This article will be my final hurrah for A Rich Life, as I embark upon the next step of my investing journey as a full-time research analyst at CCZ Equities, as opposed to my part-time role with A Rich Life.

Writing this article is bittersweet, because I’ve thoroughly enjoyed producing insightful articles for A Rich Life readers and Claude given me space and guidance to learn some valuable investing lessons in a short space of time. The potential to help investors in any way, shape or form has been the most fulfilling aspect of the role, so I thought it’s only fitting to try and pass on what I hope will be 5 useful lessons I’ve learned, as an investor.

5 Important Investing Lessons I’ve Learned

Understand what makes high-quality businesses tick

When I first started out investing, I had no idea what a high-quality business looked like because it takes a lot of time and effort to research and understand why these businesses were able to compound at high rates over a long period of time.

It’s easy to find and filter existing quality businesses based on numbers like revenue and profit growth but it’s often too late to invest by then. Meaningful alpha is generated from spotting the qualitative inputs before the numbers come out in the financial statements. I found myself spending a lot more time analysing the financial figures rather than trying to truly understand the qualitative factors driving the numbers.

I’ve noticed my threshold for investments has tightened as I study and analyse more quality businesses.

Great management teams are rare

The more businesses I’ve come across, the more I’ve realised how rare it is to find management teams that meet all of the following criteria.

- Understand its competitive advantage and are well-equipped to strengthen it

- Long-term mindset

- Truly passionate about the products and services it provides

- Aligned with their shareholders

- Act with integrity and humility

I definitely overlooked the importance of management when I carried out my initial research into Catapult International (ASX: CAT). I placed greater value on Catapult’s product potential rather than the incentive arrangements at both the board and management levels. After reviewing the leadership teams at Supply Network (ASX: SNL), PWR Holdings (ASX: PWH) and Lovisa (ASX: LOV), I quickly realised my initial benchmark for a high-calibre management team was too low and this area deserved much more attention.

Monitoring the business over a long period of time

Even when you’re unsure about the business, there is value in monitoring it over a long period of time. Claude provides a great overview of the advantages of this in his podcast interview with Owen Rask.

I’ve found myself making better and quicker evaluations when material information is announced by a company because of the time spent following it. It also enables you to assess the health of the business’ moat, which I believe is one of the most important areas to actively evaluate.

Whilst financial results, in particular, revenue growth and gross margins are probably the biggest indicators of the health of a company’s moat, these are lagging indicators. Gaining insights from scuttlebutt research has proven to be a much more beneficial exercise in keeping a pulse on the business.

For example, employees leaving for a competitor can be a strong signal that a business is no longer the industry leader or reading forums where users of a product or service are debating about the quality of the product or service. Afterpay is one classic example where you would have been able to reap big dividends if you had kept a close eye on the payment methods at retailers early on.

Even monitoring market share is a simple but effective way to understand how the overall industry dynamics are shifting. Beacon Lighting (ASX: BLX) continues to take market share in Australia and is following a similar trajectory to Bunnings.

Use a discounted cash flow model to understand the key variables

I started off thinking that the primary purpose of a discounted cash flow model was to estimate the intrinsic value of a business. The end figure you come up with is highly dependent on how well you understand the business and more often than not, performance is driven by a few key variables.

It’s also imperative to understand how these key variables perform in different economic cycles. Some industries are more susceptible to macroeconomic factors than others. Ever since I’ve focused more on gaining a strong understanding of the key variables, forecasting or understanding the market’s expectations has become more palatable.

I personally prefer to use a DCF to pinpoint the key drivers and then study these in depth so I can judge whether or not the market is underestimating or overestimating the future change in these variables.

Beware of recency bias

I fell into this trap when growth stocks like Redbubble (ASX: RBL) recorded unprecedented growth rates on the back of a whirlwind of events brought on by the pandemic. Governments around the globe dished out record-breaking stimulus payments, fuelling eye-watering levels of discretionary spending.

This goes back to getting a sound grasp of the qualitative inputs driving the key variables within a business. Even the best companies across the globe have bad years, so be particularly careful in only extrapolating the best years of growth across the future.

My preference is to find high-quality companies and then wait for them to record results that are below market’s expectations. Such businesses tend to underperform due to short-term temporary factors and will likely eventually outperform over the long term. Like all great sporting teams, writers and actors, they have their down years, you’d want to be backing them when everyone else is losing faith.

My Filtering Process To Find Stocks

My filtering process has evolved quite a lot since I first started researching. I don’t think there is one right way, and it entirely depends on your investing philosophy. At the moment and based on my research to date, I’ve found the following process to be effective for my personal investing philosophy. Keep in mind, I’m striving to find high-quality long-term compounders and then wait patiently for mis-pricing opportunities.

This investing filter is largely predicated on the investing filter built by Bluegrass Capital, whose Twitter account is filled with invaluable investing lessons. His overall framework and investing approach really resonated with me, which he goes into detail in this interview.

