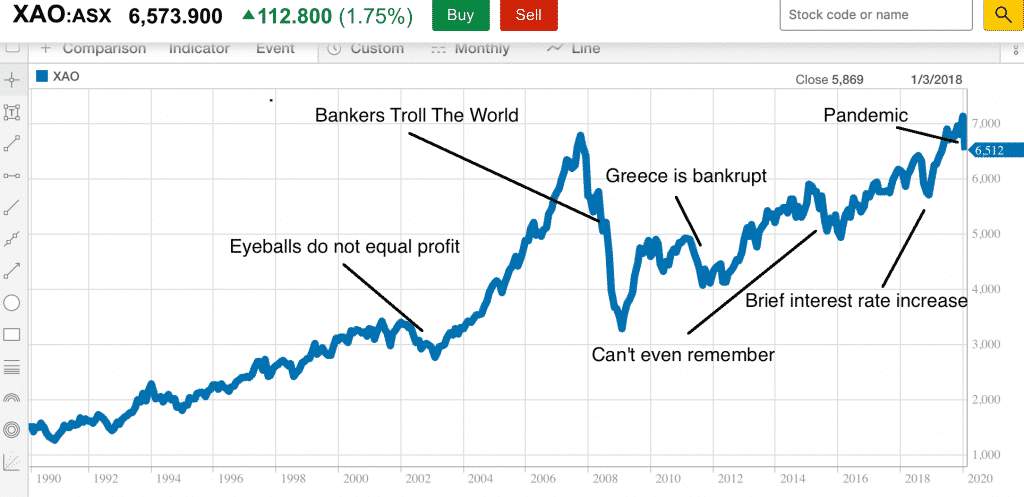

One of the nicest things about being a long term investor is that markets always go up eventually. But that doesn’t mean that they don’t go down too, and sometimes by quite a lot. As we saw in the ‘tech wreck’ high valuations alone are enough to cause a sustained sell off in the overall market.

And as we saw with the “Greek debt crisis” you can have a few tough months simply because a tiny country can’t pay its bills.

Meantime, we have a (likely) global pandemic, which will quite possibly kill hundreds of thousands of people, and make millions sick. Absent an ability to contain, slow or control the outbreak, a significant economic and psychological shock is very likely.

At this point the ASX All Ordinaries (ASX: XAO) is down just under 10% from all time highs. That’s a smaller fall than during the tech wreck, greek debt crisis, commodity price bust in 2015 and late 2018 sell-off on rising rates.

If you’re gleefully celebrating the end of the coronavirus sell-off today, it might be worth asking yourself if you think a global pandemic is less serious than Greece not paying its bills.

Zoom out:

If you’d like to receive a occasional Free email with more content like this, then sign up today!