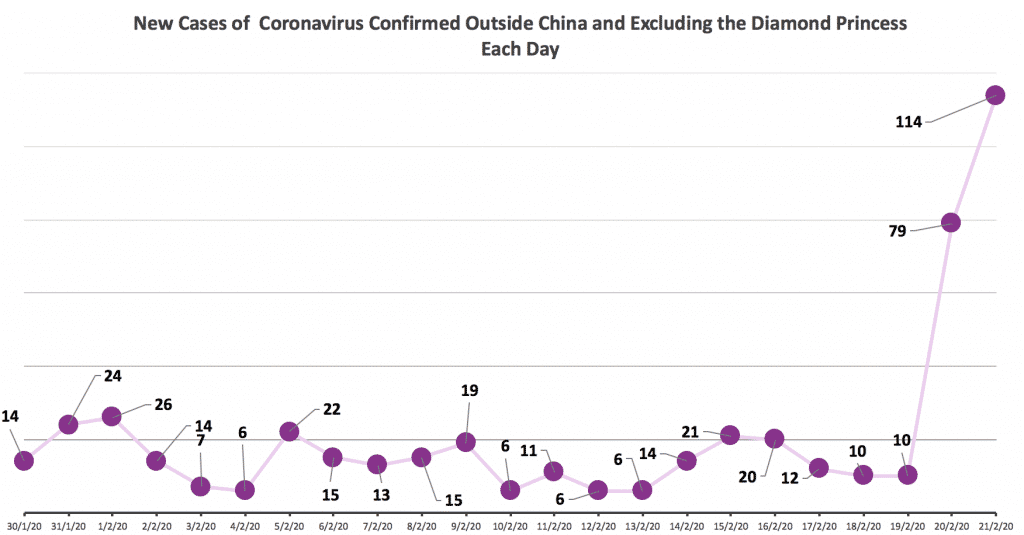

We have up until the last couple of days taken the view that the data did not support a coronavirus pandemic outside of China and that floating petri dish, the Diamond Princess.

Unfortunately we can no longer take that view as the number of cases in the wild outside of those locations have positively exploded in the last couple of days. You can see what I mean, below.

As a result, I think that the market will increasingly start pricing a global pandemic, of which it appears there are rapidly increasing chances.

On top of this, Japan has made the fateful error of allowing the passengers of the Diamond Princess who have tested negative a few days ago to mingle with the population. It is near certain that some of those passengers would have contracted the virus near enough to when they were tested that the test showed a false negative or else the person simply became infected after the test was done. As a result, I know think it is quite possible that Japan will suffer a pandemic.

Furthermore, both Singapore and South Korea have a significant number of cases relative to their population. Importantly, more than two thirds of those cases appear to have contracted it within the country, rather than in China.

I would estimate there is a 27% chance Japan will suffer epidemic, a 73% chance South Korea will (given its high number of cases and high in country transmission) and perhaps a 20% chance Singapore will. As a global transport hub linking Australia with the world, Singapore will be significant for Australia if it does have an epidemic.

Overall, I think the chances that we are going to have a prolonged human and economic tragedy have increased significantly over the last few days, and it is probably only a matter of time before this finally kills this utterly stupid “coronavirus bull market”.