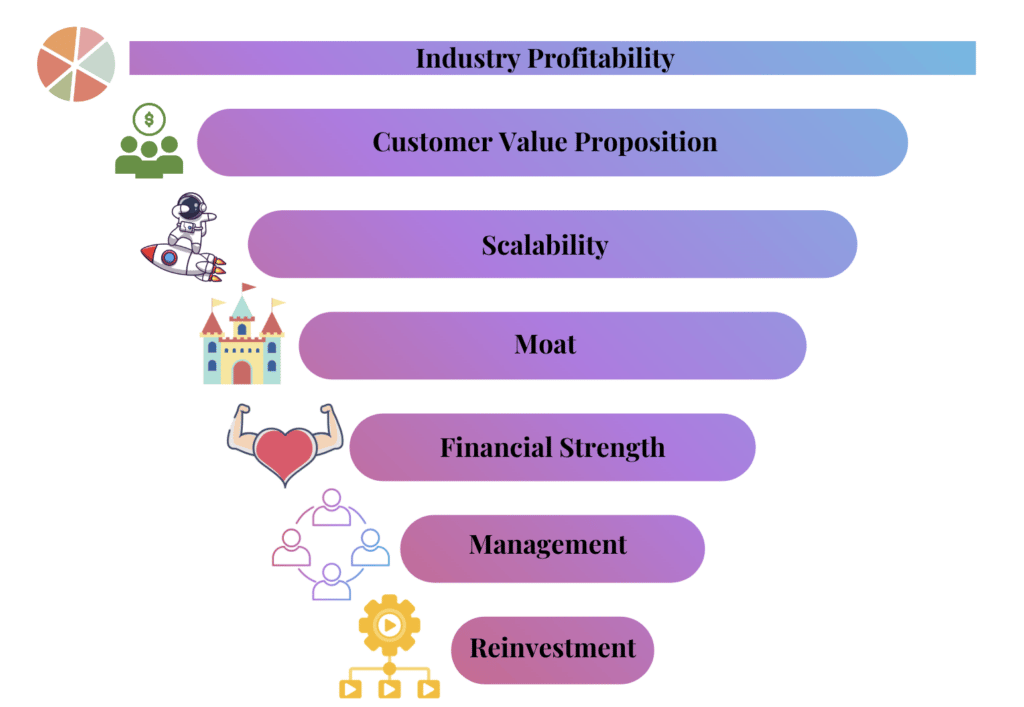

Industry dynamics is at the top because I think it’s the most influential force on a company’s return on capital. The directional change of an industry has a powerful pull, and it’s almost entirely outside of a company’s control. I also believe this applies to a lot of areas in life like careers, sports and relationships.

If I was choosing a stable job, I would steer away from industries with occupations that will likely become automated like vehicle manufacturing or warehouse logistics. As an aspirational athlete, one needs to weigh up whether to chase intrinsic glory at the Olympics or financial security in sports like the National Basketball League or the English Premier League. As a student, do I hang out with the group that’s ambitious or the one that likes to party? Different industry groups offer different returns, so what game you choose matters a lot.

Customer value proposition and scalability form part of understanding the company’s business model. These two areas are so important because no matter how good your moat or management might be, if customers stop liking the product or service then the whole business model crumbles.

If a company operates in a fruitful industry and is scaling well then I want to ensure the moat is strong enough to ward off competitors. Preferably, I want to invest in a business with a widening moat supported by a balance sheet that is becoming more resilient.

Now you might be wondering whether or not I’ve truly learnt my lesson on neglecting the importance of management by putting it down near the bottom. But in reality, I need to have enough conviction from evaluating all the preceding areas to be in a comfortable position to analyse management.

You could argue that reinvestment opportunity probably generates the most returns for a business yet it sits at the bottom of my filter. But for a business to be able to reinvest its free cash flow, it first needs to be operating a profitable business model that is run by a top management team. This is where capital allocation by management will dictate how well the business performs over the long term.

As I’ve mentioned previously, it’s very rare to find companies that hit every single mark, and even rarer to find ones that are mis-priced. The idea is to hunt for businesses that are exhibiting early signs of fulfilling all my criteria over the long haul.

Preparing For The Firewalk Ahead

The first image that comes to mind when I think about the road ahead is summed up below.

Investing never seems to get easier, well at least for me anyway, but that’s what makes it so interesting, rewarding and exciting. There is a lot of doom and gloom clouding all investors at the moment but on the flip side, optimistic investors could be well rewarded if they stay patient and disciplined.

Claude provides a tremendous framework exhibiting 10 signals that he thinks will indicate it’s time to buy some shares, even despite the difficult macro conditions. It’s impossible to predict the bottom but it’s still useful to implement a framework and process to best prepare for the road ahead.

In terms of the type of companies I’ll be scoping out, my lens will be heavily focused on those with the following resilient traits.

- Growing industry even in the face of macroeconomic turmoil

- Leading or strong market position

- Pricing power

- Widening moat

- Superior balance sheet relative to competitors

- Prudent yet opportunistic management teams

- Flexibility

Patience is probably an underrated skill that doesn’t get talked about much in the investing industry and I think it’s particularly important in the current investing climate. Given the large bouts of volatility, any buy or decision will feel like stepping on fire, but those who remain invested in high-quality businesses will come out the other end well rewarded.

I wish you all the best in your investing endeavours, and thank you for all the support!

I’d also like to give a big shout-out to Claude for offering me the opportunity to write for A Rich Life. I’m extremely grateful.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does own shares in Catapult (ASX: CAT), PWR Holdings (ASX: PWH), Lovisa (ASX: LOV), Redbubble (ASX: RBL) and will not trade these shares for 2 days following the publication article. The editor of this article Claude Walker owns shares in PWH but not the other stocks mentioned, and he will not trade these shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).