This piece is a companion to my recent article called Nowhere To Hide On The ASX: Is A Recession Coming? However, this note is initially just for supporters, so I’ll talk more specifically about the most important thing that all investors should be doing, over the next six months. We are witnessing a tumultuous moment, and we must prepare to take advantage of it.

The Big Opportunity Past

As time goes by, more experienced investors begin to realise that certain periods are replete with opportunity to buy, while other times glow with euphoria; and should be used to sell.

But in reality, some parties are so good, that nobody who actually attended them could be trusted to leave at the cinematic peak. So good are those moments at the summit, at the top, and so rich do we all feel, that those with a true investor spirit, would prefer not risk leaving too early.

Today, we are already at the next morning. And ultimately, we must live through a hangover of some sort (though that will depend on how well you took care of yourself during the heady heights). If you didn’t get home by dawn, you’ll be feeling substantially shabbier than those who did.

Whether it’s just a fantastic party, or whether it’s an economic cycle, the same psychology applies.

A few “legends” party on, even into the next day, but most of the people have taken some off the table and are rebuilding resources in preparation for the next big up. Personally, I’ve largely done my selling of equities, but I’m still dumping illiquid assets such as the investment property (assuming we can still get a satisfactory price, otherwise, I’ll keep my trees, thanks). I just got some cash from an illiquid private company yesterday, sold at less than 3x Revenue to EV by my rough calculations!

At The Bottom, Opportunities Are Plentiful

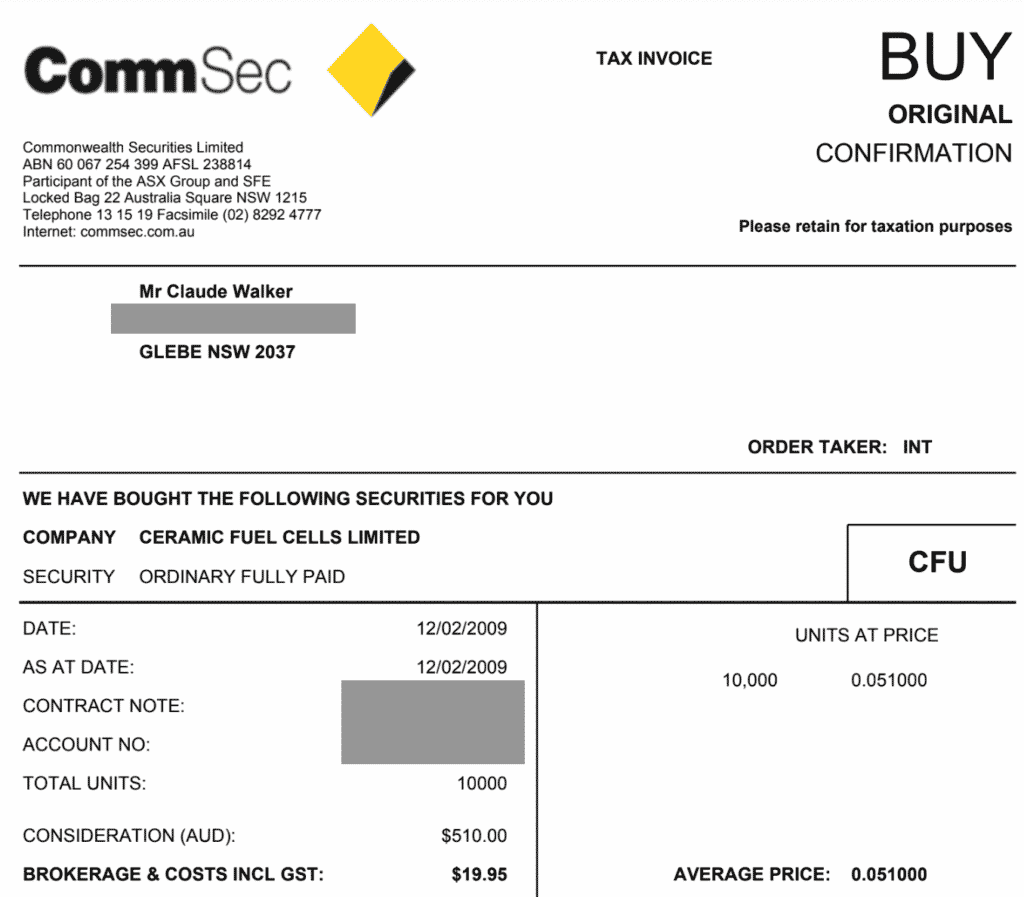

I first started reading about ASX listed stocks in 2008. I started by reading about all the stocks Australian Ethical Super (ASX: AEF) had invested their members superannuation in. One of them included a company called Ceramic Fuel Cells (ASX: CFU), which seemed like it had an interesting solution to create low emissions power (narrator: it did not). At the end of the year I had watched prices go down endlessly, and rather than buying stocks, I spent all my money on a trip to South America. I went from the coast, across the Andes and kept heading east, as deep into the jungle as I could go; at first via road, then for days on a river boat. Money well spent.

I dreamed one night deep in the jungle that I should become a professional investor and invest from a treehouse. I decided to spend all the money I had when I got back to Australia on shares.

The stock I had chosen was a complete dud, and it even needed to raise capital, in a one-for-one capital raising. So I doubled my investment at 5c a few months later.

And then, a few months later, I was up some 500%.

In reality, CFU was a dud that eventually went to zero, but the point of the story is that by simply investing at the bottom of the market, any idiot could make money.

Unfortunately, due to my inexperience, I did miss the real long-term opportunities.

