At least for a moment, Chant West Holdings Limited (ASX: CWL) looks like it might become the rarest of ASX stocks; a cashflow positive net-net. Today, it announced it will sell its eponymous Chant West business for $12 million. And at the time of writing, its market capitalisation is under $9 million.

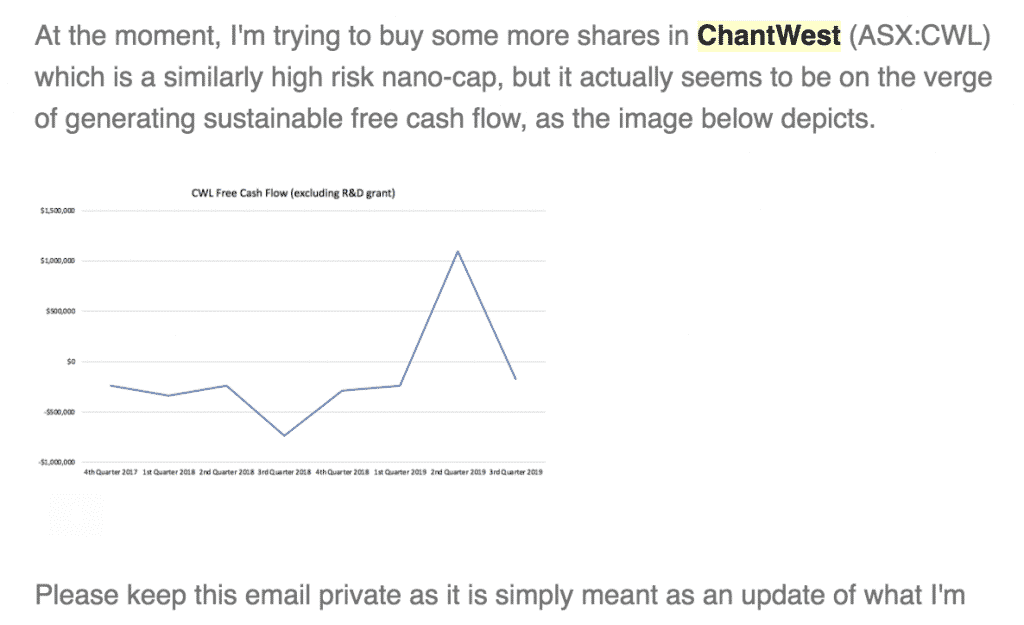

In the very first email to Supporters, on May 23, 2019, I wrote about how I was trying to accumulate shares in the very illiquid Chant West Holdings Limited (ASX: CWL). You can see the excerpt below:

Back then, the shares traded at about 6.5 cents, and until today, shares had been languishing at around that level.

Earlier this month, I covered Chant West’s quarterly results here and concluded that “I’m essentially paying for a company that is half backed by cash and free cash flow positive, which isn’t too dangerous, as it goes.”

While many people think that I only invest in growth stocks, I’d proffer Chant West as a counter example. It’s not particularly high growth, it’s certainly not sexy. But it is (or at least was) quite cheap.

Assuming the company returns about 9 cents per share to shareholders (pure speculation), after the sale of the ChantWest business, we’ll be left with the inferior Enzumo business, plus around $5 million in cash. Just last month the company said:

“Over the past 18 months, there has been a significant amount of M&A activity in the financial services sector, and some of the major banks have exited the advice industry. This has created an increased demand for Enzumo’s software support services.”

While the Enzumo business is profitable within the combined Chant West business, it’s not clear whether it would be able to be profitable as a standalone business if it had to bear all the corporate costs on its own. Therefore, my base case would be that Enzumo is worth about 2-3 cents per share (that is, about the same as the cash on the balance sheet). If the market values Enzumo, then perhaps the stock is worth more.

Today, the company says that:

“After completion of the transaction, CWL will retain Enzumo, its financial planning technology solutions business, and anticipates having a cash surplus of approximately 10 cents per ordinary share on issue.”

I would therefore value the stock at 12-13 cents, which is perhaps too conservative. I’d probably consider selling some above 10c, and I’d try to buy some below 8c!