Here is my reflection on my performance, in the hope that I can learn some lessons about what I did well and what I did poorly.

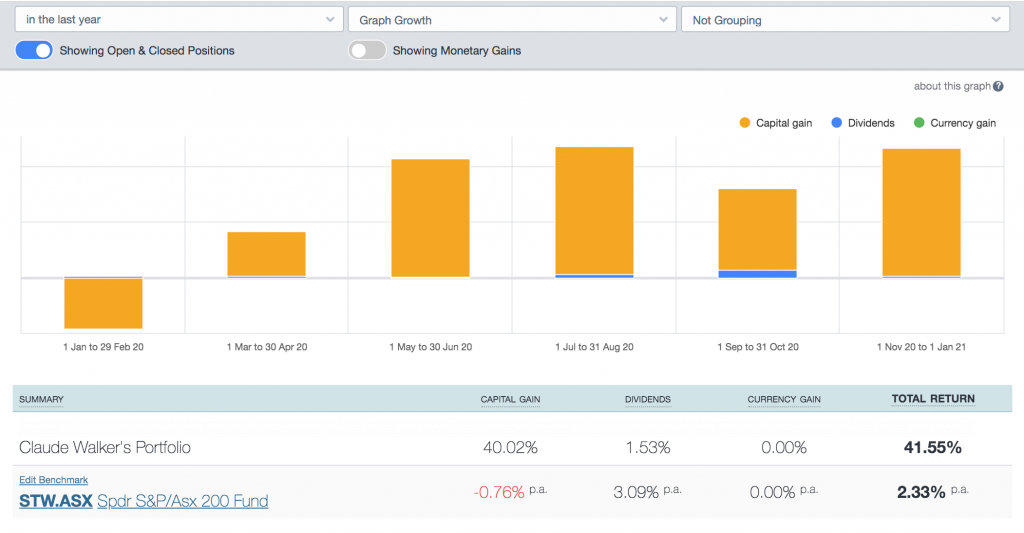

This year I am emphasising that this is the money weighted return of the portfolio. This takes into consideration the impact of flows in and out of the portfolio. Given that flows in and out of the portfolio were so extreme this year, this return figure would differ from that of a fund that had to report unit price based on cash holdings + equity holdings.

Offsetting this partially, I did hold a lot of cash in the listed ASX: AAA ETF, and also a lot in the gold ETFs ASX: GOLD and ASX: QAU.

According to Sharesight, my money weighted return was 41.55% in CY 2020. The biggest drag was holding gold and cash too long, as discussed here. The biggest absolute dollar gain was Energy One, and my biggest absolute loss was Audinate (because I sold quite a bit quite near the lows.) A rule to not sell without a corresponding buy would have helped ensure I was at least keeping money at work, and in future crashes, I will plan to not reduce overall exposure at all, by selling a stock has fallen 50% from its highs. So I still permit myself to sell, but it must be specifically to buy something more attractive.

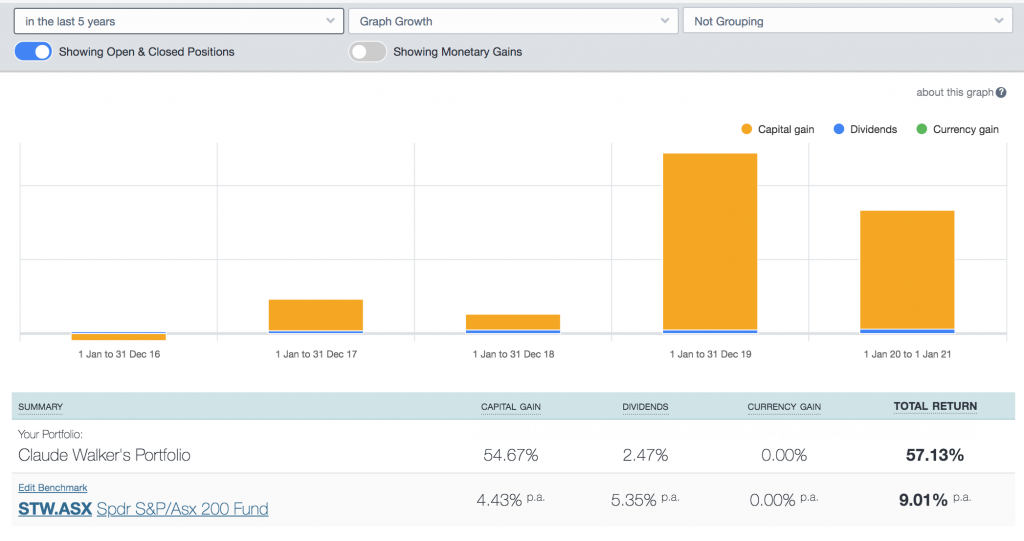

Here’s an interesting 5 year view. You can see that most of the money I’ve made was in CY 2019, when Pro Medicus went on its mega run. I’ve struggled to replicate that kind of success in CY 2020, despite plenty of opportunity. Long term holdings tend to pay off in short periods.

