The US and UK announced on Thursday night that they carried out air and missile strikes in Yemen. The White House said the attack was carried out “with the support of Australia” and other countries.

Last week, the Yemeni Armed Forces announced a blockade of the Red Sea. The Yemenis vowed to stop “all commercial vessels linked to Israel or destined for Israeli ports.” They justified their actions with reference to Gaza and Article 1 on the Convention of the Prevention of Genocide.

The straits between Djibouti and Yemen to enter or leave the Red Sea are just 25 kilometres wide at their narrowest point. This puts shipping firmly within range of relatively inexpensive Yemeni weapons.

Yemen is a politically divided nation of just 34 million people and the entire Yemeni economy adds up to just USD $70 billion. Yet because of their strategic location, the effect on global trade has been immediate.

In ordinary circumstances, 12-15% of global shipping passes through the Red Sea. To divert a ship around South Africa adds nine days to the transit time. By reducing the number of transits a ship can complete in a year, shipping between Asia and Europe immediately became 20% more expensive.

In addition, the Panama Canal, which relies on a lake for part of its route, is doing limited volumes due to drought. On Thursday night, shipping giant Maersk said it is resorting to railway to tranship across Panama.

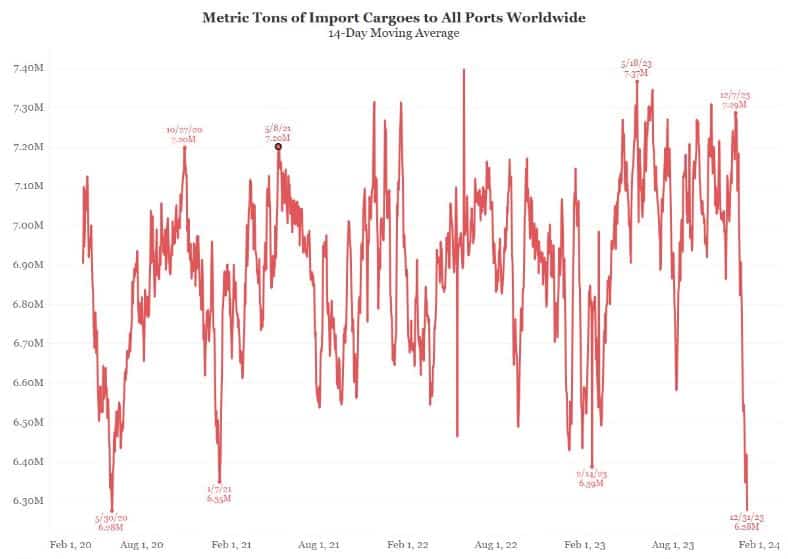

As a result, global imports have fallen to pre-pandemic levels, leading analysts to forecast the return of COVID-like goods inflation.

How long will the situation last and what will its impacts be? The Israeli prime minister has recently said the war in Gaza will continue for “many more months” and “until Hamas is destroyed.” Meanwhile, the drought in Panama is tipped to exacerbate as long as the El Niño Pacific cycle lasts, thereby reducing tonnage on the crucial route.

All this suggests that substantially higher global shipping costs will become the temporary new normal.

Sign Up To Our Free Newsletter