Catapult International (ASX: CAT) develops sports performance tracking wearables and video software solutions to help teams achieve higher performance. Since the Catapult FY 2022 results were released in May, the Catapult share price has fallen by 20%.

In my previous article, I briefly covered the Catapult FY 2022 results and honed in on Catapult’s competitors, Hudl and STATSports. Catapult recorded a loss of US$32.3 million in FY 2022, a significant fallback from a loss of US$8.8 million in FY 2021. Operating cash flow took a heavy hit as well, dropping from US$13 million in FY 2021 (9 months) to US$2.6 million in FY 2022 (12 months).

In light of the poor performance in FY 2022 and the falling share price, Catapult recently announced plans on hitting free cash flow positive in FY24. The company advised it will reduce both employee expenditure and overhead costs. We now know that the layoffs have begun, after a few employees announced their departures on LinkedIn. Such a decision provoked me to reflect on the quality of leadership at Catapult.

Adir Shiffman, Will Lopes, Paid Short Term Incentives (STIs) in FY 2022

As you can see below, Catapult Executive Chairman Adir Shiffman was paid 68% of his short term performance pay in FY 2022. Catapult CEO Will Lopes was paid 100% of this Short term incentive award, as was CFO Hayden Stockdale. Both the CEO and CFO also achieved 100% of their LTI.

