Last week we covered how to calculate enterprise value (EV) accurately from the primary documents.

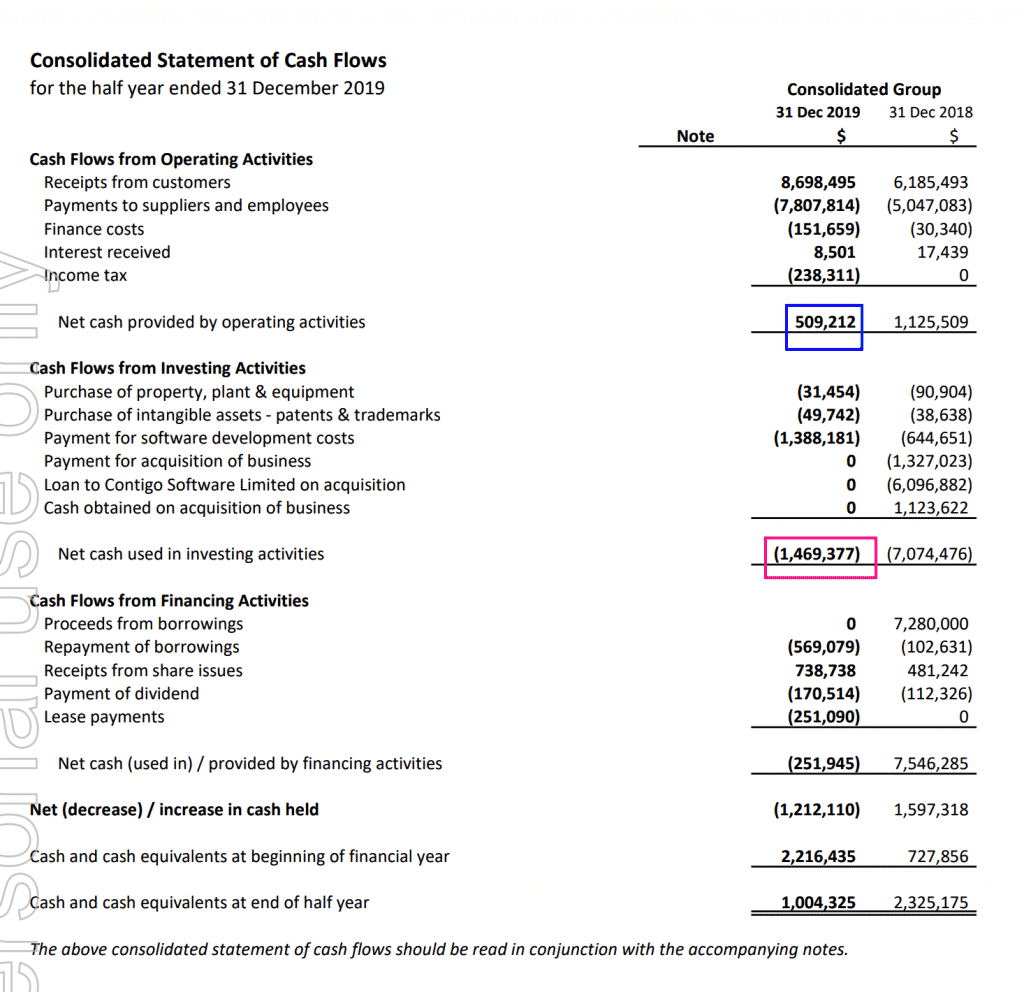

To calculate free cash flow for an Australian company you just add operating cashflow (blue) and investing cashflow (pink). Usually, investing cashflow is negative so it is actually operating cash in flow minus investing cash outflow. You can see what I mean below:

The above image depicts the cashflow statement of Energy One (ASX: EOL). As you can see, although they generated an accounting profit of $407,000, Energy One had operating cashflow of $509,000 (blue), and investing cashflow of -$1,469,000 (pink). Blue plus Pink = $-960,000.

So in the first half Energy One had negative free cashflow of almost $1 million. We can see the reason for it is that they invested in software development.

