One of my readers asked me today to write an article about compounding gains and why it is important. So in this article I will outline the three key ways the concept of compounding gains applies to stock market investing.

Investing In Small Caps Allows You To Compound Faster

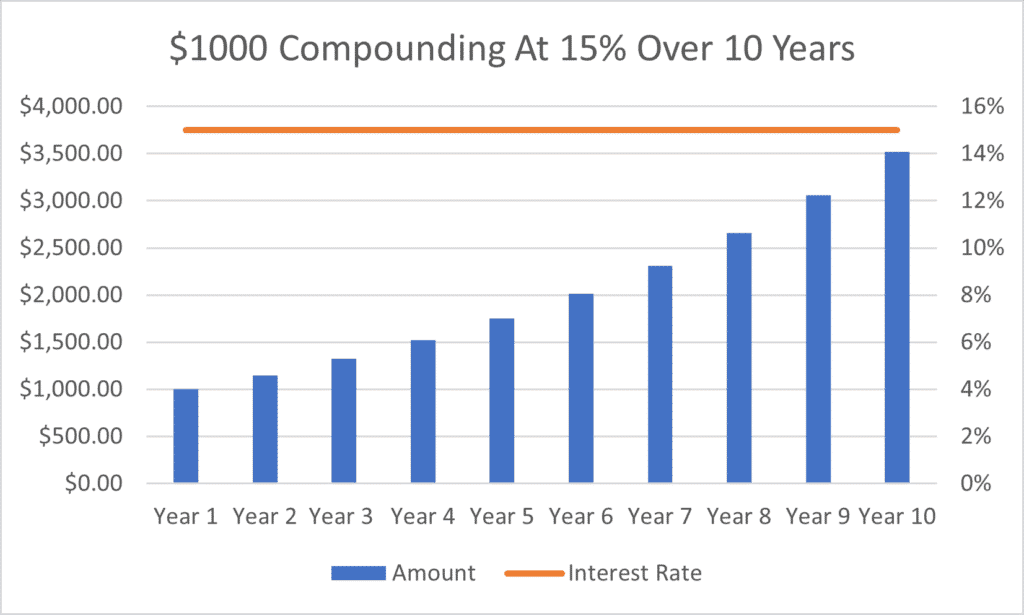

Depending on the individual and the environment, it’s fairly easy to find small cap funds that have compounded at over 15% for a decade. In comparison, balanced funds, defensive funds and cash certainly don’t have that sort of result. In this day and age, investing in cash and very secure debt might yield you 2% per year.

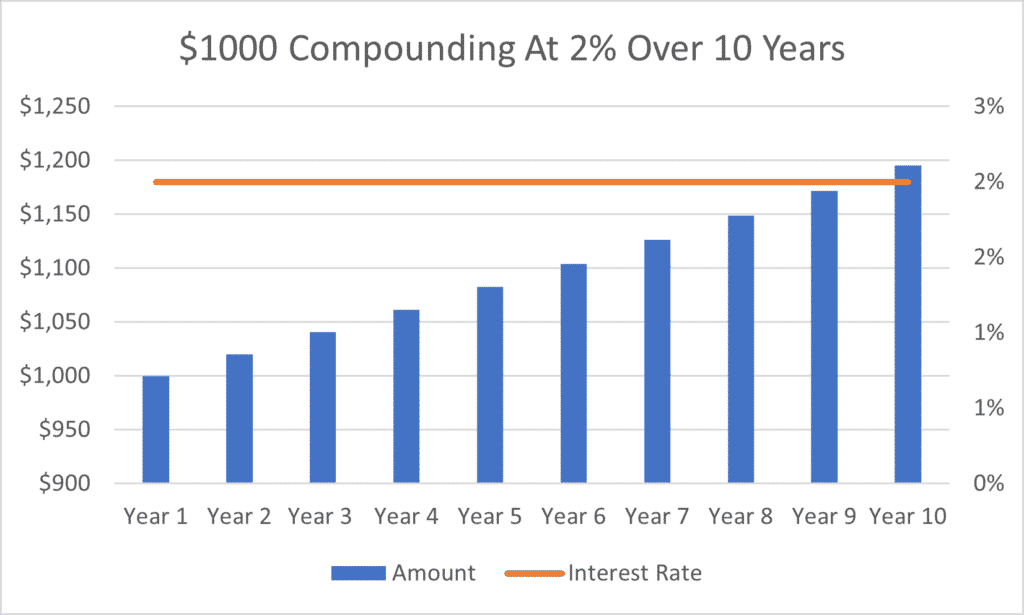

Below you can see that $1,000 compounding at 2% per year will be $1,195 after 10 years:

And here, we can see that $1,000 compounding at 15% per year is $3,517 at the end of 10 years.

Clearly, seemingly small differences in performance compound to a large difference at the end. For this reason, investors who start young are in a much better position than investors who start old, because they can develop and apply their investing skill for a much longer time period..

Selling Shares Interrupts Compounding And May Trigger A Tax Bill

One important lesson for investors who are investing in a normal tax environment is that you may crystallise a tax bill when you sell a stock. For that reason, you will be much better off if you hold one stock which grows by 15% per year for 10 years, than if you try to buy the dips and sell the peaks along the way. Even if, on average, you are actually quite good at picking the ups and downs of the stock, each year you will have to pay a little of your earnings in tax since you have crystallised a gain. Therefore, there can often be tax advantages in finding one good stock and holding for the very long term.

Learning Also Compounds

Finally, it is not just your capital which can compound the longer you spend as an investor. Knowledge and experience can also be considered to compound. You see, at the beginning of your journey as an investor, you may take 1 – 3 years to just catch up with the average of the herd. Many people need to buy a story stock for themselves and are not content to learn from the mistakes of others. For me, following some of the first companies I bought to their bitter ends has taught me valuable lessons.

Equally, finding, understanding, and holding a strong performing business run by good management for 10 years is fairly rare, and you simply can’t do it unless you’ve been investing for 10 years. Arguably, once you’ve had a lived experience of buying and holding long term winners you are better equipped to recognise those opportunities and have more resolve to hold on.

For more intelligent people who learn fast, spending just 1 hour a week thinking about investing, for a decade or more, can allow them to fairly consistently achieve better results than the average, especially when measured over multiyear periods. As long as those investors have concentrated in areas that the professionals tend to ignore (such as smaller stocks) that may mean that they have much better understanding and knowledge of a listed small cap company than most of the market, giving them a long term systemic advantage.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.