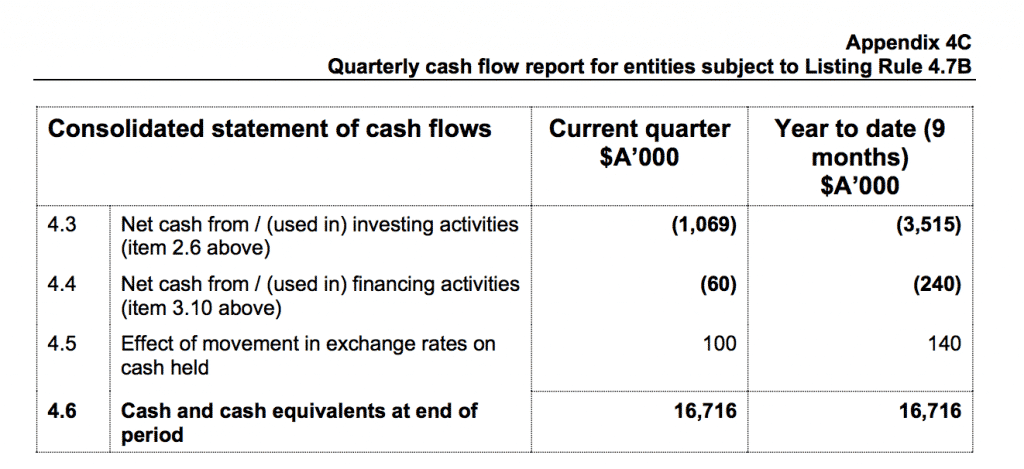

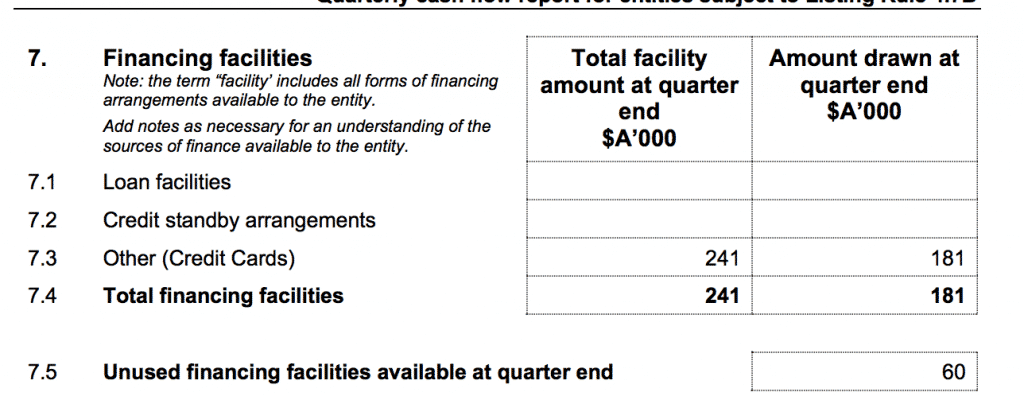

For a clean balance sheet, that’s pretty simple to apply. For example, we can look at the latest quarterly report from Whispir (ASX: WSP) to see that it has in cash, and we know it has negligible debt.

Whispir has 103,766,807 shares issued (excluding options and performance rights for now). Its share price is $1.85, so its market capitalisation is $191.9 million. Its cash is $16.7 million so its enterprise value is $175.2 million.

