This post is aimed at beginner and intermediate investors, and we recommend industry professionals or experienced investors not bother reading it.

If we cast our mind back to about a year ago, all stocks were selling off on justifiable concerns about what the pandemic would do to businesses around the world. In response, governments applied significant fiscal stimulus (think JobKeeper, and lifting JobSeeker).

But on top of that, central banks, especially the US federal reserve, decided to start buying government bonds. Now, the way a bond works is that it pays a certain interest rate, and US government bonds (and Australian ones) are considered very safe. The US bonds should always have a lower interest rate than Argentinian bonds.

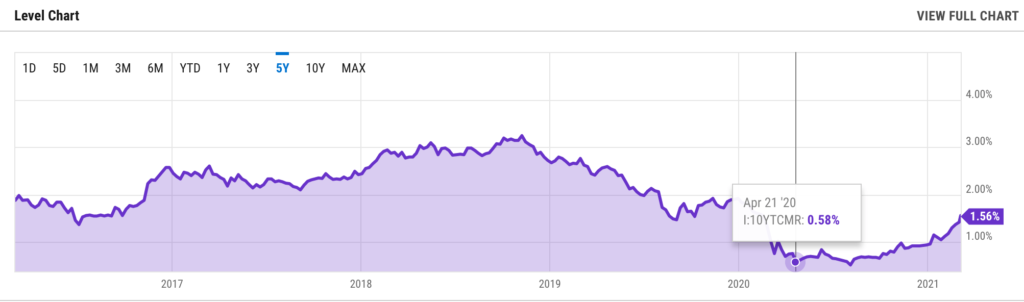

When central banks want to encourage investment, they can embark on bond buying. This pushes up the price of bonds, which now offer a lower interest rate to investors in this safe government backed products. Whereas once upon a time US bond buyers could get 5% per year with virtually no risk, today, they can only expect around 1.57%.

At the time, I thought that the main stimulus required would be fiscal, that is, looking after people directly. In this scenario, some monetary stimulus (like buying bonds) might be required. However, what happened was that the yield on the US Government 10 Year bond dropped very suddenly from ~2% to ~0.5%. This was not the only kind of asset that central banks were buying, but it is symbolic of the general trend.

This drop in the risk free rate drove money into riskier assets, seeking better returns. What we saw from April 2020 to February 2021 was a festivus of buying risk assets. This drove stock markets higher (along with just about every other asset class from trading cards to house prices).

Now that interest rates are rising, we no longer have an enormous flow of money moving into riskier assets. In fact, capital will likely be moving the other way. On top of that, we have many assets trading at speculative bubble prices, with no real fundamental support. Let’s explore that idea.

The Sociology Of Falling Interest Rates

When stocks dropped suddenly in March 2020, many were trading at prices well justified by fundamentals. However, the deteriorating fundamentals lead many to keep their cash on the sidelines, until we could see how the pandemic would impact individual businesses. It was clear many would need to raise capital, to go on.

However, by April, May and June, it was clear that central banks would be keeping interest rates low, and this succeeded in brining capital flowing back into riskier assets like stocks. This in turn made stock investors like us winners, which encouraged many people to join us. In particular, the fiscal measures in many countries actually ensured people had spare cash to put in riskier assets, like stocks.

The hype was so intense that companies with virtually zero revenue and a good story could attract legions of gamblers to become shareholders. To this day there is a Facebook group with 2,200 members for “True Believers” in a certain company. Criticism of the company is banned in the group which is mostly dedicated to allowing punters to give unlicensed and explicit financial advice, always to encourage others to buy shares.

Being greedy and overconfident is a sure way to lose money. For some it will have been going all in on zero revenue story stocks on a $1b market cap, but there are hundreds of other smaller trashcos out there attracting a naive following.

The first force that can be unravelled by the small move up in bond rate is momentum. It’s a lot harder for greedy naifs to encourage clueless dorks to buy shares in a company with no revenue and a good story at a massive valuation when stocks everywhere are dropping.

Eventually, people will be seeing how their mate lost money on speculative trash stocks, rather than made money. The firehose of new investors could turn into a dribble. It could even go the other way if investors who thought they had skill based on making money in the last 6 months pack their bags and leave the market.

If you own a trashco for momentum reasons, you should be really thinking about whether that is smart, around now. There is a huge difference between a stock on a P/E of 90 which is a great buy on P/E of 30 and a stock with no revenue on a $500m market capitalisation.

If your stock on P/E 90 falls 2 thirds, you could happily wade in with buys, and take advantage of your strong understanding of what is a quality business with great long term prospects.

But the stock with no revenue may never bounce back. It might be worth zero, so there is no real valuation support. It can just go down and down forever and the only thing that will drive it up is actual revenue or a new band of naifs willing to torch cash based on a facebook tip.

