I’ve had a number of requests from readers who would like to learn how to accurately calculate certain ratios from the primary documents, so each week I’ll give a simple lesson on how to do that.

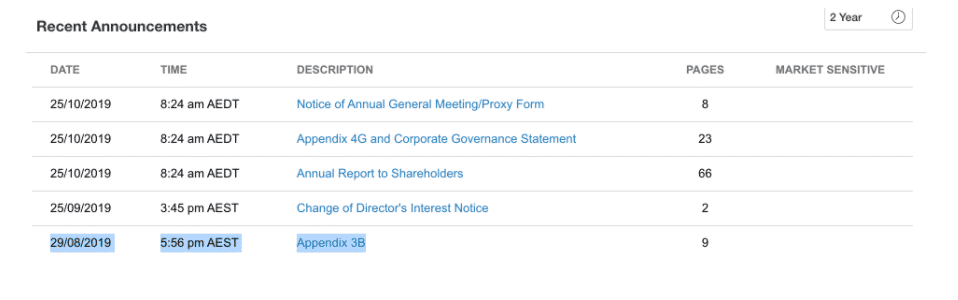

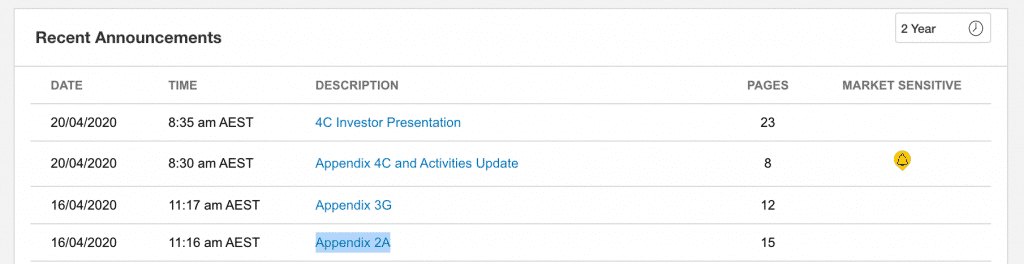

Here’s how you calculate an up-to-date and accurate market capitalisation. First, find the most recent Appendix 3B or Appendix 2A put out by the company. This is the notice that they put out when they issue more shares.

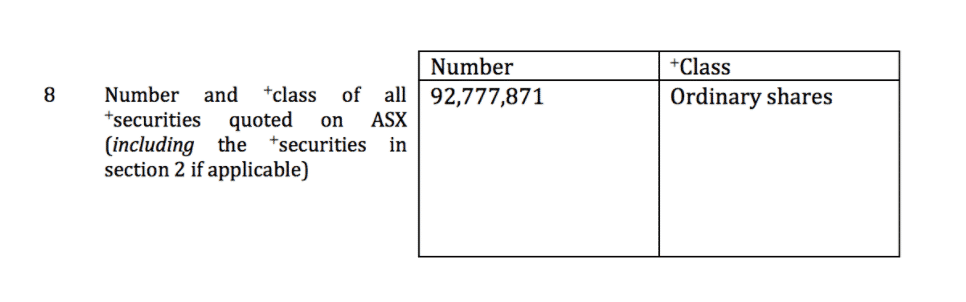

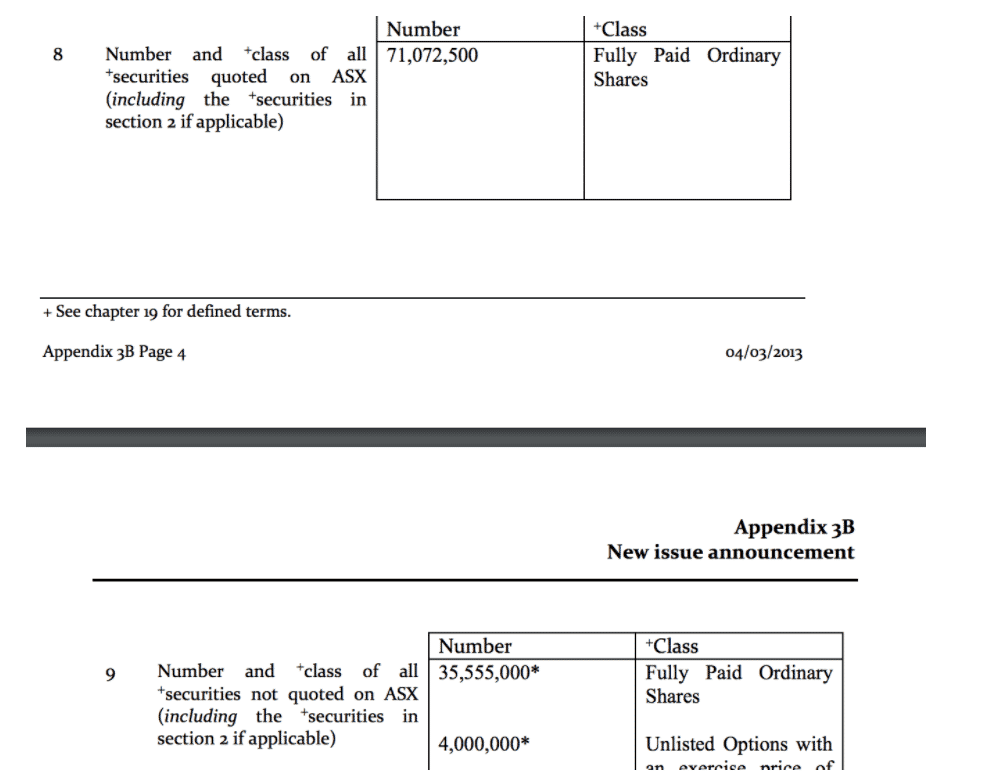

Then, look at box 8, which is the number of shares traded on the ASX. This is your starting point, and for many companies that’s essentially the number you want.