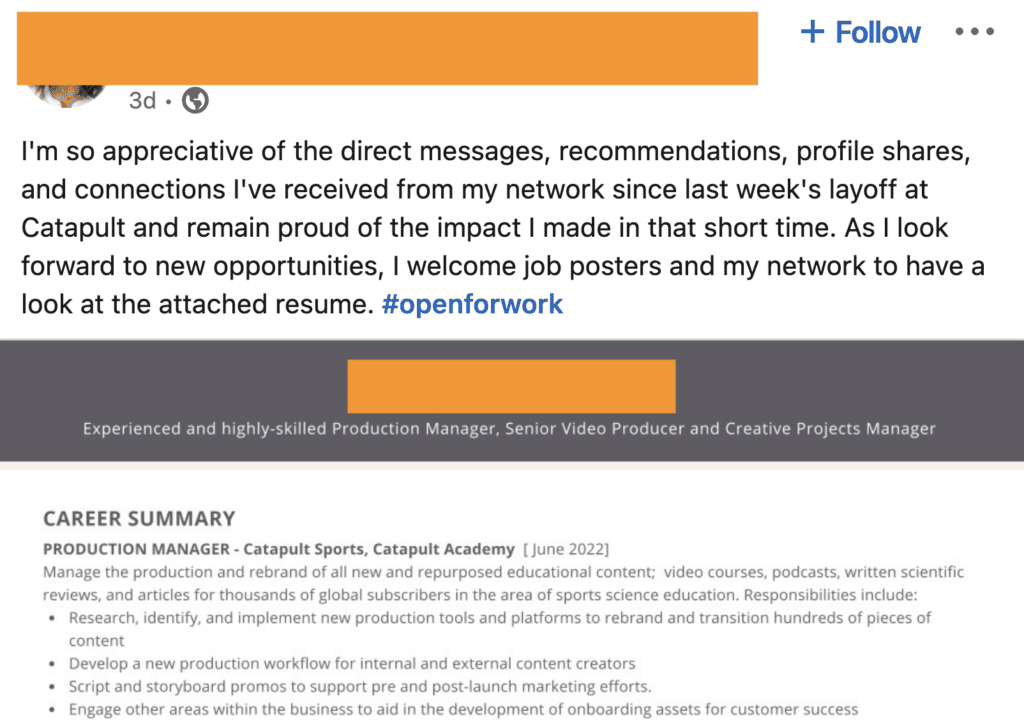

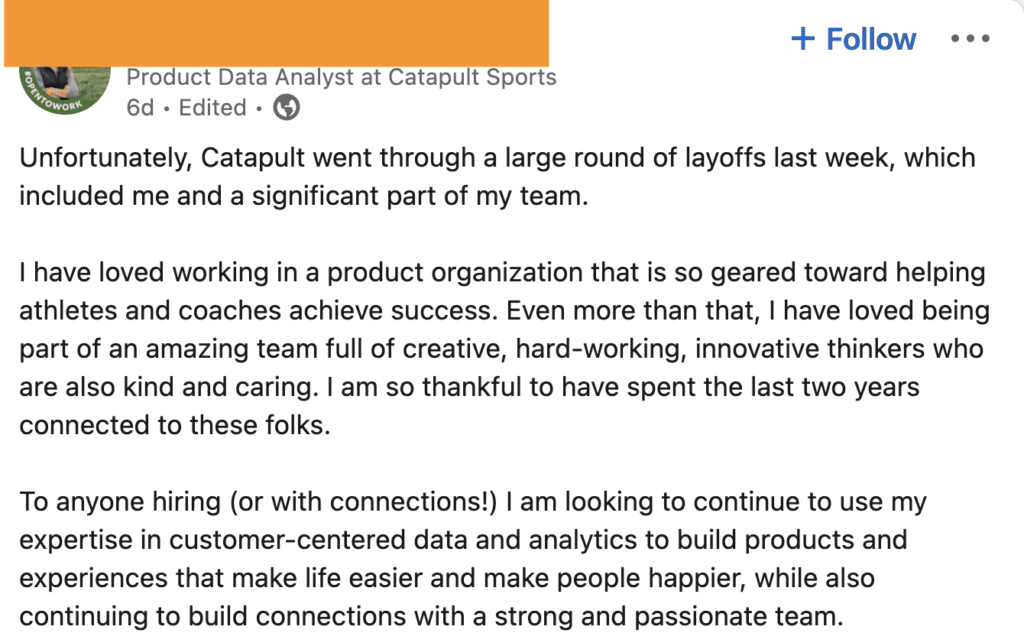

Catapult Employees Laid Off

Over on LinkedIn, however employees from Catapult posted their goodbyes as well as flagging their availability for open roles in the industry.

The first former Catapult employee above only started in June and the second staff member commenced in February 2021. Whilst the broader tech industry is undergoing major job layoffs, such significant decisions make me evaluate the quality in management’s budgeting and planning skills. Nearly every investing/business book I’ve read to date has noted that great businesses often flex their muscle in tumultuous economic conditions, so Catapult’s decision to strive for short-term gains at the expense of losing staff members, is slightly concerning.

Significant restructures and layoffs can stunt momentum as employees across the organisation need to lift their productivity to make up for lost colleagues. Not only that, the general process and transition to a reduced workforce takes time and saps employee motivation.

In contrast, Catapult’s video solution rival, Hudl recently revealed that on-site child care will be offered to staff in Lincoln. It’s important to remember that the technical skills and the knowledge employees possess are the biggest assets in the tech hardware industry.

I explored Claude’s recent list of high quality companies and looked at how they manage their workforces, whether they undergo layoffs, and considers how their leaders interacted with the public. Notably, most of the commentary from these other leaders pertains to the companies they run, whereas Catapult’s Executive Director and Chairman Adir Shiffman appears to be enthusiastic about prognosticating about a wider range of topics.

Catapult International Bonus Payments

Shiffman has quite an eclectic background that includes starting and selling multiple tech startups. Since Catapult listed in December 2014, Shiffman has been the executive chairman, making him the only executive director who also has managerial responsibilities.

At most companies, the chairperson is a non-executive director to optimise the level of independence between management and the leader of the board, because the board is ultimately responsible for ensuring management acts in the best interest of the company and its stakeholders. I generally prefer to see a Chairman who is not also an executive.

Notably, Shiffman is the only director on the board who has received a bonus every single year since listing, presumably because he is also an executive.

Shiffman’s salary has more than doubled from $114,000 in FY14 to $300,000 in FY22. To put this into perspective, the average salary of a chairperson for ASX200 companies was estimated to be $384,093 in 2020, while the average salary for a Chairperson of all ASX companies was $132,000. Catapult currently has a market capitalisation of $193 million, a much smaller company than any of the ASX 200 companies. Again, the fact that Shiffman is an “executive” chairperson probably helps explain this situation.

Arguably, investors can use high quality businesses like PWR Holdings (ASX: PWH) and Supply Network (ASX: SNL) as benchmarks for management team success. Let’s take a look at Supply Network’s chairman Gregory Forsyth. He’s earned salary wages of $770,011 between FY15 and FY22.

In comparison, Shiffman has received $944,226 in incentive payments across the same period. Supply Network has more than tripled its diluted earnings per share from $0.16 to $0.49 whereas Catapult has gone in the opposite direction, falling from negative $0.05 to negative $0.15.

Despite outperforming most companies on the ASX, Supply Network’s chairman is only receiving a salary of $107,659, which is below the average pay (of the total ASX, not just ASX 200) of $132,000 in 2020. The significant disparity in remuneration and financial performance highlights the suboptimal situation for long-suffering Catapult shareholders.

As long as Shiffman stays in his executive role, he will have an influential impact on how well the stock performs, which is something I overlooked in my initial thesis. Given Catapult’s past record of capital raising and acquisitions, I won’t be surprised to see more of the same as long as Shiffman is at the helm.

In this respect, I’m strongly considering exiting my position in Catapult. The key reason holding me back from pulling the trigger is the extreme level of pessimism in the market at the moment. So, for me, it’s a matter of looking for a more opportune time to sell, at this stage.

I think my investment in Catapult has reminded me of the importance of Phil Fisher’s last checklist point. As I recall it, Fisher advises if there are any signs of a lack of confidence in management decisions, then this would render all the 14 prior checkpoints as null.

Another big lesson I hope readers can take away is the benefit from following a business for a substantial period of time as Claude explained in his podcast interview with Owen Rask. Sometimes the best way to form a view on management is simply to observe their decisions and performance over time.

Please note that I am currently a shareholder of Catapult International, and this article should not be read as indicating my future intentions in trading the stock. Rather, it simply shows my thinking at this moment in time (which is negative). I will not trade Catapult shares for 2 days following the publication of this article, but reserve my right to acquire or dispose of Catapult shares in the future.

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author this article owns shares in Catapult (ASX: CAT) and will not trade Cogstate shares for 2 days following the publication of this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.