(Valuations as at 11:00 AM 9/3/2020)

This post is not financial advice, and you should click here to read our detailed disclaimer.

With widespread falls across the ASX, many popular local technology companies have experienced significant falls in valuations over the past few weeks. After such significant falls in comparison to their US counterparts, have they reached fair value? This article compares current valuations against their US counterparts.

The ASX listed companies reviewed:

Altium (ALU): Leader in Computer Chip design software

Nearmap (NEA): Leader in geospatial mapping software platform

Xero (XRO): Accounting software platform

ELMO Software (ELO): HR software platform

EML Payments (EML): Payments platform

Wisetech (WTC): Logistics software platform

Pushpay (PPH): church giving / engagement / management platform

Volpara (VHT): Breast screening software platform

Promedicus (PME): Medical imagery visualization platform

The US listed companies reviewed are:

Square Inc (SQ) – Leading fintech platform

Alteryx (AYX): Leading data analytic platform

Crowdstrike (CRWD): Leading endpoint security platform

MongoDB (MDB): Leading NoSQL Database platform

Tradedesk (TTD): Leading buy side advertising platform

Atlassian (TEAM): Leading collaboration/developer platform

Datadog (DDOG) – Leading IT monitoring platform

Stone Co. (STNE) – Leading fintech platform

OKTA (OKTA) – leading identity management platform

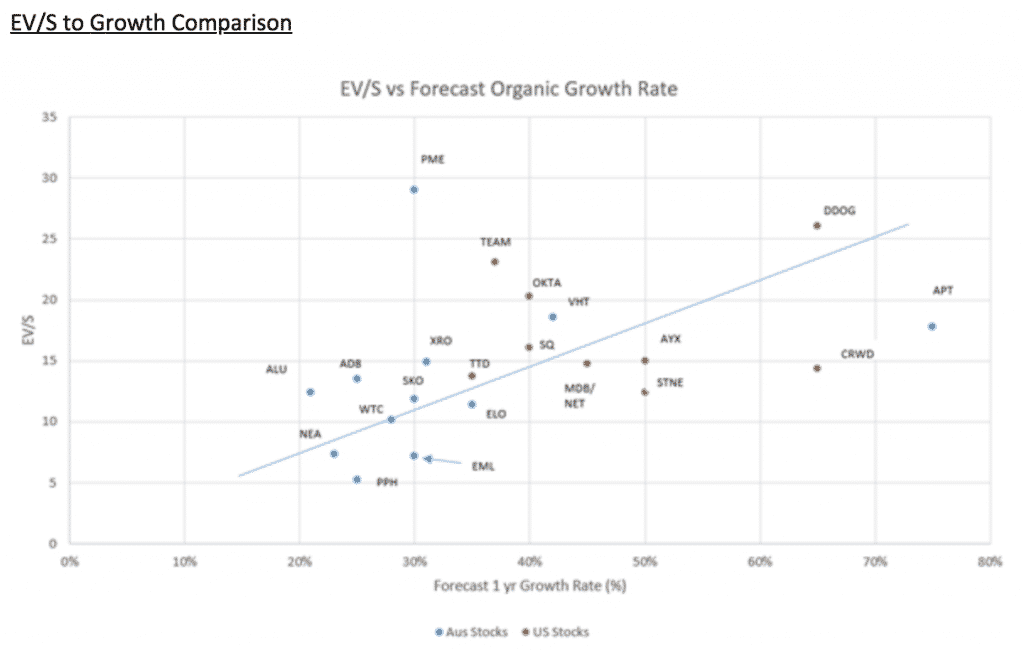

EV/S to Growth Comparison

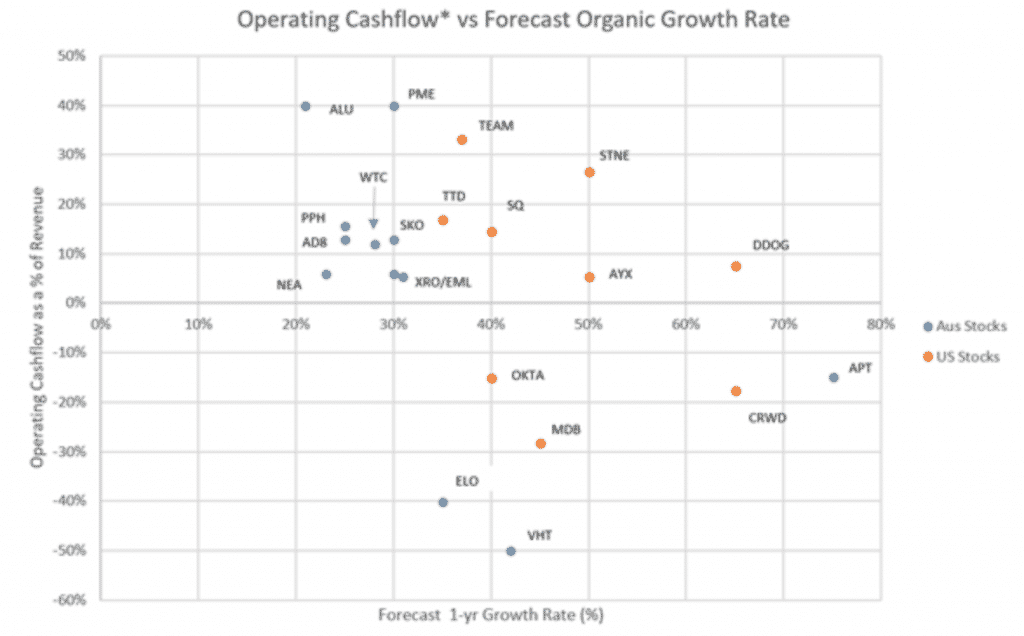

The image above illustrates that the US listed cohort have significantly higher revenue growth rates, however, this graph does not take into account business profitability. I have assessed business profitability, by applying an adjusted operating cashflow vs organic growth rate, which is shown in the image below. For my Adjusted cashflow, I have deducted stock based compensation, software expenses, and capture costs (NEA) from operating cashflow.

