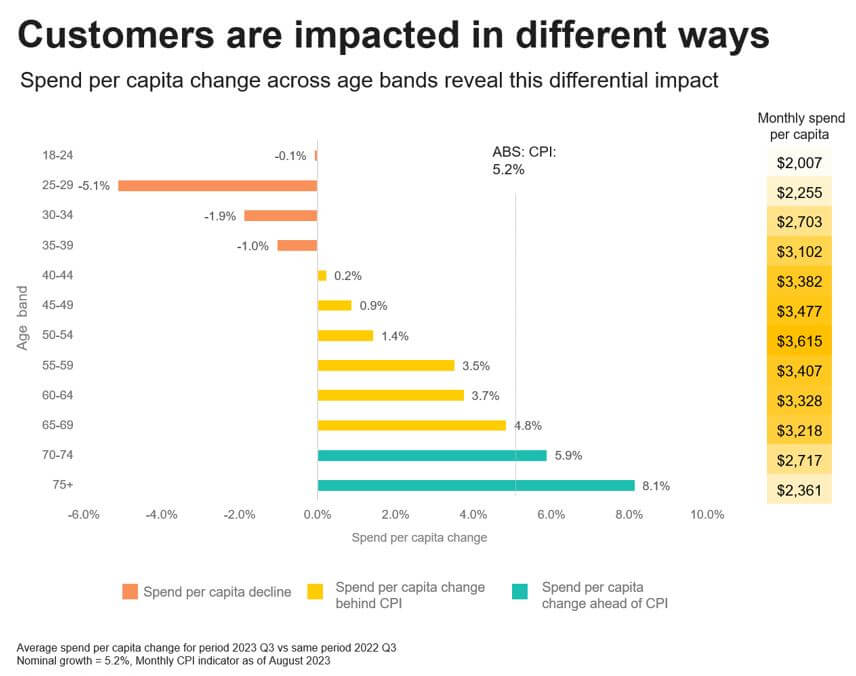

It’s plain that the cost of housing has become the albatross around the neck of the Australian economy. Indeed, last week a Commbank IQ report showed that Australian 25-34 year olds, few of whom have paid off their home, now have a lower monthly spend than 70+ year olds.

What are the policy options to make housing more affordable in the long-term? Albanese’s $10 billion housing fund is not negligible, but it falls short of structural market reforms that most affect the housing market as a whole.

New Zealand has some significant lessons from its efforts to achieve this over the past decade.

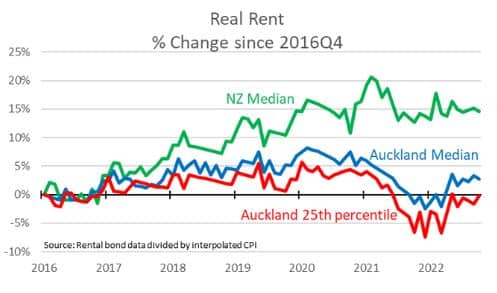

In 2016, Auckland liberalised planning regulations on large developments. The idea is that more mass-scale developments entering the markets would protect the lower end of the rental market.

The data show that this is indeed what happened. About two years after the 2016 reform, the cost of rent in Auckland began to diverge from the NZ median.

Most notably, the bottom 25th percentile in Auckland rental properties have not got any more expensive in the past seven years. This suggests the NSW ALP and Liberals are on the right track in their war of words over who can’t best stimulate high-density housing construction.

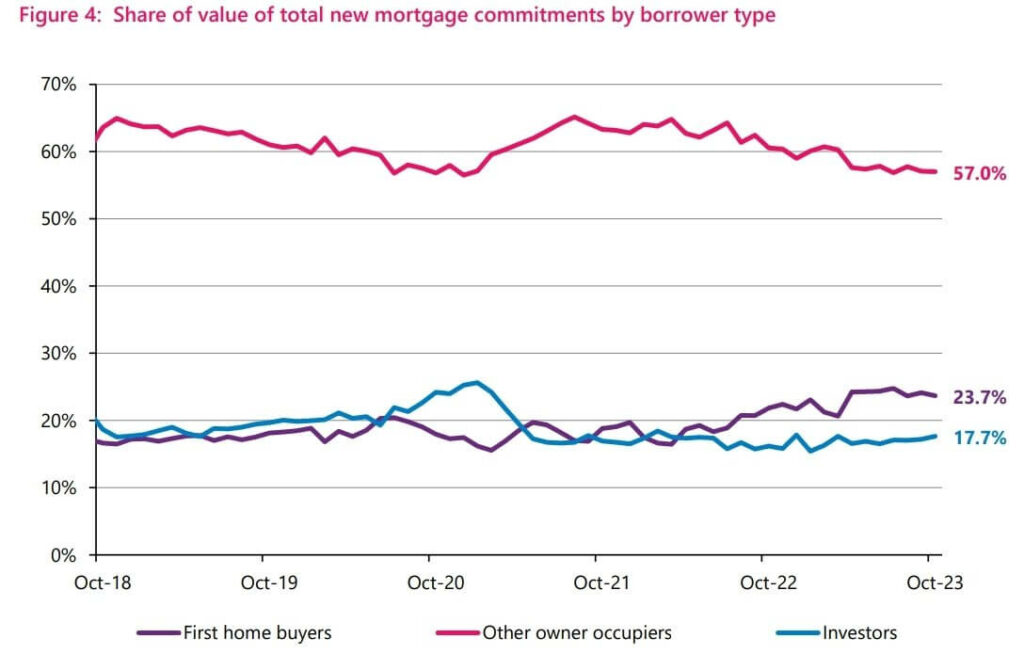

The other significant initiative from NZ is removing negative gearing. In 2021, Jacinda Ardern’s government removed negative gearing for new purchases, alongside a five-year phase-out of negative gearing for current investment properties.

The effects of this change appear to be more moderate than planning reform. As you can see below at the bottom of the graph, since 2021 there was a moderate inversion between the proportion of homes purchased by investors relative to first home-buyers.

As we all know, negative gearing was a federal ALP policy in 2019 when Bill Shorten lost the election to Scott Morrison. And indeed, it appears to have been politically impactful in NZ as well.

The new National Party government plans to stop the Ardern government’s phase-out, then reinstate interest tax deductibility for property investors by 2026. NZ property investors reportedly paid NZ $66 million more in tax in FY22 as a result of Ardern’s negative gearing changes.

Sign Up To Our Free Newsletter