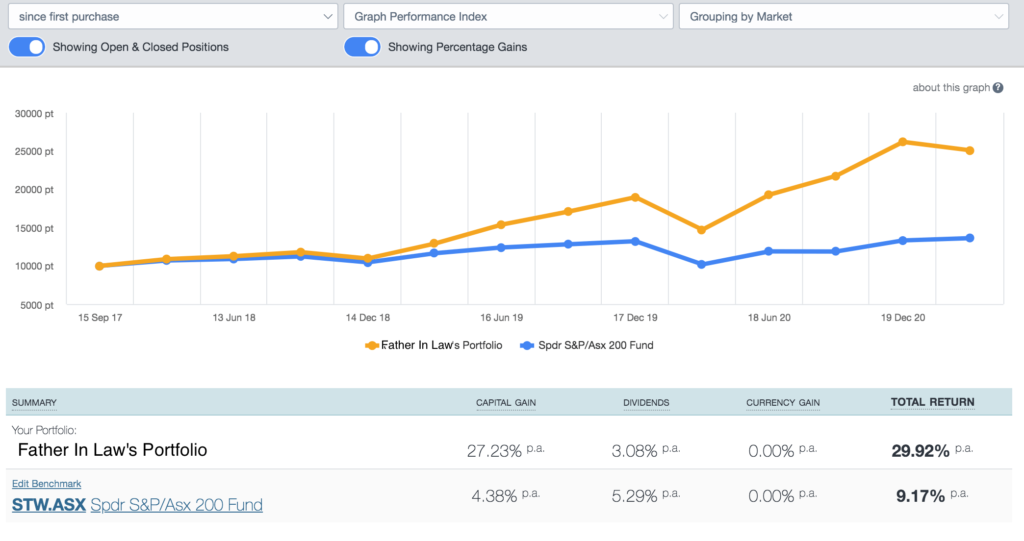

My father in law recently asked me about a few stocks so I logged in to Sharesight to take a look at his portfolio. I haven’t checked out his investing performance for ages but was delighted to see that he is averaging almost 30% per year since inception a little over 3 years ago. This does not include cash holdings (held outside the portfolio), so it’s not directly comparable to a fund manager’s return.

For me FIL’s investing is always very interesting to look at given that he’s been long term reader of my writing and only started investing in September 2017.

To start the portfolio he averaged out of a existing position in Commonwealth Bank, and a couple of other finance industry holdings, and averaged in to a portfolio of growth stocks based on public articles I shared with him. He didn’t buy every company he read about and although our portfolios have some important similarities, his looks very different.

FIL’s three biggest positions today are Xero (ASX: XRO), Pro Medicus (ASX: PME) and the Betashares Nasdaq ETF (ASX: NDQ). We share PME in the top 3, but I only have a tiny holding in XRO and I don’t have any NDQ.

Over the last few years he has had significant contributions from Data #3 (ASX: DTL) and Resmed (ASX: RMD). I don’t know how he ended up with ResMed (though I do like it as an Aussie healthcare stock). I’d say my recommendation of Data#3 for Motley Fool Hidden Gems was the impetus for his purchases below $1.70. But despite that being one of the better calls I’ve made, I never actually got on board myself, and don’t own the stock now.

Some of his underwater companies included Class (ASX: CL1), Readytech (ASX: RDY) and McPherson (ASX: MCP). I feel quite bad about the latter because I lost interest in it and sold as I forewarned in this article. This is a reminder to me that readers will often stay on board companies I sell out of. As a result, I really should do more to continue writing about companies after I sell. In the end, I couldn’t find much nice to say about MCP, given management lost $6m on hand sanitiser. And it’s hard to get excited when sales into China are falling away.

But before you cast FIL as a bagholder, consider this; he has often done well holding on, when I have sold. Just over a year ago, I disclosed:

“I sold my PKS Holdings (ASX: PKS). I should have sold this stock earlier as — even putting aside the pandemic — I don’t really have confidence in the board. The fear of the pandemic just highlighted to me that I lack confidence in Bombara, the fund that floated it, and so I’m not very comfortable owning the stock through a recession.”

Note: I lack confidence there will be enough upside for me if I buy, after they have floated it. This reflects my view that they will have achieved a good price when they IPO the stock.

Unlike me, my FIL held on to his PKS shares, and they are up 300% since I sold! That more than makes up for the loss on MCP.

So What Is The Father In Law Strategy?

Based on my chats with my FIL, I would summarise his strategy as this.

- Lean towards exposure in innovative healthcare and technology

- Don’t look at stocks every day

- Don’t overtrade

- Lean towards buying more of stocks that are going up since first purchase

- Lean towards selling or not buying more of stocks that are going down since first purchase

- Mostly get ideas from reading

- Buy a few ETFs for overseas exposure

- Sometimes trim winners for the sake of diversification

- Usually buy a position in around 3 instalments (but don’t buy more if it’s down a lot).

The Risk Of Anchoring

One of the main differenced between my approach and this strategy is that I try not to anchor on to purchase prices. Fundamentally, I think that the purchase price is best forgotten.

Having said that, in FIL’s case his bias has been against losers and for winners, so in a way the anchoring has actually resulted in him adding more to winners, and adding less to losers.

One notable negative arising from this was his greatest loss, being Gentrack. This was initially a winner, which he added to. Subsequently, it became a loser, and has been the worst losing position for the portfolio.

In Favour Of Buy And Hold

I guess the defining feature of this portfolio has been the buy-and-hold nature of it.

The biggest contributors to the portfolio have been XRO, PME, DDR, EOL, OCL. Look familiar?

FIL has purchased each of these on varying occasions, and only taken some profits from XRO and PME. In hindsight, those ‘trimmings’ have been a mistake, since the stock is up since. The real benchmark is essentially cash, for FIL as he never fully deployed the CBA proceeds, which sit in his trading account. This cash is kept available for opportunistic purchases.

Notably, the largest ever sell in the portfolio was when Wellcome Group (ASX: WLL) group was taken over. The second largest was Pushpay (ASX: PPH) in 2019, which turned out to have been a bad idea. The third biggest sell was CSL in early March last year; that has been for the best, so far at least.

What Next For FIL’s Portfolio?

What FIL does is out of my hands and none of this article constrains what he can do, or may do going forward. As I write, the top 15 positions in his portfolio are: XRO, PME, NDQ, DDR, KME, EOL, OCL, CSL, HACK, RUL, NAN, RMD, DTL, AD8, ERD.

By value, these constitute well over 50% of the portfolio, which has over 40 stocks.

This article is not intended financial advice, it is general in nature, and our disclaimer is here. The author’s FIL may trade any of the stocks mentioned at any time. The author owns many of the stocks mentioned in this article