With five interest rate rises this year, the effects were always going to be felt in the property market. That’s indeed the result in the data from CoreLogic’s most recent quarterly property sales report, which analysed property sales data up to 30 September. Short term property reselling – i.e., where the property is sold after being held for less than three years – hit a decade high nationally in the September quarter.

Given the costs involved, short-term reselling can be read as an indicator of broader mortgagee financial stress, as CoreLogic’s Head of Research, Eliza Owen, said regarding the increase.

However, three times more investors than homeowners made short-term loss-making sales in the September quarter, suggesting homeowners are more likely to be forced to absorb the loss. The median loss for all short-term re-sales was just $40,000.

Short-term loss-making sales were widely spread out across the country, The highest rates of short-term loss-making re-sales were in inner and west Melbourne and the NSW Central Coast. Overall, loss-making property sales are lowest in Adelaide and the ACT.

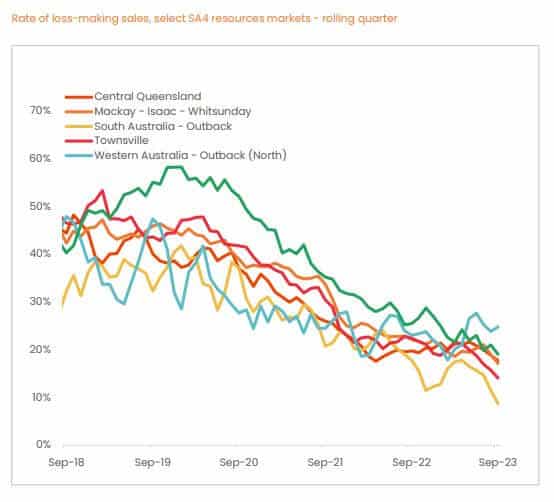

On the other side of the coin, The highest proportion of overall loss-making sales were in Perth (at 10%) and Darwin (at 30.3%) in the September quarter. This is indicative of property in resource areas continuing a medium-term decline.

The major cities also saw property sales losses. Melbourne saw 8.7% of sales making a loss and Sydney 8.9%. The other capitals were comparably secure as Adelaide and Canberra, with around 2.5% of sales resulting in a loss.

Housing in amenity regions – so-called sea-change and tree-change destinations – continues to increase. Yet profits on sales continue to slow since the peaks of 2021.This is in line with migration from regions to cities continuing to be positive, though again reduced since 2021.

Sign Up To Our Free Newsletter