IT consulting companies have a chequered history on the ASX, because the high operating leverage inherent in the business model can lead to highly volatile earnings. In essence, IT consulting companies charge a margin on the hours worked by the IT consultants they employ.

IT consulting companies do have the potential to earn ongoing revenues, since they may sell (or re-sell) some recurring revenue software products, and generally provide ongoing support to customers.

However, a large portion of their revenues depend on new projects, such as migrating clients to a new system, integrating separate systems after an acquisition, or setting up new functionalities. Put simply, growing clients are more likely to spend more on IT consulting. At the same time, government priorities have a big influence on demand. If governments are spending more on digital initiatives, then that means more work for IT consultants.

On the other hand, if and when client IT spending stalls, even for a temporary period, revenues can drop quite suddenly while the relatively fixed salary costs stay the same. This means profits can drop significantly, or even turn into losses, in an unfavourable business environment.

So Much M&A

In the past many listed IT consulting companies had fairly mediocre long term performances. For example DWS (ASX: DWS) listed at $1 in 2006, and was taken over in 2020 for $1.20 (with a dividend of 3c). With dividends, the annual return for IPO investors was around 8% per annum. It was taken over for about $162m, or 9.3x underlying profit, being 21.6 times statutory profit.

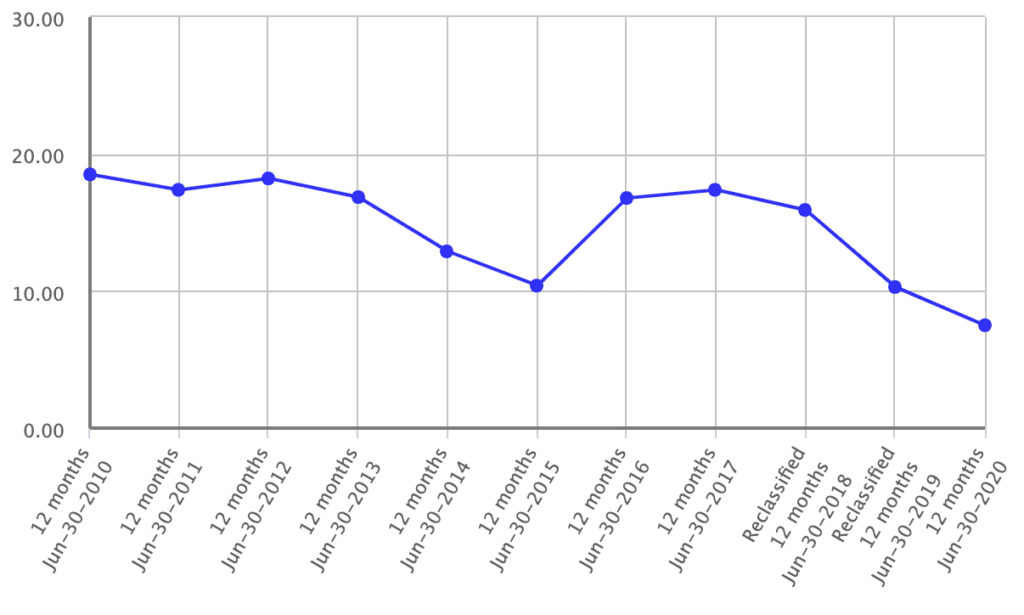

Over the years before its takeover, DWS earnings fluctuated considerably, but ultimately trended down until the market priced in too much decline, and it was taken over for a 36% premium, as you can see in the chart of DWS net profit after tax, from S&P CapIQ, below.

Now, I won’t go through each of the formerly listed ASX consulting companies here, but the lesson I took from reviewing the sector is that you only want to own these companies when demand is strong and earnings are growing. Overall, it looks to me like more acquisitions and less organic growth, is generally positive.