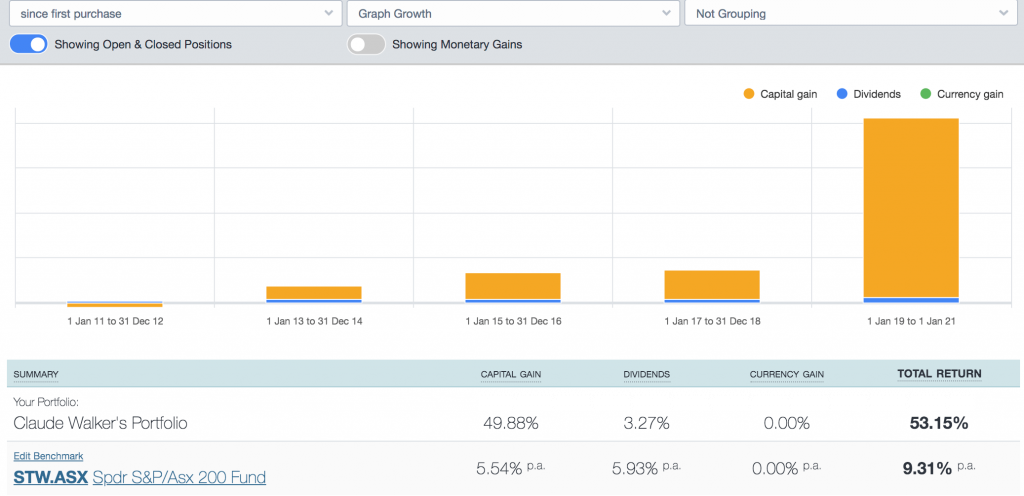

I doubt that track record beyond 5 years is that relevant for someone who is constantly developing a skill, though I accept others may prefer see a long history. Earlier years have minimal influence on my money weighted returns because I didn’t have much money before about 2014.

This doesn’t mean my returns were bad in past years. It just means it wasn’t a big overall contributor compared to subsequent years. For example, I still made ~40% in Calendar Year 2015 (with my biggest winners being Bellamy’s and Capilano Honey). But the amount of money was less.

The fact is that the money weighted returns averaging over 50% is mostly attributable to gains in CY 2019 (in which I returned ~96%).

Moving to the percentage returns of this calendar year, the big winner was Energy One, with a gain of ~150%, followed by Objective Corp (~97%), Damstra (~85%), and super specs 4D Medical and IntelliHR with a gain of around 80% each.

However, what really matters is the dollar contribution, since this is what matters to me. In those terms, Energy One was still the best, but that was followed by Pro Medicus with its end-of-year surge above $34. Whispir of all things came third which just goes to show that me getting the guts to aggressively pile in at the right time was the crucial factor here. There were many better businesses on sale than Whispir.

Objective Corp, Dicker Data and Damstra are next, which just goes to show its the better-quality or at least decent quality companies where I make most money. However, the exception that proves the rule came in at 7th, in OpenLearning. I now suspect OpenLearning is a bit average as a business, at best.

Skipping a few now, I note Mainstream in 9th place. This is hilarious because it was a “guess the motley fool recommendation trade”, which I wrote about at the time.

CWL value play (thanks to DMX Capital partners for the idea) came in 10th… quite nice.

I owned around 100 different positions during the year that did not make a meaningful contribution nor deduction from my returns. However, the “small results” do skew positive, with more wins than losses. This suggests the “opportunism plays” are a net positive in terms of returns (though it is more questionable whether having capital reserved for opportunism is wise).

My worst 6 losses accounted for over 70% of my total losses. That is to say the “fail fast” small losses (all 47 of them) accounted for just 30% of the total losing positions. It really is the worst 6 (or perhaps 10) losses that all the damage was done.

My 6 worst losing stocks were ASX:USD, ASX:MCP, ASX:SKF,ASX:ANO, ASX:EML and ASX:AD8.

Most of these were avoidable. I would argue that all these losses represent genuine mistakes.

USD — believing that USD would be a sustainable safe haven when the country is a cesspool of covid.

MCP — believing China would not retaliate strongly for calling a pointless inquiry into the origins of the coronavirus. Also the management lost money on hand sanitiser.

SKF — panic sold on the pandemic news, but sold too late.

ANO — should have sold when sentiment was higher. Chairman is too much of a cowboy for me.

EML — again, panic selling too late. Go early, go early, go early.

AD8 — again proving a medium amount of confidence is the most dangerous amount. Sold some close to the bottom.

I covered my worst percentage loss in this audio reflection on my biggest mistakes. However, for the record Connexion telematics was the worst at -54%, followed by Tambla at -35%, then Advance Nanotek at -34%.

This post is not financial advice, and you should click here to read our detailed disclaimer. Please note the author does hold many of the stocks mentioned in this performance report, though many of the positions have also been sold. None of this performance report is expressing a view on future prospects of the shares mentioned it is all just about historical performance.

I hope you have enjoyed my post mortem on 2020, I am wishing you all the best for 2021.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!