The Reserve Bank’s official cash rate currently stands at 4.35%. This quick rise from 0.1% as late as March 2022 has had the intended effect of slowing inflation as well as overall economic growth.

Australia’s GDP increased by just 0.1% in the first quarter of 2024. That marks a further slowing from just a 1.1% annual increase in the 12 months prior. In the same period, inflation came down to 3.6%.

Interest rate rises of course affect business investment. Monthly turnover of businesses with annual turnover of $20m or more fell in May 2024.

It may be that the Australian economy will execute the much sought-after “soft landing”, with raised interest rates slowing economic growth and inflation but without sending the country into recession. If that is the case, however, it will have as much to do with the 2022 federal election as with the Reserve Bank.

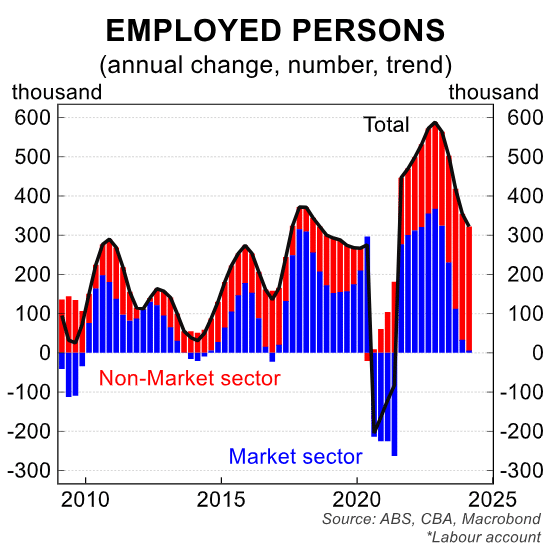

New ABS data parsed by @avidcommentator shows that private sector employment growth has dropped to near zero.

As you can see when the numbers are presented in this way, it is the public sector that is keeping employment figures in the positive.

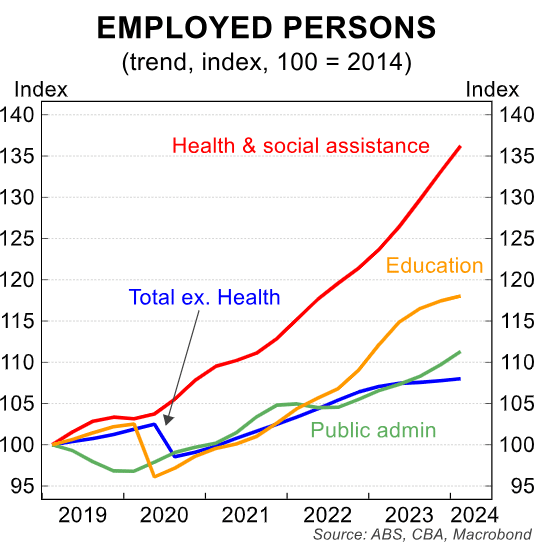

This is a continuation of a trend noted earlier this year. As The Mandarin reported at the time, February’s annual job index revealed a 14.3% fall in permanent job opportunities and a 5.3% fall in demand for casual staff. In striking contrast, public administration increased its staffing demand by 9.8% over the prior 12 months.

There is inevitably greater confidence in the public sector under an ALP government. Yet this confidence has been backed by concrete measures.

The government has increased pay for public sector professionals, dramatically raised funding for community-led organisations and added $100m to funding for the ABC and SBS. The 2024 budget increased federal funding for schools, boosted hospital funding and increased fee-free TAFE and university places.

With a $9 billion 2024 budget surplus, the Albanese government could hardly be lauded for dramatic counter-cyclical spending. But whether by luck or good management, its economic policies appear to have been pushing in the right direction.

Sign Up To Our Free Newsletter