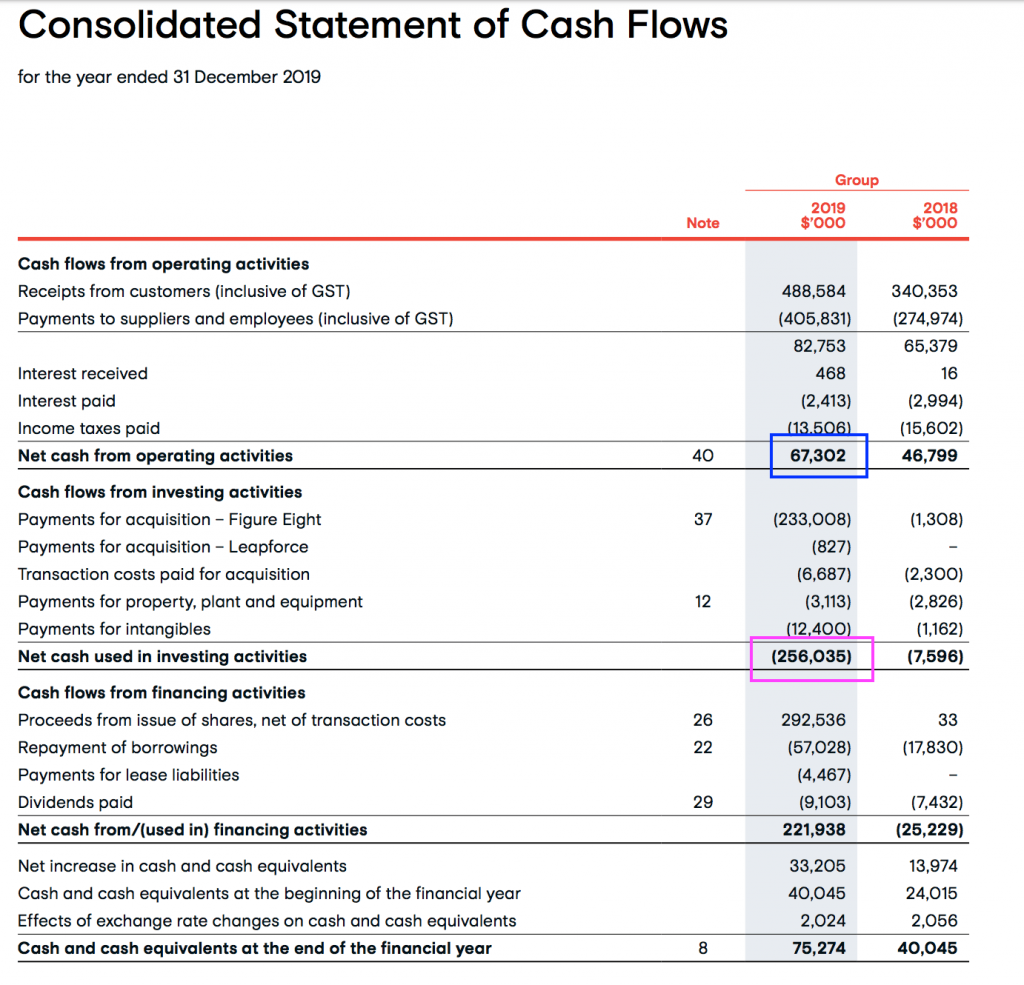

Another example can be seen with Appen, below:

Now, at first glance, Appen has negative free cashflow of $67.3m – $256m = -$188.7m.

However, as you can see, there is an investing outflow of $233m as payment for the Figure Eight acquisition. While this is a genuine cash outflow, to get a better look at the underlying cash generation power of the business, we might want to adjust free cashflow for that acquisition.

So, free cashflow excluding acquisition payments (for Leapforce and Figure Eight) would be $67.3m – $256m + $233m (Figure Eight) + $0.8m (Leapforce) = $45.1 m. Therefore, you might say that the adjusted or “underlying” free cash flow was $45.1 million. You could also say that the “free cash flow excluding acquisitions” was $45.1 million, for the half.

Next week, we’ll delve into how we can use Enterprise Value and Free Cash Flow to compare company valuations, as well as considering some of the other factors to consider when looking at free cashflow.