Adjusted Operating Cashflow to Forecast Organic Growth Rate

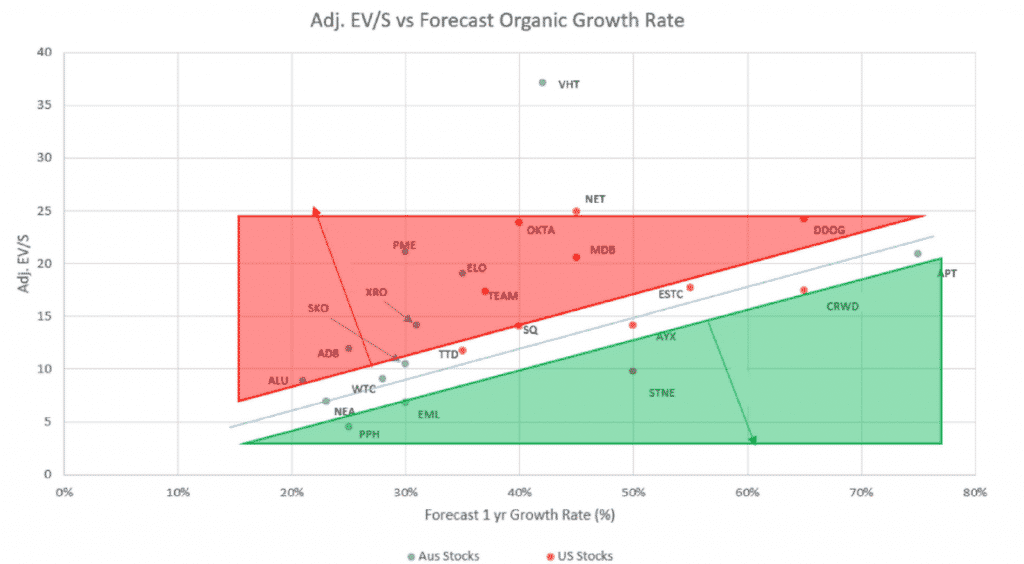

Adjusted EV/S to Growth Comparison

To get a better picture around valuation, I have discounted EV/S according to the cashflow as a percentage of revenue generated for the business. The results are shown in image below:

Australian software businesses have fallen significantly in value in recent weeks. More so than their US counterparts, with a number of names approaching what this report considers fair value. Of course, with so much volatility going on at the moment, it’s hard to say how long that situation will endure.

The question remains, whether the above names will continue to fall, and whether other company valuations will hold over the medium term. XRO for example, is currently valued more highly than TradeDesk, despite revenue growing at a rate 15-20% below TTD, and having lower cashflow margins.

Volpara’s valuation in particular is an outlier and is priced above hyper growth names such as Alteryx, a business with accelerating growth (+70%), yet is generating cash.

The key consideration going forward, is how will recent events impact company outlooks. For example, will Serko’s revenue experience a downgrade as a result in a fall in corporate travel?

Conclusion

This review shows a number of Australian businesses have relatively high valuations when compared against their US listed peers, despite the recent falls in share prices. The review highlights the need for investors to consider the potential risks that may impact future revenue growth, and operating margins, against the business valuations.

Disclosure: The author of this piece, Sean holds shares in ALU, AD8, APT, EML, XRO, PPH, AYX, CRWD, MDB, TTD, STNE, OKTA.

If you’d like to receive an occasional Free email with more content like this, then sign up today!