Last month, the Federal Government released its “Future Gas Strategy”. Its projections out to 2050 focus on “opening new fields” and being a “reliable supplier” and mumble about decarbonisation.

Yet there was a bigger surprise than the commitment to push on with gas for 26 more years. Nowhere in the government’s strategy is there a mention of tax, royalties, or sovereign wealth.

Perhaps Australian governments have forgotten how. Figures released today show that over the past four years, there were zero royalties paid on some of the largest gas fields in the world: Chevron’s Gorgon and Wheatstone fields, Shell’s Prelude field and Woodside’s field, all of which are floating LNG projects off the WA coast.

Exports from these fields since 2020 total $111 billion, which amounts to 73% of gas exported from WA. Shockingly, while sitting on top of what is effectively one of the largest gold mines in the world, gas royalties account for just 1.5% of the WA government’s revenue.

If we add in the royalty-free facilities in the Northern Territory, the giveaway increases to $149 billion over the past four years.

The gas majors do no better when it comes to tax. In fact, over the past ten years Australia’s schoolteachers have paid twice as much tax as the gas and oil majors. It’s surely one of the most egregious cases of negligent governance to be found anywhere.

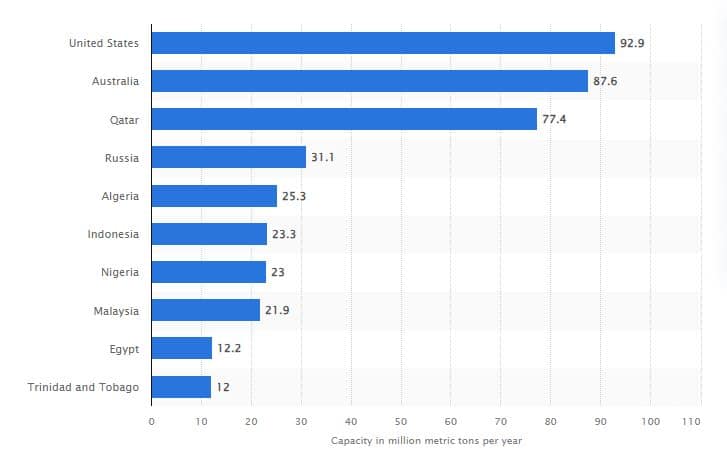

As you can see below, Australia is close to being the largest LNG exporter in the world. Australian LNG exports amount to 94% of the USA’s and 113% of Qatar’s.

But perhaps the best comparison is Norway. The Norwegians’ made the first contribution to their “Oil Fund” in 1996. The fund now owns 1.5% of all listed stocks worldwide and funds 20% of the national budget, which itself has the highest public spending relative to GDP ratio of any developed country.

Australia is a lucky country, but it is run by second-rate people.

Sign Up To Our Free Newsletter