Sorry you don’t have access to this content because you’re not a Supporter.

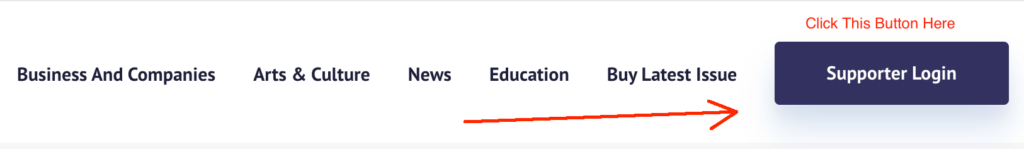

If you are a Supporter, please use the button at the top right of the screen to log in or click here to login.

If you are already logged in, you may need to renew your subscription, or update your card details by clicking “My Profile”. If your membership has lapsed and you would like to renew, or you think you should currently have access, please email Claude.

If you would like to join the waitlist to become a Supporter, please do so below.

A Sample Of The Feedback We’ve Received From Supporters

I just wish I had joined his supporter program earlier.– David

Raise your bloody subscription fees!!!!! You are too cheap and i worry (probably not as much as you) that by being too cheap you might attract a certain kind of subscriber that could lead to a “watered down” service to please the masses. (me being selfish). I am sure you have it covered, just wanted to say thanks for your efforts and keep it up!– Jon

Just a quick note to say how much I’ve been appreciating your website, and your regular postings throughout the current crisis. Your posts have definitely helped me steer my modest portfolio to a better place than I would have otherwise.– Matt B

A more reserved 60 year old rode out the GFC and now I am witness to another major market disruption; life is nothing if not interesting. I can however say with certainty that one of my best investments is becoming a Rich Life Supporter.– Doug M