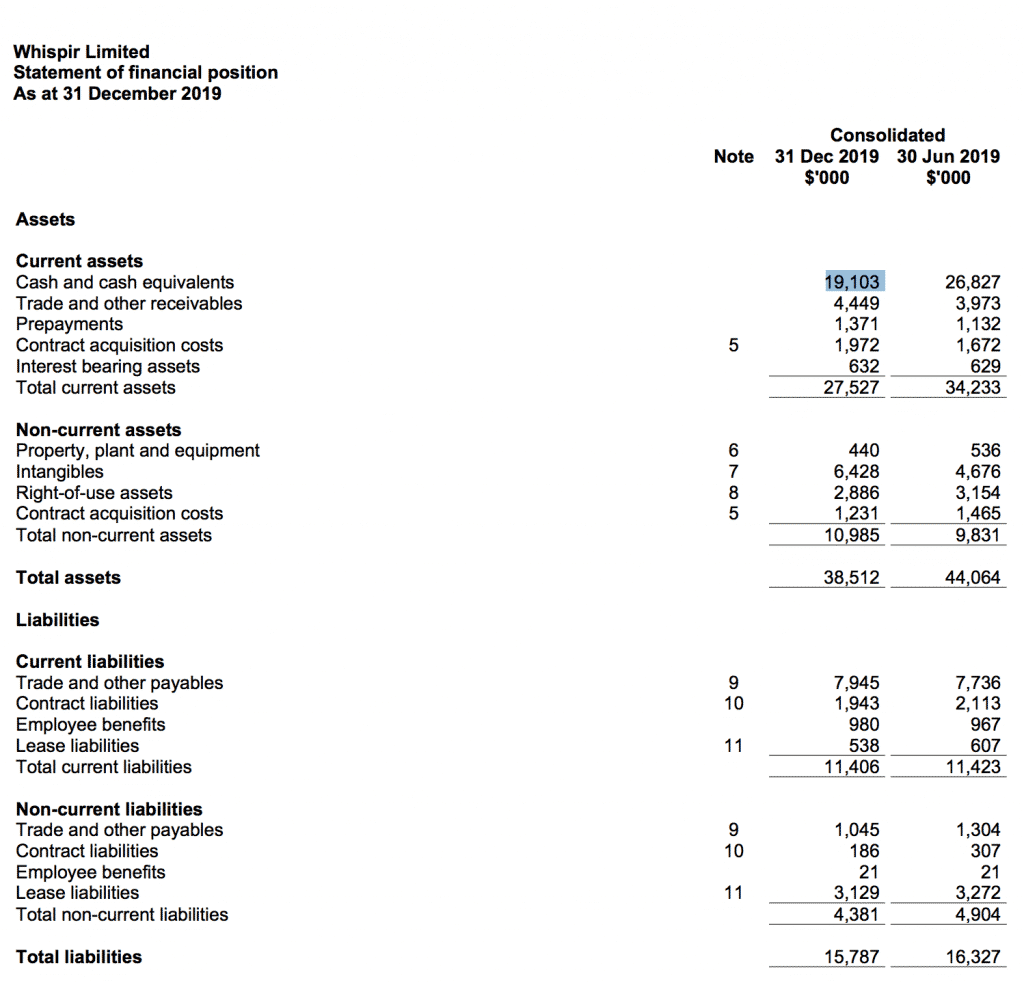

However, most companies don’t report quarterly, so we would look at their last published balance sheet instead. Here is Whispir’s below. We would get a different result if we used this out of date information, but it does give us more granularity around payables and receivables, which may be a consideration in some circumstances.

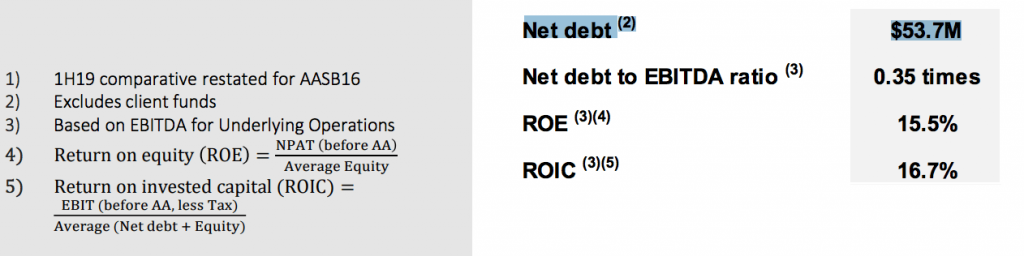

Finally, it’s not always so simple to perform the correct calculation. For example, some companies such as Webjet (ASX:WEB) hold funds on behalf of clients. It deals with large sums of payables and receivables as it collects money from travel agents (and customers) and pays hotels (and airlines) on various payment terms. It will take some discretion to decide how you want to calculate EV.

One approach is to simply rely on the non-audited material. At the end of December 2019, the company said it had net debt of $53.7m, when excluding client funds.

Of course, it becomes even more complicated with a company like Webjet, because it simply must have a strong balance sheet in order for customers and partners to want to work with it. Therefore, it needs a decent amount of working capital (or cash) available at all times. So it might be more appropriate to adjust the enterprise value to exclude an amount of cash that you think the company always needs to have to prove liquidity. I’d argue for Webjet it would not want to drop below about 20% of payables held in cash. These kinds of adjustments are where you can express your own subjective view of the business. Strictly speaking enterprise value is still defined as market capitalisation plus net debt.