The Australian Future Fund has released a position paper outlining its macro-view of investment moving forward. The paper presents “paradigm shifts” that the fund argues are essential investment considerations for our times.

The Future Fund’s “Paradigm Shifts” of Our Times

What are the paradigm shifts for investing now and into the future, according to the Australian Future Fund? They are inflation, the energy transition, “de-globalisation”, populism, technology disruption and changing asset class correlations.

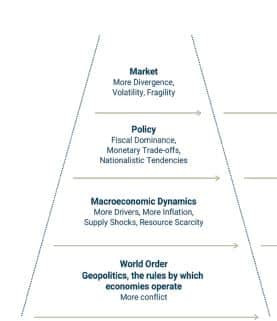

For these reasons, they call geopolitics “the bedrock of the new investment order”; in other words, market dynamics are downstream of geopolitical competition policy settings and macroeconomics. The fund also suggests that this means long-term investing is becoming more complex, challenging and risky for the average investor.

The funds’ analysts point the finger particularly at the COVID pandemic. They argue that it is responsible for an emphasis on securing supply chains and nationalising production, in other words “economic resilience” over “economic efficiency.”

Their second point is the rise of strategic competition. This refers to plans from the US and EU to attempt to untangle their production chain from China’s industrial base, particularly in new energy and computing.

The third is populism. The fund convincingly argues that increasing populism and disillusionment with politicians and “the system” is an upstream case of economic disruption and policy reform gridlock.

In turn, all of these factors make the risk of violent conflict higher, with all its dangerous consequences.

So what are the solutions put forward? The fund argues first and foremost for rethinking geographic diversification. The potential for restrictions or sanctions on capital flows is leading the fund to prefer “on-shore” investments.

They argue for hedging against financial disruption through investing in gold and other commodities. In the event of crisis, their value almost inevitably goes up.

Fund analysts are relatively less concerned about the financial risk of overt conflict. “While it attracts the most attention from investors it is also the factor they most often overemphasise,” the fund argues, given that “few conflicts have long-term impacts on global financial markets.”

Of course, given successive governments’ unwillingness to properly tax gas and other natural resources, Australia’s Future Fund is relatively measly compared to other sovereign wealth funds. It currently sits at US $149 billion, 3.5 times smaller than Qatar’s, though we export more gas than Qatar, and 11 times smaller than Norway’s.

Sign Up To Our Free Newsletter