Audinate (ASX: AD8) H1 FY 2025 Results: Has The Worst Passed?

Growth Gauge has long followed Audinate shares, and is expecting more optimism in the future, after the undeniably tough H1 FY 2025 results were released.

Growth Gauge has long followed Audinate shares, and is expecting more optimism in the future, after the undeniably tough H1 FY 2025 results were released.

The BSA Ltd share price fell 83% yesterday.

Chris Coe explains why he recently bought some share in this little known dividend stock with a P/E ratio around 9.

The Fiducian Group share price gained around 10% in response to some fairly solid H1 FY 2025 results.

Adore Beauty (ASX: ABY) reports strong margin expansion in H1 FY25, but revenue growth remains weak. With 25+ stores planned, can its shift to physical retail drive long-term gains? Read more.

The Pro Medicus (ASX: PME) share price was down slightly in response to the very strong Pro Medicus H1 FY 2025 results.

AI and cybersecurity are so hot right now yet this little loss making ASX software stock languishes.

Northern Star benefitted from higher gold prices, but free cashflow is restrained by capex requirements.

The Bravura Solutions (ASX: BVS) turnaround is complete, and the Bravura share price is up 18% after the H1 FY 2025 results.

Two of the most beautiful business models on the ASX. REA Group (ASX: REA) and CAR Group (ASX: CAR) may not be cheap but they sure are quality.

A failed acquisition is masking the profitability of a high quality underlying business.

While the EGL share price has been volatile the underlying business is growing; and it helps the environment!

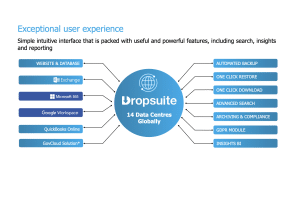

Although overshadowed by the takeover offer, Dropsuite’s Q4 FY2024 were surprisingly strong and pleasing.

AFG shares boast a P/E ratio under 15 times, a grossed up dividend yield of over 7.4%, and potential for growth.

The Genetic Signatures (ASX: GSS) share price suffers from its lack of profitability, but the diagnostic testing company may be on the verge of substantial growth.

You don’t often find dividend paying micro-caps with exposure to a potential demand tailwind, and a well-aligned board.

Factors outside the company’s control will have a negative influence on profit growth in FY 2025 and FY 2026

The Fineos (ASX: FCL) share price performed strongly after a recent company presentation.

Maas Group (ASX: MGH) has just announced three acquisitions in the construction materials division… plus a share purchase plan at $4.65.

With the share price in the toilet after many years of bad results, is Experience Co stock presenting an opportunity?