“Many ASX ‘growth’ investors are currently discovering a hard reality of high momentum, high multiple growth stories,” wrote the genius ‘value’ investor, “the bull goes up the stairs and out the window. EML for instance has just given back 5 months of gains in 4 days. Momentum reversals, when they happen, are brutal.”

Leaving aside, for a moment, the brain damage inducing false dichotomy between ‘growth’ and ‘value’ let’s engage for a moment with the premise of this patronising schadenfreude-laced missive. It assumes that many people like you and I, or anyone who holds high beta, high multiple stocks stocks with good momentum are so stupid that we are now “discovering” the hard reality that stocks with darling status fall hard.

For a few unlucky punters who’ve just started their investing journey, that might be true. But for the majority of investors in small growth stocks like EML this is not a discovery. It’s known. It’s obvious. It’s the ticket to the dance.

I’d sooner kick myself in the crotch than become someone who assumes that those who invest differently are clueless. EML is far from the first example of a growth stock giving up 5 months of gains in 4 days, and it sure won’t be the last. This is a well known feature of investing, and it is metaphorically, your ticket to the dance. If you can’t stomach a steep reversal of fortunes then the market in general, let alone small growth stocks, is not a great place to play.

So as the market reaches the end of its arguably ludicrous coronavirus bull market I’ll be taking my inevitable drawdown in my stride. I hope I’ve taken the right amount off the table, but some will have taken more, and others less. Some will have timed their sales better, others worse. Some will have effective hedges, others will not. We are all investing and learning together but there’s little point in pretending that the big red days aren’t part of it. They are. They are the ticket to the dance.

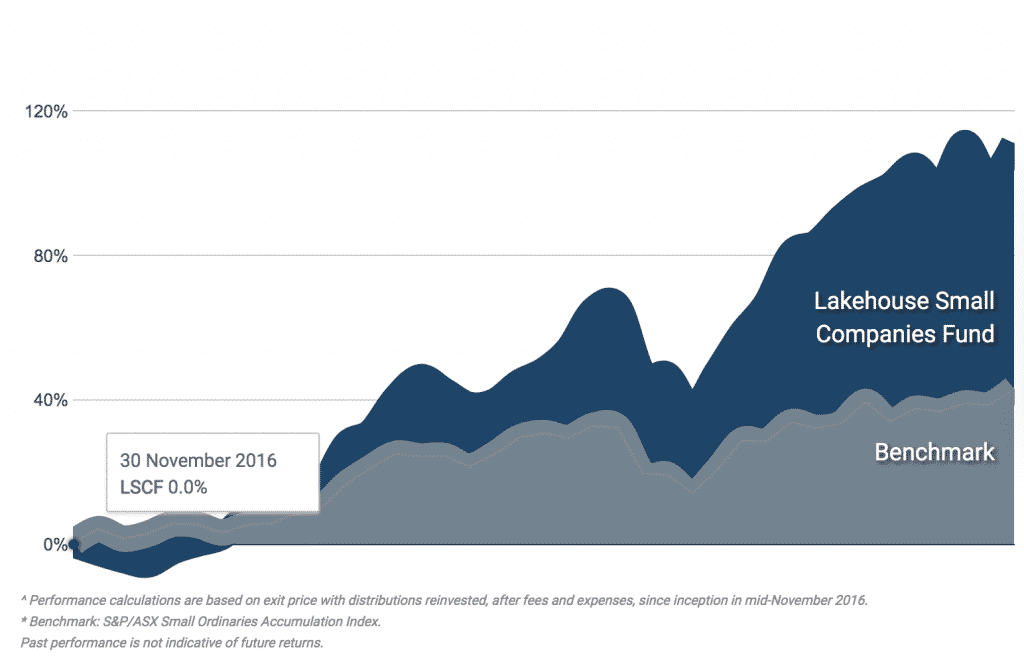

But don’t forget to zoom out. Below are the 3 year returns from Lakehouse Capital, a decidedly ‘growth’ oriented fund that has invested in stocks such as Afterpay and — you guessed it — EML. My family invested in Lakehouse at inception, and still own units today.

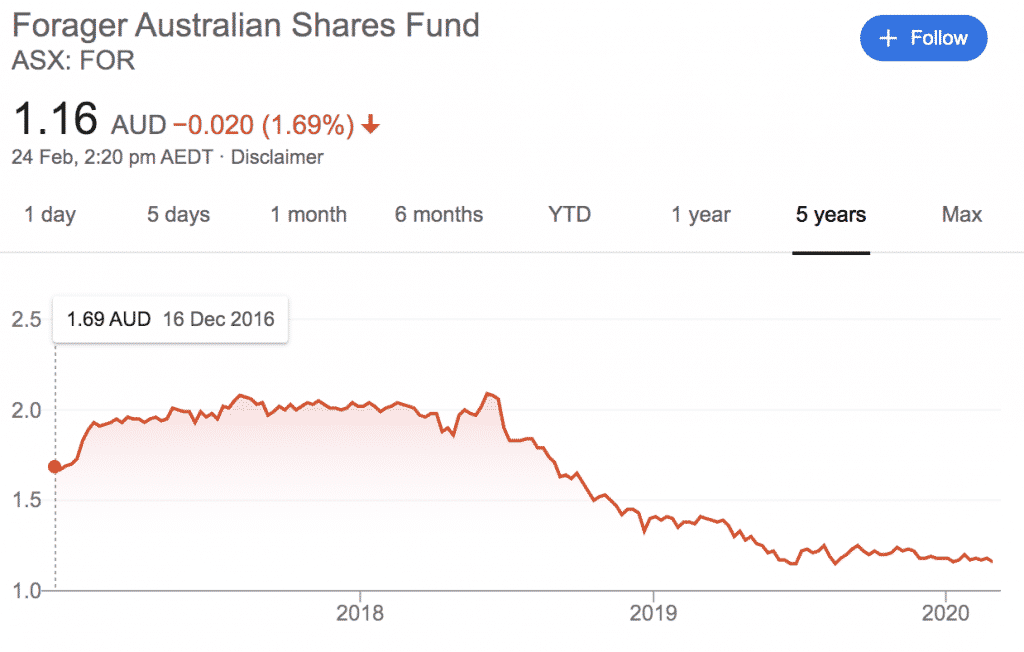

And here are the returns of Forager Australian share fund, a prominent ‘value investing’ listed investment company which avoids such frivolities.

Over roughly the same period, anyone holding units in the value fund lost around 30% while those invested in the growth fund more than doubled their money. Now, that doesn’t mean all the value fund’s investments are bad. In fact, I held one of my stocks, Dicker Data (ASX: DDR) during the same period they did. And other stocks I hold such as Chant West never had growth as a significant part of the thesis.

Personally, my own portfolio has taken an absolute wallop in the last few days. But focussing on the here and now during a sell-off doesn’t paint a full picture. After yesterday, I’m still up about 70% over the last year. And I’ve taken most of that profit off the table already. When the dust settles from what looks to be a very rough period, I’ll be ready to invest again; in growing businesses in which I see value. And indeed, I’ll probably be buying before the bottom.