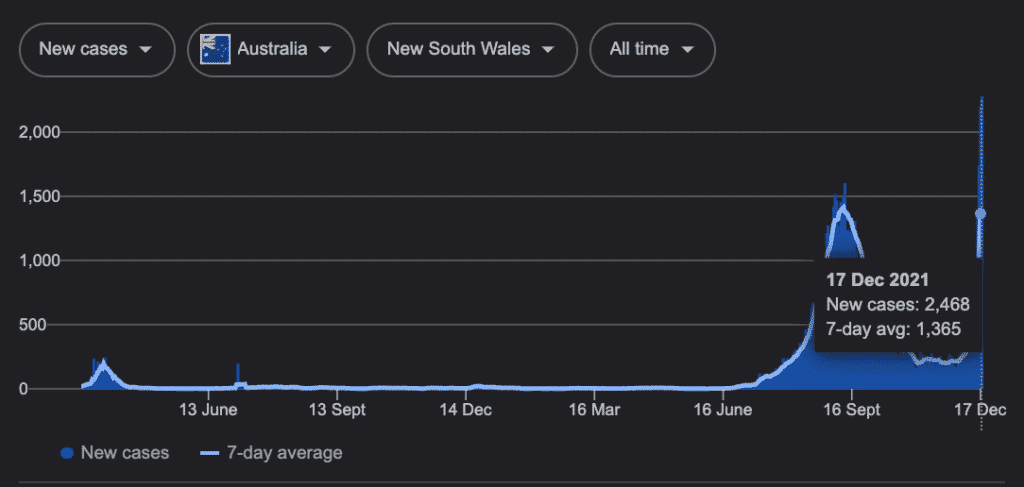

Sydney is recording record Covid cases, largely because Omicron evades vaccines easily. The precious moment of herd immunity to Delta is over. Covid is spreading freely in (most, but not all of) Australia’ population.

Meanwhile, inflation is zooming higher, putting downward pressure on loss-making tech stocks.

source: tradingeconomics.com

My US “moon rocket growth stonks” have been tanking, especially the lower quality ones. The top echelon in terms of quality, such as Atlassian, ServiceNow and Crowdstrike are still well above my purchases in 2020, and have been more resilient. But the riskier “yolos” like Fastly, Upstart and Digital Ocean are below my purchase prices.

Here in Australia, lower quality growth stocks like Nearmap are down around 30% or more from their highs, and loss making idea stocks are down closer to 50%. My portfolio hasn’t yet felt the full pain yet, because the highest quality businesses like Pro Medicus and Objective Corp haven’t dropped as much (yet). In a “risk off” environment, the pattern is often for the lower quality, lower conviction, riskier stocks to sell off before the higher quality businesses. But that does not mean the high quality ones will hold up forever. I suspect they will not.

I suspect that this growth stock sell off will run until inflation starts falling (I do not know when that will be).

What to do about inflation?

In times gone by I probably would have sold more aggressively during the year, but as it happens I was already taking a fair bit out of the market to fund a beach house purchase. As a result, we now have a forest house and a beach house, which I figure is probably the best I can do to protect myself inflation (since they are not making any more land).

Obviously, property prices can easily go down if interest rates go up, because millennials will have less borrowing power (and so will have to reduce their offers). My approach since our forest house purchase in 2016 has been to buy the worst house in the best street. For example, the Chairman of one of the growth stocks I hold had a house not far from ours, and the next door neighbours were ex-bankers.

Unfortunately, I never got to live in the forest house which we will probably look to sell next year, since we are currently over-exposed to property. Probably it would be better to sell it now but it is not an appropriate time to be asking tenants to have inspections, so we’ll probably have give it the best part of a year before we list it. For now we’re overly long property.

Secondly, my super is in a lot of cash and while I’m not sure about Chloe hers is also defensive in preparation for our SMSF. That should put me in a position to be deploying capital into the growth stocks worst hit by inflation dduring 2022. However, I’m not in too much of a rush because with inflation still running high, it’s hard to see any further multiple expansion in the already bubblicious small cap tech growth sector.

I have also been buying more dividend paying boring businesses with assets. For example, Duratec is a cheap stock that pays a decent dividend while DGL Group owns a lot of property and has a resilient operating business. These are low conviction, but I’m more optimistic on Australian Clinical Labs which obviously benefits directly from increased testing.

What to do about Omicron?

At the moment, we seem to have a situation where half the world thinks that because Omicron results in fewer hospitalisations per million cases, it is nothing to worry about. In Australia, we have a golden opportunity to react before the herd, because the herd is very, very slow.

As growth investors, we are generally trying to take advantage of the fact that humans have trouble understanding exponential growth. We buy stocks that are “too expensive” according to our monkey brains, because we don’t understand exponential growth intuitively.

