Is The Pro Medicus (ASX: PME) Share Price Too High?

The Pro Medicus share price is up more than 50% in just a few months. I take a look at the PME stock valuation ahead of the AGM tomorrow.

The Pro Medicus share price is up more than 50% in just a few months. I take a look at the PME stock valuation ahead of the AGM tomorrow.

The Catapult International (ASX: CAT) H1 FY 2025 results have pushed the Catapult share price well above $3. Is the move justified?

Xero’s half year report showed its ability to increase prices in Australia, but hinted at a more difficult competitive situation in the USA.

Looking beyond the share prices.

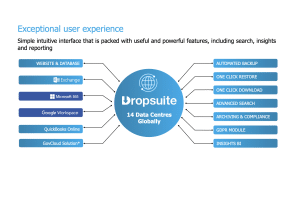

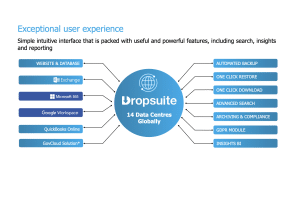

Both multiple expansion and fundamental business growth have driven Dropsuite share price gains.

The company had a slightly weaker quarter, but it was just one quarter.

Annual General Meetings don’t usually tell us a lot, but it is still worth keeping track of the impressions they leave.

What if you could profit from rich people trying to pay less tax?

CTI Logistics (ASX: CLX) shares offer a huge dividend yield, but the business is capital intensive and margins dropped in FY 2024.

Is Coventry Group (ASX: CYG) a good ASX small-cap stock to invest in? Our short stock analysis of Coventry Group is provided at the request of a reader.

The company demonstrated everything I had hoped to see in this set of results, with earnings per share up 15%.

Is Veem (ASX: VEE) a good ASX small-cap stock to invest in? Here is a short stock analysis of Veem, provided at the request of a reader.

Dropsuite grew revenue more than 30% in H1 FY 2024, but this impressive organic growth came at the expense of the bottom line.

Hub24 (ASX: HUB) continues to gain market share and grow profits, and it has the lofty earnings multiple to match.

Steadfast (ASX: SDF) presented record results, but has the share price run too far?

Supply Network management does not talk much but they absolutely walk the walk.

Net profit before tax was up 71% to $10.2 million.

SiteMinder (ASX: SDR) made a loss in FY 2024 but there are signs the business is improving in quality.

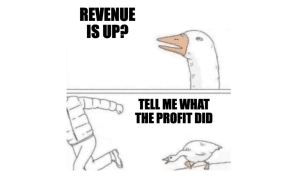

Profit before tax was down 10%, but if you accept the company’s various “one off” adjustments, it was up 10%.