Kip McGrath Education Centres (ASX: KME) FY 2024 Show Stronger Second Half

Evaluating the Kip McGrath Education Centre (ASX: KME) FY 2024 Results.

Evaluating the Kip McGrath Education Centre (ASX: KME) FY 2024 Results.

Vysarn (ASX: VYS) grew profit before tax at over 50% in FY 2024 (and profit after tax growth was even better).

Energy One (ASX: EOL) produced record revenue in FY 2024, though profit was down.

REA Group (ASX: REA) is going really well in Australia where it dominates already, but success is far from certain in India, where it hopes to grow.

Directors have been buying shares in Silk Logistics Holdings (ASX: SLH) at around current levels.

Audinate (ASX: AD8) continues to smash the competition, and the Audinate share price is recovering from being smashed by negative outlook.

A strong performance in FY 2024 saw earnings and dividends per share come in slightly above what I’d been hoping for.

The long term thesis remains in place but significant reinvestment in the business will depress profits in the short term.

The Pro Medicus (ASX: PME) share price gained more than 8% after it reported another set of strong results, beating analyst estimates.

Supporters can request we look at any company under $2b market capitalisation, as part of our small-cap mailbag series.

Supporters can request we look at any company under $2b market capitalisation, as part of our small-cap mailbag series.

Supporters can request we look at any company under $2b market capitalisation, as part of our small-cap mailbag series.

A seasonally strong fourth quarter tops off an incredibly disappointing FY 2024 for hospital workflow software stock Alcidion (ASX: ALC).

The share price might be volatile but the annualised recurring revenue growth is quite consistent.

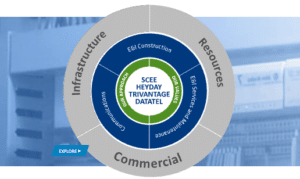

After the SXE share price gained 147%, Southern Cross Electrical Engineering is more of a growth stock than a dividend stock.

However, the updated software license subscription revenue was really strong.

SiteMinder (ASX: SDR) is still losing money, but it is headed in the right direction.

Albeit hardly thesis changing, there is some new information to consider regarding each of these stocks.

The logic is sound, and the raising fair.

The Catapult International (ASX: CAT) share price is up on the release of its FY 2024 financial results.