The current predicament we find ourselves in, as a society, stems from the fact that governments have decided to let covid rip. The result, predictably, is that businesses are struggling to find staff, and the healthcare system is no longer able to offer elective surgery. GenX leaders have put us in a situation where the older generations may die from treatable maladies such as strokes and heart attacks.

Similarly, these same people have decided children under 5 can take their chances with long covid and MIS-C, all while child hospitalisations from covid reach all time highs in Australia, the UK and the parts of the USA, simulatenously.

ANZ Senior Economist Adelaide Trimbel has the data:

ANZ data: Spending is at its lowest level since Delta lockdowns.

— Adelaide Timbrell (@AdelaideTimbrel) January 7, 2022

Caution about being in public is compounded by staff shortages to stifle spending across dining, shopping & travel.

Syd & Melb spending is now down at lockdown levels, with Sydney at its lowest since COVID began pic.twitter.com/5Un1Q93qW0

Of course, this was the mind-numbingly obvious result of removing all physical restrictions to Omicron covid spread, even though it was evident that it could evade immunity. As a reminder, ventilation, air purifcation, and N95 masks can physically disrupt the transmission pathways for covid, regardless of the variant.

Sydney has unsafe schools and is loosening harmless restrictions like mask-wearing into a new wave of Omicron, which often escapes two-dose immunity. No appetite for lockdowns (understandably) but the gov’t is taking NO measures to slow spread.

— Claude Walker (@claudedwalker) December 14, 2021

This ends badly for Sydneysiders.

The current stage of this slow motion trainwreck is for people like Doctor Nick Coatsworth, who previously said that covid was definitely not an airborne pathogen, to encourage people to send their children to school, despite the fact that they run a high risk of getting covid.

The starting point is keeping children at school and starting the term as planned. All subsequent actions flow from that. Hybrid learning or remote learning needs to be resisted by Australian parents. There is no justification for it #auspol #covid19aus https://t.co/O4CDtLkYz5

— Dr. Nick Coatsworth (@nick_coatsworth) January 9, 2022

Eventually, it is likely that enough children will end up in hospital or suffering significant illness, that many parents will start getting angry about the fact that most classrooms don’t have masks, proper ventilation (with CO2 monitoring) and HEPA filters.

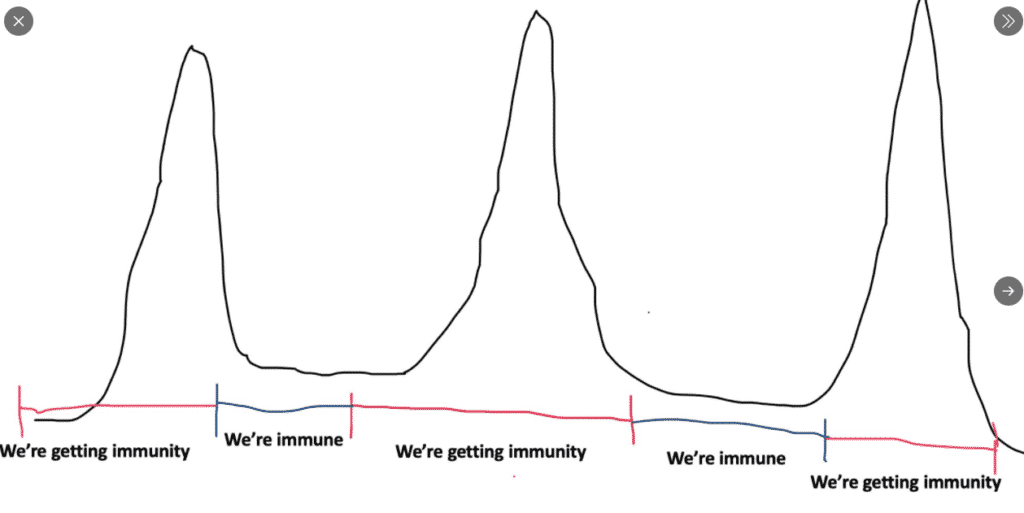

Depending on how society reacts the current omicron epidemic is poised to potentially peak in late January. In most countries, coronavirus has spread in separate waves. First the Wuhan version, then Alpha (or Beta in South Africa) then Delta (or Lambda in South America), then Omicron. Herd immunity to Delta has not prevented the spread of Omicron.

The comforting fallacy du jour is that people ‘win’ immunity to Covid-19 by being infected with Omicron.

While there is some chance this will happen, it is certainly only a chance.

I hope that I am wrong, but the evidence suggests that what you ‘win’ is immunity to Omicron. Once enough people have had Omicron, the scene will be set for another variant to take over. Evolutionary pressures mean that the variant that succeeds after Omicron will evade immunity to Omicron. I hope that it takes a long time for the randomness of genetic mutation to produce a variant that evades immunity to Omicron, but it may not. Like the flu, it will eventually produce other bad variants.

Humans have essentially forgotten what it is like to deal with regular epidemics, because public health controls them. In the absence of appropriate public health measures, this is what epidemic diseases like smallpox, polio, measles, influenza, and even the very very common seasonal RSV looks like.

How do we profit from the unpleasant truth?

By identifying where the comforting lies are causing mass delusion, we can make bets on what will profit from the comforting truth.

While my high priced tech stocks are currently being wrecked by the spectre of interest rate increases, I have been making money from betting against the comforting lies. I recently sold about a third of my holding in Australian Clinical Labs, which benefitted from the boom in PCR testing, but I still hold all my shares in this potentially global beneficiary of the unpleasant truth.

As it happens, I have been harvesting my portfolio since around April last year, in order to make a property purchase in regional Australia. Long term readers will know this is our second investment in tree-changer areas. The reason these areas are a good investment for us is I don’t think that high skilled wealthy employees will tolerate forced infection by self-interested middle managers who try to force them back into the office.

Only employees with medium to very low market value (or very low value for their own health) will tolerate forced infection. High value employees are currently working from home. What we are looking for is the competition between high earning knowledge workers and established wealth. Those groups will be relatively economically insulated from the bumpiness caused by mass infection (and increasing interest rates).

Personally, I have a fair bit sitting in cash at the moment. It just so happened that I have received a few liquidity injections lately, including the regrettable winding up of Brazier Equity, which generated extremely impressive returns for me, of over 30% per annum.

One lower volatility play on the unpleasant reality might be to simply invest in healthcare. It is quite likely that the coronavirus will cause a lot of ongoing health difficulties which we don’t currently understand, colloquially known as long covid. Once I start deploying capital for my SMSF, one of my first moves may well be to invest some of my cash to global healthcare ETFs such as IXJ and DRUG (the latter being currency hedged).

Please remember that these are personal reflections about investing, and stocks, by the author. I own shares in Australian Clinical Labs and recently took some profits at slightly below current levels. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!