The 5 Small ASX Fund Managers I Like Best

Choosing a fund manager to manage your money is a very important decision. Here are the funds I have an interest in.

Choosing a fund manager to manage your money is a very important decision. Here are the funds I have an interest in.

Are large language models like ChatGPT and Google Bard really better at stock picking than fund managers (even though they can’t count)?

When investors calculate the Rule of 40, should they use EBITDA or Free Cash Flow?

Your handy ASX small cap reporting schedule, replete with links to results conference call registration and results webinars.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Claude, Dave and Peter answer any and all questions from our subscribers.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

In Raymond Jang’s last piece for A Rich Life, he reflects on key investing lessons, his filtering process, and the road ahead as an investor.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Resources for small cap investment research will naturally have a bias. Improve your investing by considering the biases of your research.

A podcast aimed at beginner investors who are interested in ASX small caps.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

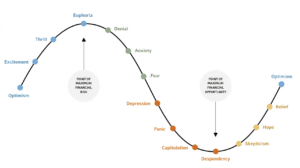

Human instincts make investors too conservative at the time of maximum opportunity, so I use pre-identified signs to overcome my hesitance.

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

Sorry, you’re not authorised to access this page Hi there, you’re seeing this page because you don’t have a membership OR your account has expired. But I have an account! If you have just logged in to your account and you’re seeing this message, please follow the steps below: 1. Press the … Continued

This earnings season calendar for ASX small cap stocks tells you when these ASX companies report their results in August 2022. Also includes webinar or conference call details.

Even once you have a bank account set up for the SMSF you need an electronic service address. Then you can rollover your funds to the SMSF, from the website of your existing fund.