When it comes to Omicron, the exponential growth is in the disease, and the hordes are taking too much comfort in the arithmetic reduction in hospitalisation rate.

If Omicron spreads so fast that 150,000 people get sick in a week compared to 15,000 for Delta (and NSW is forecasting more than this at 25k per day), then even if the hospitalisation rate is 20% of Delta, there will be more cases in hospital, unless we slow the spread. Now, if the hospitalisation rate is 2% of Delta, we might be in the clear, and if hospitalisation rates are 5% of Delta we might muddle through ok.

What people are really underestimating is that hospital capacity will actually go down if we have an uncontrolled outbreak, because health care workers will get sick. Even if they do not require hospitalisation themselves, they will have to stay home if they are ill. This means that hospital capacity may actually go down, right at the time we want it to go up.

The new “just a flu” catch-cry is “cases don’t matter”. But cases still do matter: they are a leading indicator of hospitalisations and deaths. If we can bare to look at the cases (while accepting we don’t know exactly what the hospitalisation rate will be), we will be ahead of the crowd looking at hospitalisations.

All this means that the ASX will still likely have some “panic days” ahead.

The market will likely start to have big “risk off” days when hospitals start getting stretched. It’s impossible to know if we will go into lockdowns again, but again, the average punter on the ASX (both institutional and retail) thinks there is close to zero chance we will.

I beg to differ. If NSW has too many hospitalisations, then we will likely start having quasi lockdowns where risk averse people are staying home, because they don’t want to get sick at a time when hospitals are already overwhelmed. John Hempton, who positioned his fund perfectly for the initial onset of Covid in March 2020, because he had access to good data and modelling, seems to think lockdowns will be avoided, because hospitalised patients are not ending up in ICU so much.

That will not last.

— John_Hempton (@John_Hempton) December 15, 2021

But the real question is going to be how many wind up in ICU.

When you run out of ICU capacity mortality goes vertical.

If >400 wind up in ICU we can expect pretty sharp restrictions.

I do not think it will happen – but that is the number I watch.

This is valuable information, and it’s worth keep an eye on ICU numbers to be able to predict a lockdown. But that is not the only path to lockdown. For example, if once schools go back it causes paediatric ICU wards overflow with unvaccinated toddlers, I would hope we’d see a government response.

Having said that, my base case is that, for business purposes, we’ll be heading into a quasi-lockdown situation over the next couple of months where many people will be avoiding bars, clubs, gyms and restaurants and many people get covid. While I’m not confident that we will go back into actual government lockdowns, I think that it is a possibility.

For example, Denmark has already closed theatres, cinemas and concert halls, while the Netherlands has gone for a very strict lockdown, essentially cancelling Christmas gatherings. To flippantly minimise the possibility that something similar may be required here is the equivalent of the racists who initially minimised covid by discarding the panic in China as the crazed actions of some sort of lesser, misguided developing country.

In fact, the panic in China in February 2020 was actually the canary in the coalmine.

Whether or not we go into lockdown, this upcoming Omicron wave in Australia will certainly have economic consequences.

It is likely that high multiple growth stocks will continue to have a very volatile time. Travel stocks may continue to struggle. The short term risk vs reward of markets is looking worse than usual. For this reason, I have begun shorting stocks again, as a short term hedge.

For more of my thoughts on Omicron, check the video below from Ausbiz:

From 4pm: We’ll get you across the best and worst performers on the day. Plus @claudedwalker from @ARichLifeAu gives us a #Omicron stockpick special $CHL $ACL $VIVA #ausbiz

— ausbiz (@ausbiztv) December 16, 2021

https://t.co/lGDtZt5EYz

Wishing you a safe and happy holiday period

The reality is that Omicron will keep spreading in Australia until a large enough group of people have immunity to it for herd immunity to start reducing the replication number below one. At the end of the wave, covid will return to relatively low levels again (until the next wave). Some Australians — more than ever before — will get covid. Some won’t.

If you want to be in the group that avoids covid, your best tool is probably an N95 or P2 mask. If you wear one of these ‘respirator’ masks, you’re effectively protecting yourself form infection because very few virus particles are able to make it into your lungs.

The second most useful tool will likely be rapid antigen testing, which do a decent job of detecting when people are infectious.

Beyond that, we’ll all need a little luck.

On that note, I wish you all a very happy and lucky summer holiday period.

We will continue to publish articles during the holidays, and new articles will be posted to the site when they are ready.

However, we will not be sending our regular fortnightly email on the 2nd of January. Rather, we will send the next issue on the 9th of January.

Please remember that these are personal reflections about a stock by author. I own shares in some of the companies mentioned above. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.