For example, one obvious high quality business I could have bought shares in was CSL Limited (ASX: CSL)

In June 2009, it was trying to take over a company called Talcris, at attractive “GFC” prices. The US Federal Trade Commission blocked the move due to the risks of it creating a monopoly. CSL spent the rest of the year relentlessly buying back shares. The ASX announcements for that year are just pages and pages of share buyback notices.

The company made $1b in operating cashflow and $1.93 in earnings per share in FY 2009. The company traded for well below 20x earnings, at a share price below $35. It went on to 10 bag over the next 10 years, once you include dividends (otherwise, it fell slightly short). This didn’t take a huge gamble or risk, because the company was profitable and reasonably priced.

Fast forward to 2012, and CSL had already doubled; you might reasonably have thought you missed the bargain. But there were still even better opportunities lurking.

Pro Medicus had just reported a very slim profit of around $250,000. Recently returned CEO and founder Sam Hupert explained that they knew earnings would fall down because they had just sold Amira for $15m. Pro Medicus had acquired the profitable Amira imaging business as part of its purchase of both Visage and (the profitable) Amira in 2009 for just $4.5m, funded by cash reserves.

Anyway, even in 2012, after Pro Medicus had already sold the unwanted part of this acquisition, Amira, for $15m, it only had a market capitalisation of $45 million (a share price under 45 cents) and a director was buying shares on market. It was also buying back shares.

In the case of both Pro Medicus and CSL, it would be possible to spot that there was potentially a big opportunity in the offing. Not everything that looks like it could be a big opportunity will be, but the name of the game is to identify those companies that could be CSL or PME style opportunities.

You Need Dry Powder To Take Opportunities

For quite some time now I’ve been talking about the fact that I have plenty of cash on the sidelines. But for me, part of setting up for what should be a great set of investment opportunities (assuming there is a recession) is having as much cash as possible. I’m genuinely excited to be collecting the biggest cash horde I’ve ever had, but I’m not excited to deploy it, yet.

Indeed, as my disclosure shows, while I have been tentatively buying some stocks, I’ve largely been funding that by selling other things. I’m keeping my dry powder dry, for now.

The most important thing for me is that when the market does bottom, whenever that my be, I need to be able to deploy serious capital in the early days of the new bull market. You see, even if I wait until large cap stocks are rebounding from their lows, I am sure that there will still be small cap stocks languishing. The reality is, that the small-cap market is less efficient than the large cap market. Once we see inflation coming down, and business conditions recovering from the likely recession, it’s likely that large cap stocks will start climbing again. But many smaller less popular businesses will be languishing.

The Two Types Of Opportunities I’m Targeting

The two types of opportunities that I’ll be looking for are high quality profitable businesses, available at an attractive price. Those kind of businesses are those featured in my lists of high quality fluffy dogs.

The second kind of opportunity will be in riskier stocks, that aren’t yet reliably profitable. During a recession, the unprofitable businesses that were previously valued on revenue mutiples, will likely take a beating. Indeed, they already have. Rightcrowd (ASX: RCW), which boasts accelerating losses and falling annualised recurring revenue has clearly made some major miss-steps. But it is now trading on a market capitalisation of less than $11m. The company actually has more than $6m in cash, so its enterprise value is less than $5m.

For this price of $5m, you get a company with revenues well over $10m per annum. Now, the market pricing suggests very little trust that the CEO and founder of Rightcrowd can do a good job from here.

I have a very low opinion of Rightcrowd management, but I do think self interest dictates that the company should gradually improve, though I’m fearful that the board will announce some sort of low-ball capital raising (not available to ordinary shareholders), before bothering to cut costs. It doesn’t take much competence to get a business earning over $10m in revenue per year to turn a small profit, especially when the biggest expense by far is staff costs. Even a 5% net profit margin would make the company look startlingly cheap at current prices.

Now, I’m not saying I’m buying Rightcrowd shares right now. But I am saying that we can already see how some share prices might get so low, that even moderate success over the next 5 years could see the share price trade much, much higher.

During the next 12 months or so, my focus will be on buying two types of companies:

First, profitable businesses that I think could increase by around 10x in about 10 years, assuming a combination of realistic earnings per share growth and some multiple expansion.

Second, unprofitable or breakeven businesses that I think could increase their share prices by at least 20x or more, over the next 10 years.

My criteria for actually buying shares will be different, for each type of opportunity.

For the profitable companies, I will start buying shares once I think the shares are undervalued. That means I’ll inevitably buy before the bottom, in a larger number of smaller transactions. This strategy is called dollar cost averaging. For example I have already bought some Energy One (ASX: EOL) shares at around $4.50, even though it could well go lower after the next set of results (which will have a lot of acquisition costs in them, and not much growth).

For the unprofitable or breakeven companies, I’ll be trying to time my purchases based on sentiment. You can see an example of this thinking in this recent article on Nanosonics, where I speculate that the lowest point for sentiment might be some time after the FY 2022 annual results are released. For these unprofitable companies, I’ll be more focussed on trying to find the inflection point where sentiment starts to improve.

Playing Offence, As The Market Focusses On Defence

Over the next 6 months, I’ll be focussed on two main tasks:

First, trying to approximately identify when higher risk companies will suffer the worst sentiment, and buying shares just as the picture looks its most ugly.

Second, I’ll be honing my valuations of higher quality companies, in order to identify when their share prices trade at a sufficient discount to my estimate of intrinsic value. Then, when they are undervalued according to my estimates, I’ll slowly buy shares on “red days”.

I aim to exploit the (likely) extreme sentiments of Benjamin Graham’s Mr Market in the hard months ahead. But to do so I’ll need to ensure I have plenty of dry powder.

As an investor, the most important thing is that you have money to invest, when the best opportunities arrive.

Please remember that these are personal reflections about markets by an author. The author owns shares in some of the companies mentioned, namely (RCW, EOL and PME). This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.