Why I Like Polynovo (ASX: PNV)

It is not obviously cheap but it is obviously taking market share from its competitors.

It is not obviously cheap but it is obviously taking market share from its competitors.

You don’t often find dividend paying micro-caps with exposure to a potential demand tailwind, and a well-aligned board.

Factors outside the company’s control will have a negative influence on profit growth in FY 2025 and FY 2026

The Fineos (ASX: FCL) share price performed strongly after a recent company presentation.

Maas Group (ASX: MGH) has just announced three acquisitions in the construction materials division… plus a share purchase plan at $4.65.

With the share price in the toilet after many years of bad results, is Experience Co stock presenting an opportunity?

I don’t have full confidence for the long term, but I do think the valuation has become attractive.

The 2024 Pro Medicus AGM showcased its phenomenal employee retention rates and reflected back on the company’s beginnings.

The Pro Medicus share price is up more than 50% in just a few months. I take a look at the PME stock valuation ahead of the AGM tomorrow.

The Catapult International (ASX: CAT) H1 FY 2025 results have pushed the Catapult share price well above $3. Is the move justified?

Xero’s half year report showed its ability to increase prices in Australia, but hinted at a more difficult competitive situation in the USA.

There was nothing much to celebrate arising from the Alcidion AGM and Q1 FY 2025 update.

Looking beyond the share prices.

Audinate (ASX: AD8) stock has dropped more than 50% from its peak 7 months ago, due to its extremely disappointing guidance.

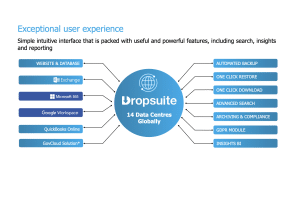

Both multiple expansion and fundamental business growth have driven Dropsuite share price gains.

The company had a slightly weaker quarter, but it was just one quarter.

Annual General Meetings don’t usually tell us a lot, but it is still worth keeping track of the impressions they leave.

What if you could profit from rich people trying to pay less tax?

CTI Logistics (ASX: CLX) shares offer a huge dividend yield, but the business is capital intensive and margins dropped in FY 2024.

Is Coventry Group (ASX: CYG) a good ASX small-cap stock to invest in? Our short stock analysis of Coventry Group is provided at the request of a reader.