Lawyers for the federal government were at the Administrative Appeals Tribunal last month, in a bid to foreclose freedom of information (FOI) requests over Centrelink’s automated debt recovery plan. Advocates are seeking cabinet documents relating to the “business case” for the policy and other policy discussions

Known as Robodebt, the scheme issued false debt notices to 443,000 welfare recipients in the four years from its inception in 2015.

The Robodebt story appeared to be finally over on 11 June, when a Federal Court, Justice Bernard Murphy, ordered the government to pay back $751 million in incorrect repayments. Along with wiping outstanding debts plus interest and legal costs, the total ruling against the government amounted to $1.8 bn, approximately $4,000 per claimant.

But now, the federal government has signalled its willingness to return to the Federal Court in opposing FOI requests. The FOI Commissioner initially ordered the government to make public 10 of the 13 documents advocates requested. The current proceedings were brought by the government in an appeal against that request.

The Robodebt program formally began under then Social Service Minister Christian Porter. However, the initiative was first flagged when Scott Morrison was responsible for the ministry. Under Morrison, pursuit of welfare debts was presented as the second biggest saving in the 2015 federal budget.

This undoubtedly adds to the political tension of the current FOI claim. Does Morrison have something particular to hide? Or is the appeal more like the usual bureaucratic reflex against accountability and oversight?

How Bad was the Robodebt Program?

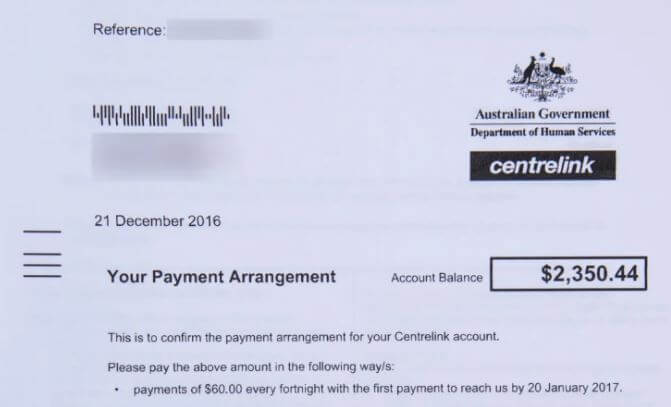

In a 2017 Senate Inquiry, the government admitted an error rate of 20 percent in its debt claims issued to Centrelink recipients. The recipients were notified in writing in what the government called “initial clarification letters.”

However, thanks to a previous FOI request made by Labor Senator Katy Gallagher, we do know that 27 percent of all robodebt claims issued in the ACT were incorrect. This is probably closer to the actual error rate.

Centrelink then partnered with debt collection agencies giving them a 10 percent fee, according to Ben Eltham. This has produced a barrage of would-be claimants. Welfare recipients now say they are regularly phoned in phishing attempts alleging they owe thousands of dollars to this or that government department.

In his ruling, Justice Murphy called robodebt “a shameful chapter in the administration of the commonwealth social security system and a massive failure of public administration.” But where is the fall-out?

As former Liberal leader John Hewson recently put it, shamelessness is a threat to democracy. When a government truly commits to sweeping even a $2bn failure under the rug, it is difficult to see where accountability will come from.

Follow Christian on Twitter for more news updates.