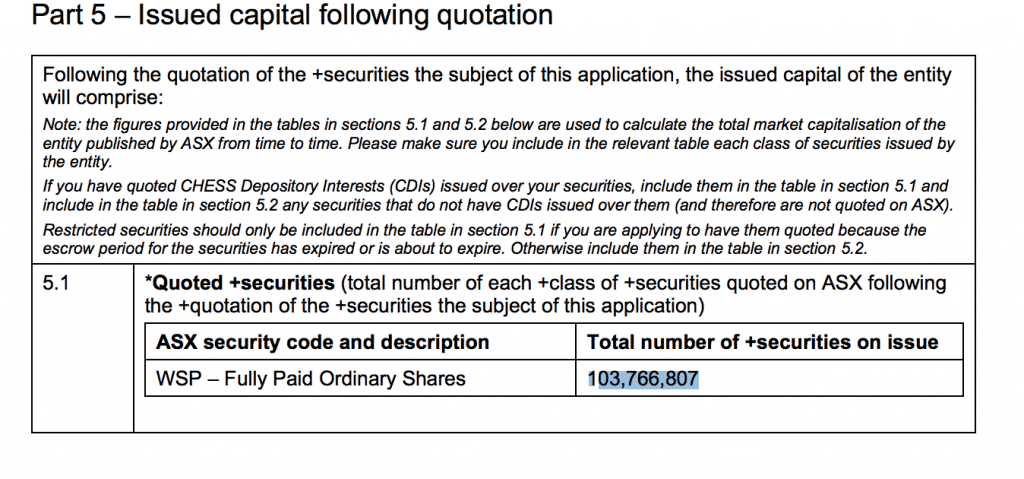

Or use box 5.1 if looking at an appendix 2A

However, it’s always important to also check the shares not listed on the ASX, in box 9 (or box 5.2 if using an Appendix 2a). Most companies will only have option and performance rights listed here. You’ll have to make a call about whether you adjust for that (giving the fully diluted count), but you often will not need to.

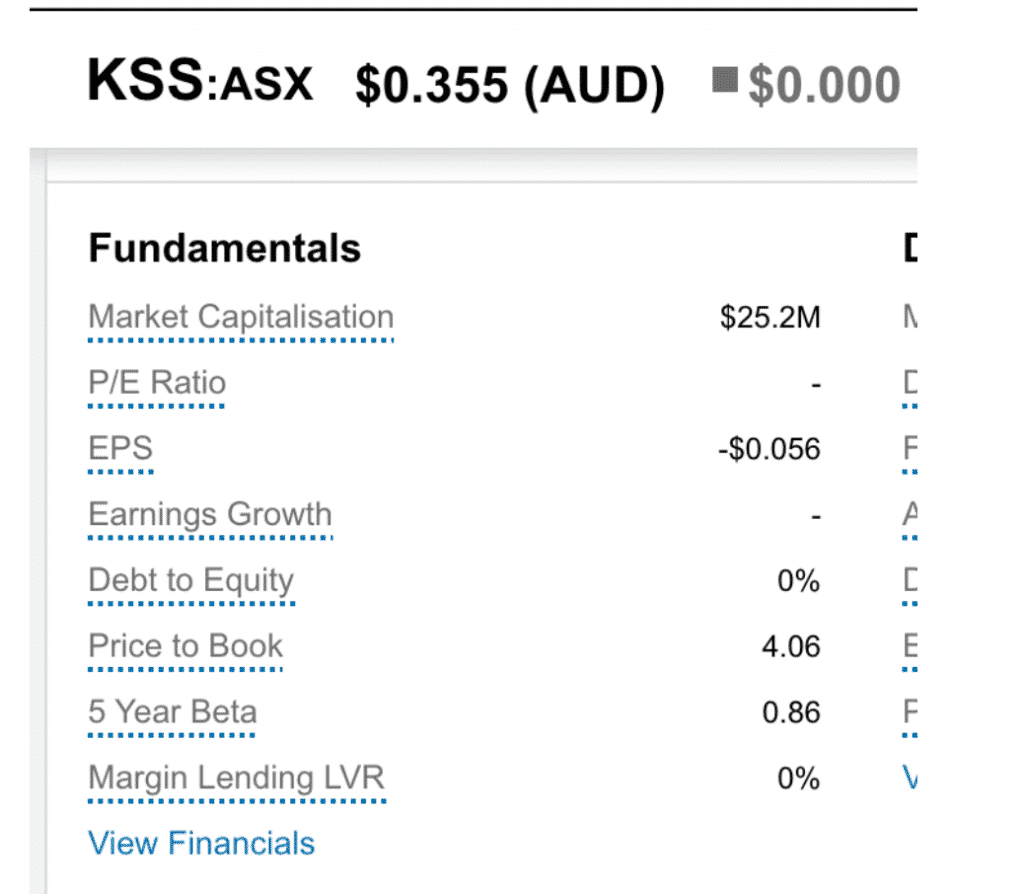

However, some companies will have large parcels of escrowed shares. Many data providers will then exclude those shares from the market cap calculations, thus giving a misleading market capitalisation. In the example below Kleos Space (ASX:KSS), over 35 million shares have been escrowed (but already issued), and not listed on the ASX.

That means that the true share count is over 100 million, giving it a market capitalisation of over $35 million at $0.35. However, brokers using Morningstar data display $25 million for that company, which is misleading for beginners. If you’re serious about investing well, all your data should come from primary documents (other than for scanning or quantitative work).

This post was original published in the periodical dated 17 November, 2019.