Why Growth Stocks Are Hit The Hardest

Interest rates available in safe investments like bonds impact the required returns from riskier assets like stocks. If you can only get 0.5% per year in a safe year for a decade, then a company paying a 2% dividend might look pretty good, even if there’s a chance it will be worth less in 10 years.

On the other hand, if you can get 1.5% safely then suddenly you might want 3.5%, or more, to hold a somewhat riskier stock. But this impact is exaggerated when the earnings are further out in the future.

Let’s imagine three companies. For the sake of the argument, let’s just say that each company pays out all its free cash flow each year, and then implodes at the end of 5 years. Each company will produce a surplice of $50 in free cash flow over that 5 years.

Importantly, we are only interested in how much the valuation changes as a result of interest rates rising. If you already understand why growth stocks are hit harder than value stocks, then you really don’t need to read this.

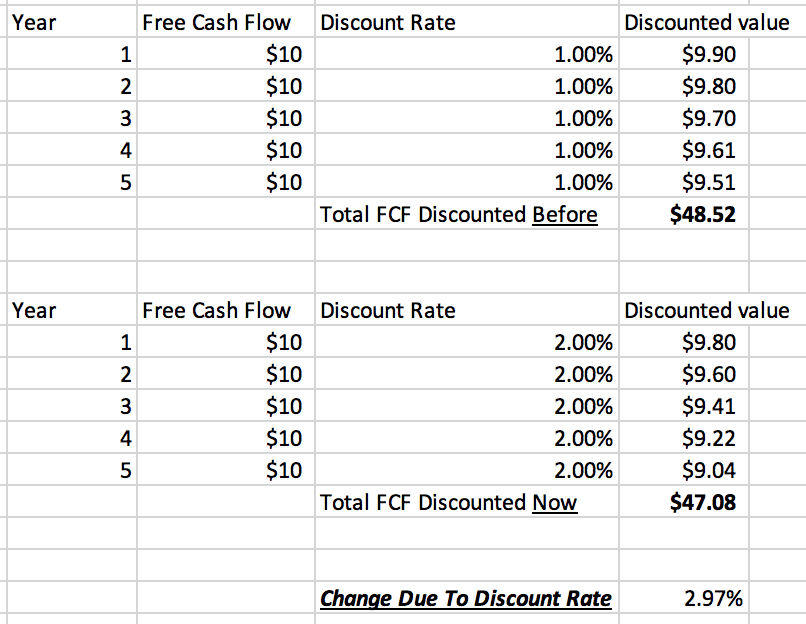

Company A will produce $10 each year. In this scenario, moving the discount rate from 1% to 2% decreases the value of the discounted free cash flow by 2.97%.

Remember, when you get paid the money in 1 year, you could invest it in bonds, to get a guaranteed return. That’s why money paid sooner is worth more than money paid later. In order to adjust for that, analysts apply a discount rate on a per year basis. This means year 2 will be discounted more than year 1, and year 3 discounted more than year 2; et cetera.

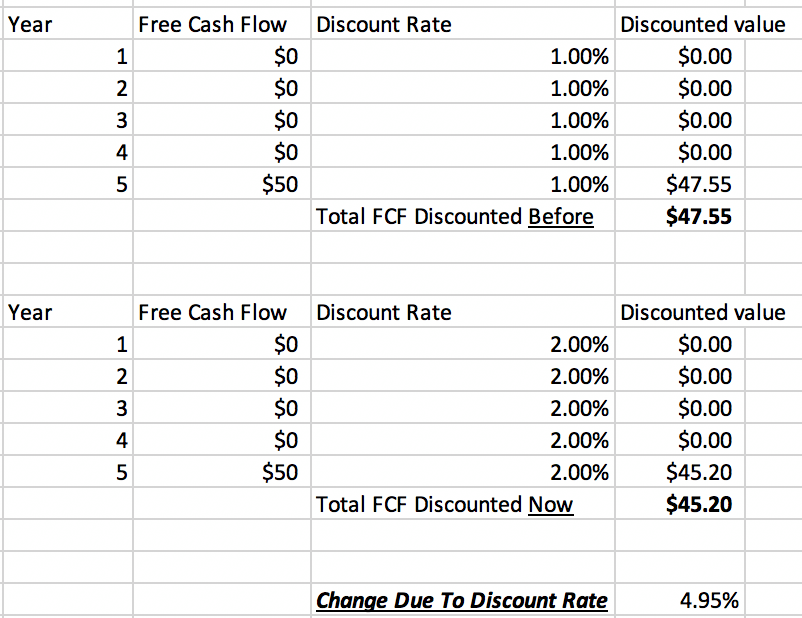

Company B will produce $0 for 4 years and $50 in year 5. In this scenario, moving the discount rate from 1% to 2% decreases the value of the discounted free cash flow by 4.95%.