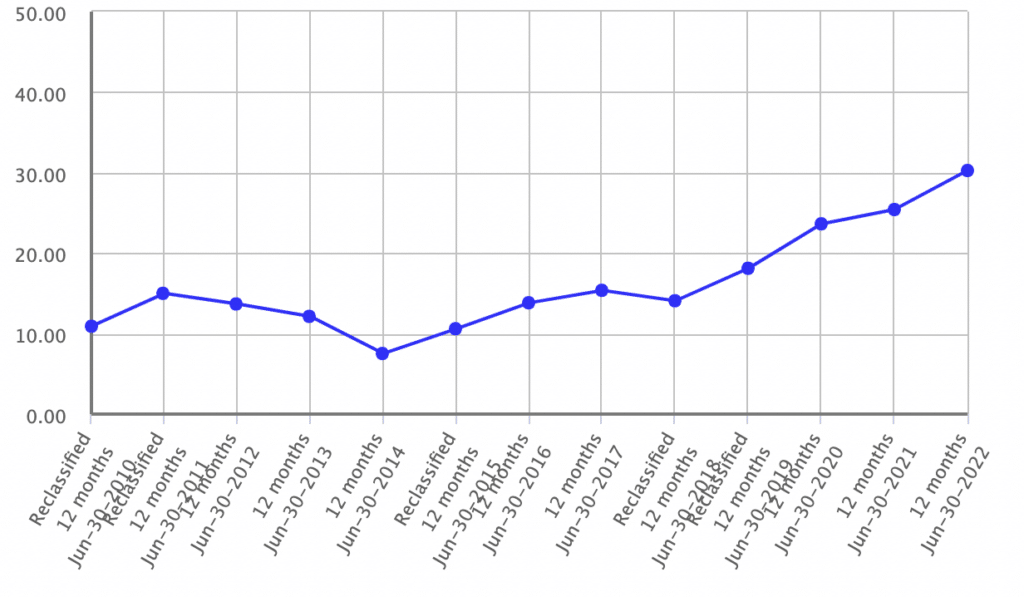

Perhaps one of the best success stories to look at is Data#3 (ASX: DTL). You can see our past Data#3 coverage here. I own shares (purchased when it hit my pre-published buy price range). I have followed the stock for many years since I recommended it years ago for Motley Fool Hidden Gems. The chart below from S&P CapIQ shows its earnings over the last 12 years. It has had ups and downs, but a strong period of earnings growth has seen Data#3 trade on around 30x trailing earnings, much higher than the price DWS was taken private for.

Looking back of the history of the ASX, it is important not to forget that Data#3 is the exception. In general, patchy volatile earnings have lead to low market multiples, and a string of subsequent corporate transactions.

One of the oldest ones, SMS Technologes (ASX: SMX), formerly Sausage Software, once traded above $6, but was eventually taken over by another, ASG (ASX: ASZ).

ASG Group itself was then taken private. As were Empired (ASX: EPD), Citadel (ASX: CGL) and others I haven’t mentioned. In fact, share price weakness and a takeover seems to be quite a common end for this kind of business.

When Would I Buy An IT Consulting Services Business?

The lesson I take from the history of the IT consulting sector on the ASX is that I would only want to own a business like this when the earnings momentum is positive.

As Data#3 shows, huge returns are possible if a company can sustain earnings growth for many years. But a review of the sector also shows that simply holding the stocks during period when earnings are improving (and dividends are flowing) can be a successful way to invest, as long as demand remains strong. Ultimately, for these kind of businesses you’d only want to continue holding as long as you think the next year’s earnings will be roughly flat or higher.

The problem with holding these businesses when earnings drop is they suffer lower earnings, and a lower multiple.

In the long term, IT consulting businesses are cyclical, and so even the large ones have their ups and downs.

In the short term, I think that the announcement from Data#3 today that “net profit before tax for the first half of FY23 is expected to be near the top end of the $21 million to $25 million guidance,” is not just a positive sign for Data#3, but also for the sector, because it implies a decent business environment.

One limitation for Data#3 is that its large size makes it harder to move the dial with acquisitions. In comparison, smaller IT services companies are more likely to be able to bolster organic growth with acquisitions. This is a positive in strong demand environments, but can quickly lead to big problems where demand weakens.

For those interested, I’ve just published this new article about 3 small IT services companies that I think are well positioned to benefit from strong demand for IT consulting. I believe that these businesses will benefit from the ongoing modernisation of digital systems, and could present medium term opportunity, despite the limitations of the IT consulting business model, in the longer term.

Finally, for some different perspectives on the IT consulting industry covering both the positives and negatives, check out the episode of Baby Giants Podcast, below.

Sign Up To Our Free Newsletter

Disclosure: the author does own shares in DTL and will not trade for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.