It’s long been an expected consequence of climate change. Now over the past month the price consequences of climate-fuelled extreme weather events are being borne out.

First up is insurance titan IAG, a company currently valued at $14 billion on the market. A 14 June market announcement from IAG flagged a 20-30% price rise on its house insurance premiums.

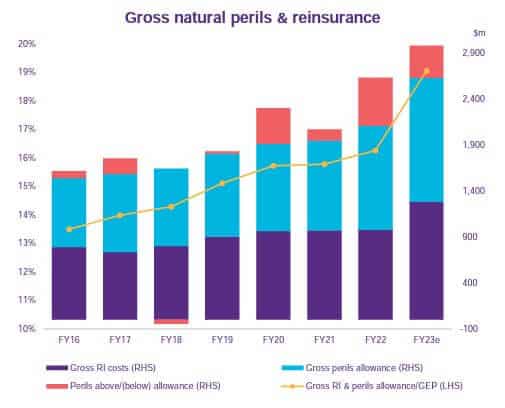

From $1.4 billion in costs on “gross natural perils and reinsurance” in FY18, IAG is now projecting roughly double that figure for FY23. The increase is responsive to interest rate rises and inflation in the cost of assets that have been insured. Yet the increases in a low-rate environment from FY18 to FY21 show the part climate change has played as well.

Further afield, Californians are facing new challenges ensuring their homes. While floods have been Australians’ prime concern since 2022, it is bushfires that have concerned insurers in California.

Since early June, major US insurer State Farm has ceased insuring new houses in California, citing bushfire risk. “In the last six years, we lost 20 years’ worth of underwriting profit,” an industry spokesperson told media.

A smaller lender called Allstate Corp then followed suit, the two being California’s 1st and 4th largest home insurers. Allstate had previously flagged a rise in insurance premiums of 40% before deciding to opt out.

The move threatens to interrupt the state’s entire housing market, given that home insurance is a requirement for most mortgage lending.

By 2030, the Climate Council estimates 1 in 25 Australian homes will be uninsurable. Around 9% of homes are expected to fall in the medium risk category, paying 0.2% – 1.0% of the total value in insurance costs annually.

High-risk zones are concentrated in Toowoomba, Brisbane and the Gold Coast in southeast Queensland and the Northern Rivers region of NSW, which face risks from both flooding and bushfires.

Sign Up To Our Free Newsletter