How Generation Development Group Ltd (ASX: GDG) Stock Could Benefit From Superannuation Law Changes

What if you could profit from rich people trying to pay less tax?

What if you could profit from rich people trying to pay less tax?

CTI Logistics (ASX: CLX) shares offer a huge dividend yield, but the business is capital intensive and margins dropped in FY 2024.

Is Coventry Group (ASX: CYG) a good ASX small-cap stock to invest in? Our short stock analysis of Coventry Group is provided at the request of a reader.

The company demonstrated everything I had hoped to see in this set of results, with earnings per share up 15%.

The H1 FY 2024 result was ever so slightly better than I’d feared, but still not good enough to deserve an upgrade, in my view.

Although weak demand has weighed on the FY 2024 result, the long term thesis remains valid.

Is Veem (ASX: VEE) a good ASX small-cap stock to invest in? Here is a short stock analysis of Veem, provided at the request of a reader.

Negative media coverage has revealed Steadfast faces scrutiny from the ACCC.

Prophecy International (ASX: PRO) revenue up 17% in FY 2024.

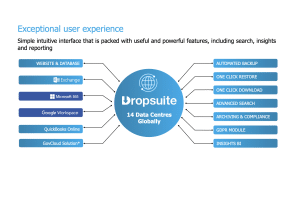

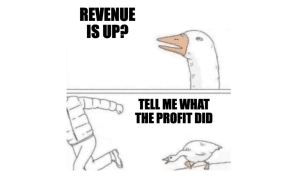

Dropsuite grew revenue more than 30% in H1 FY 2024, but this impressive organic growth came at the expense of the bottom line.

Hub24 (ASX: HUB) continues to gain market share and grow profits, and it has the lofty earnings multiple to match.

The company says FY 2025 will be an improvement.

Steadfast (ASX: SDF) presented record results, but has the share price run too far?

Supply Network management does not talk much but they absolutely walk the walk.

Net profit before tax was up 71% to $10.2 million.

SiteMinder (ASX: SDR) made a loss in FY 2024 but there are signs the business is improving in quality.

Profit before tax was down 10%, but if you accept the company’s various “one off” adjustments, it was up 10%.

A couple of delayed contracts muted growth, but free cashflow was extraordinarily strong.