While it certainly hasn’t been easy to predict how Covid-19 would spread around the world, it’s fair to say that the disease itself is more predictable than the widely varying human reactions to it.

Today, it’s fairly likely that we will see infection levels in a number of US States approach levels that should have rational people paying close attention to the threat. Let’s take a look.

What we can say for certain:

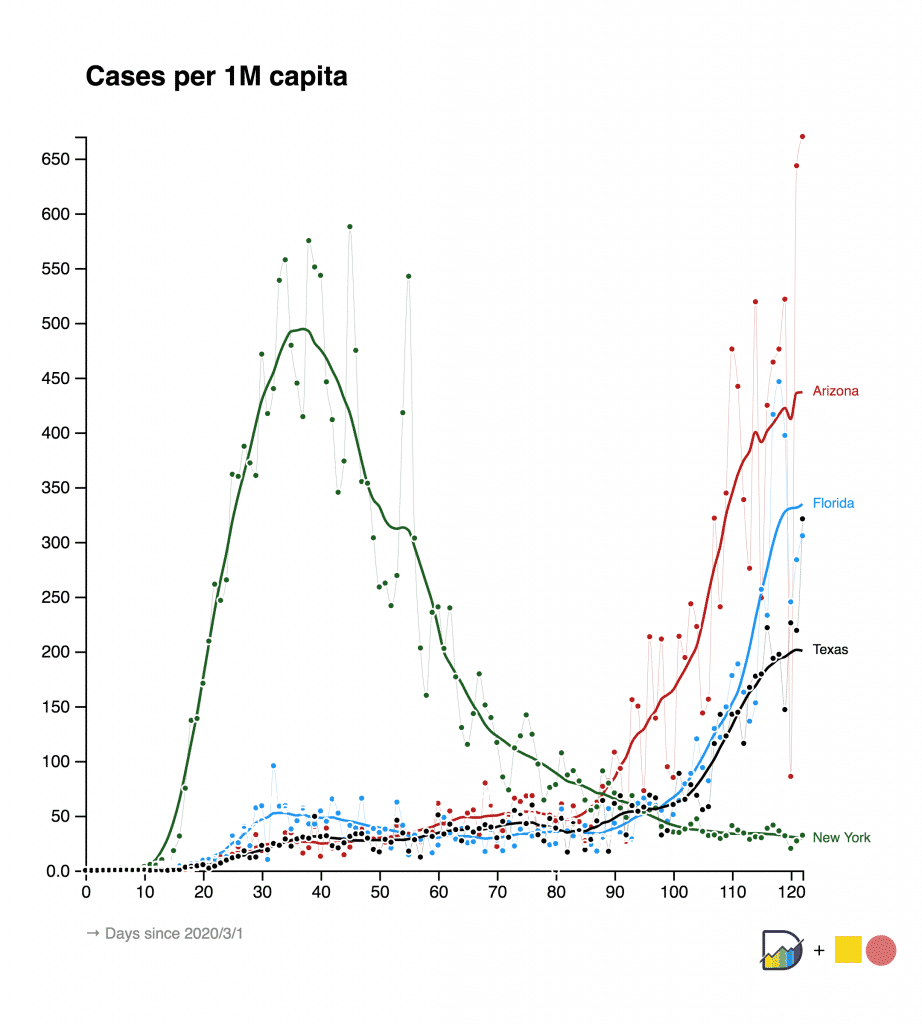

- The rate of infection in Arizona is on track to reach levels not seen before in the USA.

- By the time New York was on track to be recording 0.05% of the population as Covid positive per day, leaders were understandably demanding a strict containment response.

- The politics of the pandemic have changed and Arizona waited until 2 days ago to reimpose lock-down.

- Given the lag time between lockdown and a reduction in infections, Arizona is on track to set a new record in infection rates in the US.

- Texas reimposed lock-down a week ago and is already seeing a flattening of cases

- Florida has not re-imposed lock down.

- Lock-downs work quite effectively to slow the spread.

- Flare ups are both likely and severe in the USA because of non-compliance with basic hygiene measures required to prevent flare ups

- States will be going in and out of lock-down until they either adapt to pandemic conditions or receive a vaccine.

- That means a huge chunk of the economy can’t sustainably operate in their old ways: bars, nightclubs, concerts, congregations, universities.

At an economic level we also know:

- Capital markets are no longer free and will not be allocating capital efficiently.

- The Fed will release liquidity to pump up stocks.

- This will lead to greater social instability as the gaps between the haves and the have-nots widen.

- Some companies will benefit from the social changes required to deal with pandemic.

- The environment will be deflationary except where supply is constrained.

- Where supply is constrained (healthcare, gold) the people who can afford the supply constrained goods and services will have more money to pay for them.

Putting all this together, I struggle to see how there will be another sell-off until there is a wave of bankruptcies. At the moment, the Fed is keeping all companies alive but there’s a certain point at which it simply no longer makes sense for dead zombie companies to keep going indefinitely. Ultimately, I would expect a second wave of unemployment to follow a second wave of the virus.

At this point, I don’t think the full economic impact of the virus will be felt in America until the final quarter of the calendar year. At that point, so many people will have been infected that it will be difficult to sustain the view that it’s nothing to worry about and should be ignored.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!