Over the last couple of days, hundreds of avid viewers have been tuning in to listen to Elaine Stead’s lawyer Sue Chrysanthou SC cross examine Australian Financial Review columnist Joe Aston.

“Can’t success also be making money for it’s investors?” she asks.

“Well that’s certainly not what Vinomofo has done,” Joe retorts: “How could a business like Vinomofo compound at 25% per year?”

It’s as if the Judge can hear the laughter through the Microsoft Teams broadcast, to which about 150 were listening live, at any given time. He gives some helpful suggestions to Sue Chrysanthou SC to rephrase the question, explicitly demanding Joe accept contentions about the definition of success which he plainly does not personally believe to be true.

We are well into day two now, and the cross examination comes across as an embarrassing re-appraisal of the disgusting collapse of Blue Sky (ASX: BLA), which was run by a cashed up cohort of movers and shakers who tapped gullible investors for $100 million just a couple of years before the music stopped.

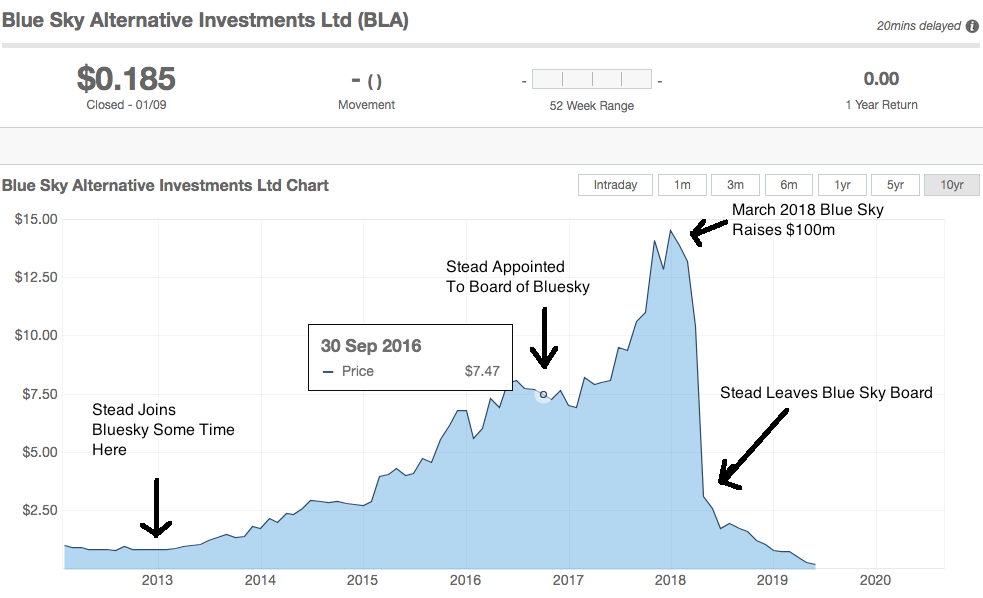

Elaine Stead did better from Blue Sky than many of the shareholders, and was a director on its board from September 2016 . As I understand it she has even managed to keep her job managing South Australia’s government VC fund, which had previously been outsourced to the disgraced Blue Sky entity.

The court proceedings are significant to the many people who saw something was wrong at Blue Sky, and dared to report on it, because the director who oversaw this collapse is now suing one of the main publications that covered the stock fearlessly. We should all thank the Australian Financial Review markets team for the great service they do to our financial markets; “keeping the bastards honest” to borrow a metaphor.

Much of the content on business websites is openly conflicted or worse; funded by deliberately obscured vested interests. This can be very harmful if disclosure is not transparent and funding independent from the subject of analysis. For example, some publications seem to only ever have positive things to say about the worst stocks on the ASX.

Over 150 were tuned in to the Microsoft Teams powered broadcast, which required listeners to successfully mute themselves or else disrupt proceedings. Plenty of fun was had in the naming field, with the Ron Burgundy reference to the part in the proceedings that amusingly prompted the Judge to clarify for the court that the Brick Tamland character in the Ron Burgundy movie is considered to be a “gaping moron”.

Edit: I now understand there was a restraint against posting a screen shot illustrating this. I have immediately removed the screen shot and I am very sorry for inadvertently breaching the restraint against that.

I believe all this was in aid of exploring whether Joe genuinely held the reasonable opinion that Ms Stead was a cretin. Sue Chrysanthou SC, lawyer for Elaine Stead at one point seemed to argue the distinction between “doing a stupid thing” and “being stupid” causing quite a few people on twitter (myself included) to wonder if it’s smart to sue someone for calling you a cretin, or if the case itself was “doing a stupid thing”.

However, darker scandal came on the second day when the Sue Chrysanthou SC made an offhand remark about short seller John Hempton. I won’t repeat the remark but note that Hempton was quick to lament that he wished the lawyer Sue Chrysanthou SC would make those remarks outside the absolute privilege conferred by the court during proceedings.

Personally I thought it strange that she would be taking jabs at Hempton given he was actually correct that the company was a dumpster fire. Let us not descend into Peter Switzer style opposition to short selling, especially when the short sellers are correct.

But away from the apparently-too-conceptual consideration that there is a public interest value in being able to expose ASX listed dumpster fires, the cross examination of Joe Aston stands testament to the lack of penalty for directors who lead a company off a cliff. For clarity, this is a reference to the share price chart, and I of course accept that Elaine Stead was only one of a leadership group, not the leader.

And I think all those who value free speech (especially criticism of wrongdoers) should take a moment to consider the enormity of the threat. While Fairfax and Joe are taking the heat today, everyone should be free to state reasonable critical genuine opinions even if they are overly harsh at times.

Does anyone know if Elaine Stead is self-funding these proceedings? I don’t understand why would she want all this dragged up again, but maybe you do. Having Joe explain on oath that he does indeed think she is stupid and that her “mass customisation” company Shoes of Prey was oxymoronic in essence and doomed to failure doesn’t make her look good. All the more because Shoes of Prey did indeed go into liquidation in March 2019, proving Joe correct on that point at least.

The real problem with this defamation case is that to see journalists pursued after a company has collapsed (and the skeptics proven correct) has a chilling effect on the press. It truly is an intractable business, and I lament that this case is in court.