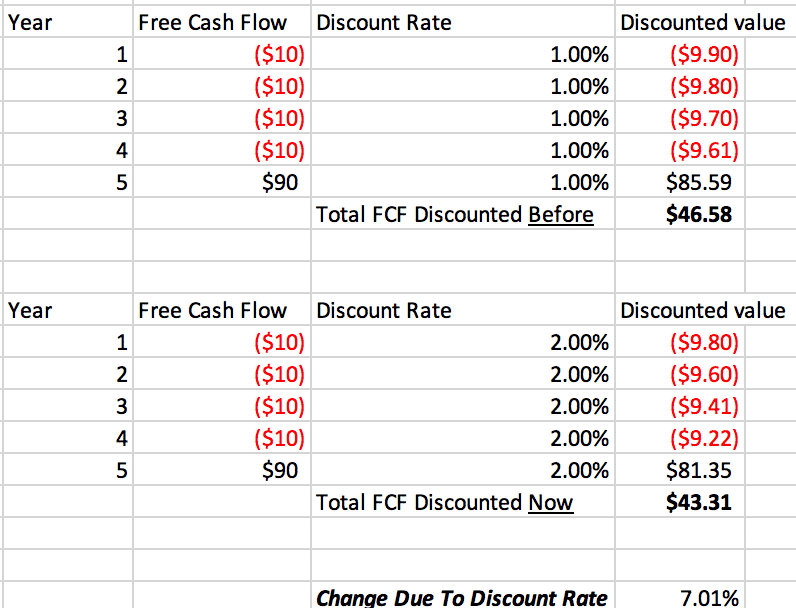

Company C will burn $10 for for 4 years and make $90 in year 5. For this example, I’ve assumed that it has $40 in cash to burn (or can borrow it at 0%!). In this scenario, moving the discount rate from 1% to 2% decreases the value of the discounted free cash flow by 7.01%.

3 Ways Factors Determining The Impact Of Rising Rates On Your Stocks

The most important 3 things to remember are that:

1) Companies that lose money are more exposed to higher rates

2) Companies with lot of debt are exposed to higher rates.

3) Companies with more of the earnings expected in the future are more exposed to higher rates (ie, growth stocks).

If capitalism is allowed to work properly (and it may not be), then many of the terrible companies with no real customers currently trading at large valuations will go bankrupt, and so too will the companies with heaps of debt. Personally, I don’t have that much faith in the central banks to allow it, but let’s see.

Most of all, it’s important to remember that it’s the trend in interest rates, rather than the absolute rates that is spooking the market most of all. As you saw in the chart, the US 10 yr is still actually below where it has been for the last few years.

Once bond rates stabilise, it’s likely stock markets will cease dropping so quickly. We don’t know when that will happen exactly but inflation expectations can be a good guide. That’s a discussion for another day but suffice it to say that technology, globalisation and the lack of public support for workers have proven rather apt at keeping down inflation in many areas of the global economy, in recent years.

To quote econofact:

“The spread of global supply chains, declining unionization, a fall in the real minimum wage, and shifts in social norms around pay may have reduced the ability of employees to bargain effectively for higher wages, thereby limiting inflationary pressures coming from tight labor markets.”

While this trend will go into reverse with the end of the pandemic, I wouldn’t hold my breathe for huge multi year changes, given that so many workers are focussed on not allowing gay people to marry, being allowed to buy guns, and other cultural issues; allowing for their continued exploitation.

I habitually take profits from stocks that I think are overvalued, but I don’t sell quickly because experience has taught me momentum can take stock prices well into overvalued territory.

Last week I sold a few of the companies I own for momentum or that are losing money (or both!). Rising rates encourage me to ensure all my businesses have a good fundamental valuation argument supporting them (even if my valuation is below the current price). But I’m not doing anything drastic.

Having said that, I do think it’s important to have cash ready to deploy. For someone still earning money with sensible investments in profitable companies, it may not be necessary to take any action. For someone without cashflow, you’d hope they were already cashed up by the time markets were hitting their highs earlier this year (if not earlier)! And I’m sure many switched on retirees will indeed be looking to this sell off to produce buying opportunities.

And that is the important thing. We are looking like approaching a time when people are playing defence, so it’s important to be in a mind-state to play offence. It’s definitely time to think about what stocks to be buying if and when fear takes hold more strongly.

But that will be a post for Monday (and for Supporters only).

While this article does cover financial subject matter, the article is not financial advice, and should not be the basis for any buy or sell decision. It is general in nature, and our disclaimer is here.